Over the weekend, I was captivated by a poem in Rudy Francisco's new collection, Excuse Me As I Kiss the Sky, where he pens a poignant letter from Orville to Wilbur Wright, imagining the night before their historic flight. One segment in the middle of the poem particularly resonated with me, echoing personal experiences of conquering fear:

“Brother, sometimes,

people who have never even tried to run a mile

will tell you that a marathon is too far.

Some people will try to talk you out

of jumping into the water

simply because they have

always been too scared to learn how to swim.

Fear is when the brain digs out all faith from the body

and then calls it survival.

Fear is when we turn up the volume on

everything that might go wrong

and then allow it to speak louder than our courage.

But for those who do not worship at the altar of panic,

for those who will not sacrifice their ambitions

to a demigod of worst-case scenarios,

for those who do not give up,

failure is just a short story they tell

before they talk about success.”

This part of the poem stood out to me because I appreciated the way Orville described how people let fear control them. Most people desire safety and comfort like a 9-to-5 job. I've never desired a "normal" life; from a young age, I knew I was meant to forge my own path as my own boss. This ambition was constantly met with skepticism. I was told I was too white, too short, too small to succeed in basketball. My lack of a traditional 9-to-5 job was seen as reckless. But I learned early on not to "worship at the altar of panic," and I knew, deep down, I was born to fly.

When the market pulls back, fear often manifests as panic—the cries of “the sky is falling”. Our job, however, is to analyze the data, protect ourselves appropriately, and take calculated risks. NEVER let someone else control your decisions or destiny. The market dip in January provided a great opportunity to leverage others’ fear for gain, offering a golden window for strategic moves.

In my recent article, "Bouncing Back After Being 'Trumped'", I shared data predicting a market rebound, pinpointing two areas for action. (See image below):

· Gap close

· 568 to 572

Notice the safety measures built in - the ability to cut quickly and retry at lower levels if the gap close doesn’t work. While we can’t predict the exact moment of a bounce, we must remove fear and take calculated shots.

One of the reasons I anticipated a bounce was the weekly quadrant balance momentum, which was bottoming out and approaching oversold levels. Below is the chart I shared:

Now, here’s the updated reading:

This data point worked perfectly. Another indicator I mentioned was the bond yields. I predicted that yields would reject the 4.7-4.8% range and warned that climbing over 5% could spell trouble for equities.

The rejection at 4.735%, as shown below, validated this prediction:

These data points allowed me to stay confident and not let fear take control. Francisco’s words come to mind again: “Fear is when the brain digs out all faith from the body and then calls it survival.” By following the data, I achieved a profit of $1,099,825 during this dip. I’m also holding partial positions in SPY at 576 and other dip buys until the data indicates a sell or I’m trail-stopped out. Similarly, this is how I am still holding NFLX in the 200s.

NFLX’s earnings were nearly perfect, demonstrating how strong reports can make stocks cheaper in terms of ratios, even as their prices rise. If the rest of the “Magnificent 7” can deliver earnings like NFLX, the narrow market rally could continue; however, I’m skeptical. If earnings meet guidance or fall short, we could see significant money flowing from these high-growth names into value stocks.

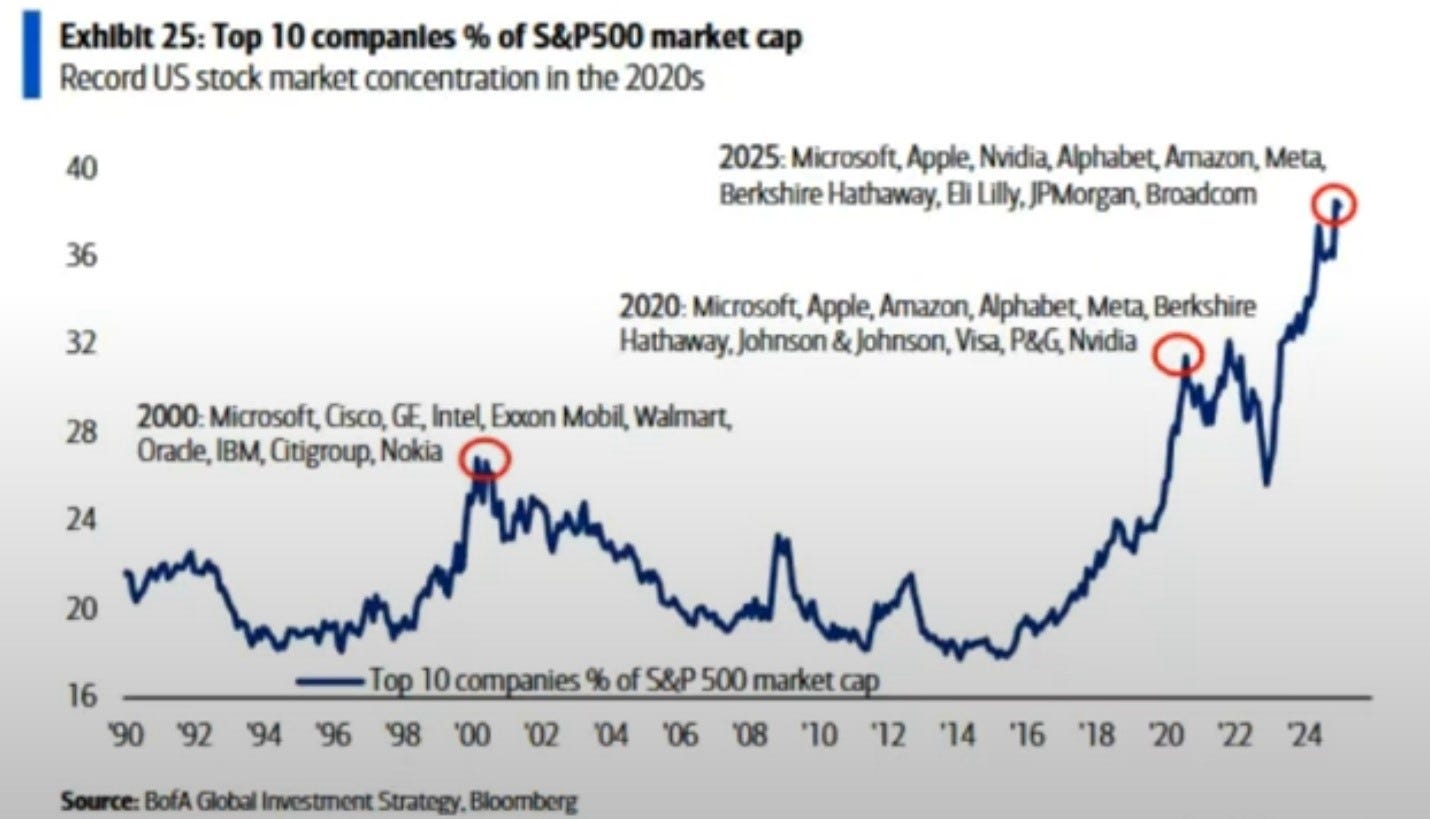

Consider this: the top 10 companies in the S&P 500 now account for nearly 40% of its market cap, a record high surpassing even the dot-com era. While this doesn’t necessarily signal an imminent collapse, it highlights the need for broader market participation.

The percentage of companies outperforming the S&P 500 is at a historic low. This presents a rare opportunity to invest in undervalued companies.

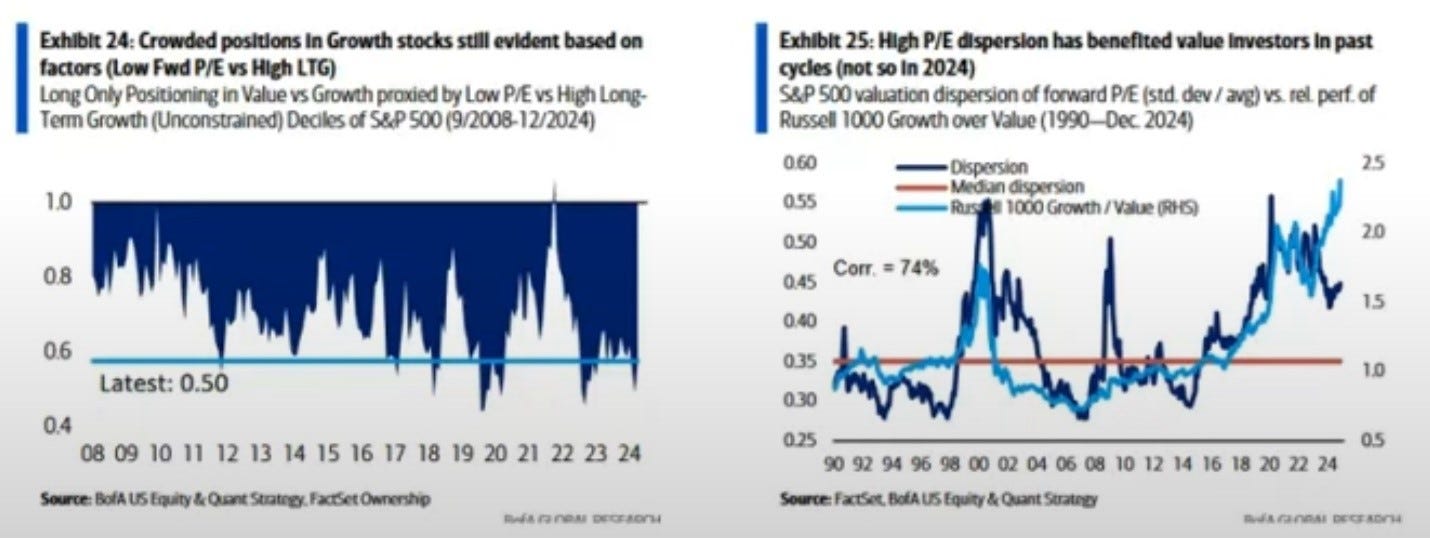

According to Bank of America, positioning and valuation favor income and value plays.

Growth versus value metrics remain elevated, with growth looking expensive relative to trailing EPS.

Recency bias has led many to believe that growth always outperforms, but a shift toward value is overdue. I believe this transition could begin in 2025. Much depends on macroeconomic factors, including the Trump presidency. If his “Golden Era for America” vision materializes, it could create opportunities for all, not just the Magnificent 7.

Additionally, the weakening dollar—a trend I’ve been betting on for months—should boost emerging markets. Those chasing “shiny objects” will face a reckoning, while value investors stand to gain significantly. Many of you have already seen the potential of value plays. We’ve celebrated 100% winners in names like MMM, GNRC, C, and VFC, and a 200% winner in CRK. VALUE remains my focus for 2025.

Let me close with the final part of Francisco’s poem:

“Tomorrow,

we will call gravity a liar.

We will kiss God on the face.

Tomorrow, I will look you in the eyes,

and I will say, I told you the wind would feel different up here.

What they think does not matter.

When we are in the clouds,

we won’t even be able to see them.

Brother,

I have a joke.

What do you call the first

two men in the world who figure out how to fly?

Legends.”

The Wright brothers did something that people thought was impossible. They didn’t let the naysayers bring them down but used their skepticism as fuel to light the fire underneath them to change the world forever.

My mantra for trading is “I can fly,” and I have a picture of Michael Jordan’s free throw line dunk on my wall and computer. Just like the Wright brothers, I too am kissing the sky.

The air does feel different up here. I don’t care what others think because I can’t even see them from this height. Becoming a legend requires pain and sacrifice, but it’s worth it. Be the legend for your family. Change the course of history.

Friend, I have a joke: What do we call people who master their fear, defy doubt, and learn to soar? Market Legends. You, too, can fly.

What a motivational read, I have struggled getting into the trading mind set. Your continued training and patience is appreciated.

Love this. Thanks for the inspiration and teachings DMan…