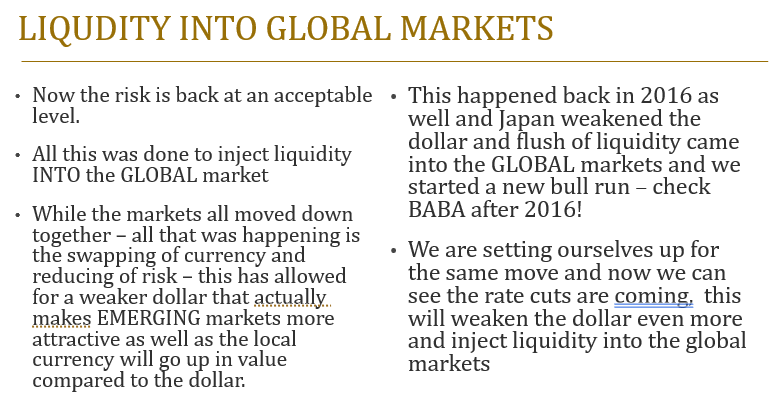

Six weeks ago, I highlighted the critical need for increased liquidity in global markets, predicting that a rate cut by the Federal Reserve would be the catalyst for economic stimulus worldwide. As anticipated, Jerome Powell and the Federal Reserve have cut rates by 50 basis points, setting the stage for economic maneuvers globally.

Following this, China, through the People's Bank of China (PBOC) led by Governor Pan Gongsheng, has indeed launched what could be described as an economic 'bazooka'. Previous attempts with smaller stimulus packages did not yield the desired revitalization of China's economy. However, the recent announcement marks a significant shift:

Reduction in Borrowing Costs: Aimed at spurring investments.

Increased Bank Lending: Banks are now encouraged to lend more freely.

Reserve Requirement Cuts: Less cash required to be held in reserve, freeing up capital.

Mortgage and Down Payment Adjustments: Making housing more accessible to stimulate the real estate sector.

Liquidity for Equities: The PBOC is setting up a swap facility for securities firms and insurance funds to directly inject liquidity into the equity market.

This aggressive policy underscores China's commitment to not just revive but also to reignite investor interest in its economy. Governor Gongsheng's statement to "expect more to come" suggests that China has more tools at its disposal, indicating a sustained effort to boost economic growth.

Given these developments, I've been advocating for investments in undervalued Chinese companies, particularly in tech giants like Alibaba (BABA) and JD.com (JD), as well as the KWEB ETF. My own portfolio includes positions in these assets, based on the belief that once the US initiated rate cuts, countries like China would follow with their stimulus, leading to a significant cash influx into their markets.

Alibaba's stock movement this year — from $68 to $90 and back to $72 — reflects the market's volatility but also its potential for recovery. This time, however, with solid economic policies backing it, I believe we are at the beginning of a sustained upward trajectory. The recent base formation over two and a half years could propel BABA beyond $100, moving towards its intrinsic value.

Investment Strategy: Patience is key. While pullbacks are a normal part of market dynamics, resist the temptation to take quick profits. If you've been following my analysis, now is the time to let your investment strategy mature. Hold onto your shares in BABA and similar assets; the real payoff for your patience is yet to come.

Thank you for your attention to these developments. Let's stay vigilant and responsive to the evolving economic landscape.

Make sure you go back and study my talking points from the presentation 6 weeks ago. It is critical to understand the global economy and how the USA effects the other markets. I’ve included the Power Point slides below

.

Great analysis!