Earnings as the Key: Capitalizing on Market Rotations and Value Plays

Market Outlook: Earnings as the Catalyst for Opportunity

The market has made fresh highs, with the SPY breaking out last week after consolidating for most of July. While many traders and analysts are calling for a top, referencing the speed of the rally off the April lows, it’s important to understand the dynamics that drive such V-shaped moves. These quick reversals often trap short sellers and leave many investors on the sidelines, waiting for a pullback that never truly materializes. The surge in NAAIM exposure reflects this scramble to chase performance.

Historical patterns indicate that after minor pullbacks, rallies often persist, underscoring the risk for long-term investors attempting to time small corrections of 2-5%. Such timing can lead to missed opportunities, particularly in a market poised for further gains; however, traders with substantial profits might consider taking partial positions in extended names to manage risk.

Rotations Under the Surface

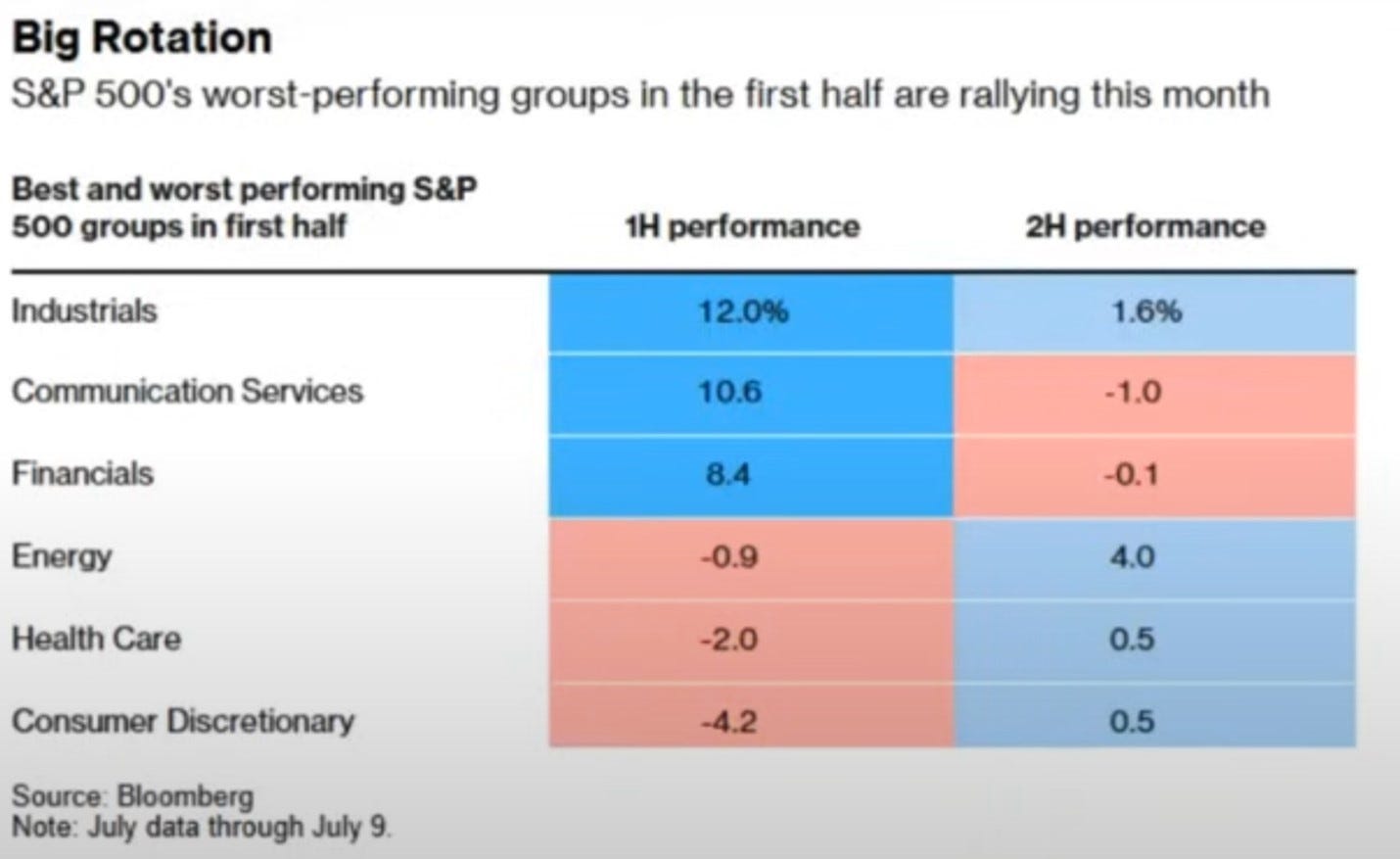

This rally has not been evenly distributed. While the Magnificent 7 have led, the broader market, particularly equal-weighted indices, are showing signs of life. I’ve been actively rotating into the RSP (equal-weight S&P 500) and small caps (IWM), where I believe we’ll see outperformance in the weeks and months ahead.

ETF flows since April 8 show growing demand for crypto, value, and growth — in that order. Meanwhile, outflows have hit levered long ETFs, small caps, long-duration treasuries, defensive sectors, and China. These "unloved" areas present attractive opportunities, especially if the markets’ leadership begins to broaden. I’ve already started positioning in small caps + China, and early signs suggest a rotation is underway.

There’s a notable inverse correlation between the U.S. dollar and small-cap performance. While the dollar has remained strong, it’s recently shown signs of breaking down. Short dollar has become the most crowded macro trade, and a countertrend bounce could shake out the late entrants. But in the longer-term time frame, I expect continued weakness, which should support small-cap outperformance. If interest rates start to fall, that will only accelerate the move.

On that note, political pressure may build for lower rates. Whether through a potential Trump announcement to replace Powell or public pressure to stimulate growth, the market will remain forward-looking, especially toward 2026 when rate cuts become more likely.

Valuations back this up: Tom Lee recently highlighted that the average P/E ratio is now just 16.9 — even lower than earlier this year. Historically, that signals stronger forward returns. Many strong-performing stocks have already seen profit-taking, and capital is beginning to rotate into undervalued names.

It All Comes Down to Earnings

This week and next marks the heart of earnings season, and the outcome will likely define the next leg of the market. TSLA and GOOGL will dominate headlines this week, but I’m watching a wider basket of names for earnings setups. You can view my full earnings worksheet here.

Some highlights:

GD – Strong historical post-earnings performance. If results are strong, I expect continuation. A negative overreaction could be a buying opportunity.

NFLX – Despite stellar earnings, the stock sank after a 46% pre-earnings run. I added shares around 1220 and 1200 and will continue at 1180, 1150, and 1130 if offered.

Pre-earnings plays I’m watching:

SBUX – Daily TTM squeeze and a solid pre-earnings run profile.

EBAY – Attractive chart setup and strong pre-earnings stats.

DASH – Weekly rev strat forming with a 91% and 82% positivity rate two and one week before earnings, respectively.

UBER – Pulling back into support with a strong historical run into earnings.

IONQ – 65% positivity rate two weeks before earnings, looking ready to break out. I am willing to use size for weekly options trades if we breakout.

DIS – 83% positivity rate for 2 and 1 week before earnings while the chart is back testing its breakout.

Post-Earnings play:

JPM – Post-earnings continuation potential within the 130 TPS range.

July 28th through August 1st we have juggernauts like AAPLE, MSFT, META and AMZN reporting.

Other setups I am watching this week:

AAPL – Inside week and day with stacked squeezes.

GRAB – Possible breakout, though it’s a thick stock.

AXP – Large daily cup and handle.

PEP – Day 3 AVWAP play.

AVGO, GE, PLTR – Daily inside candles.

TLN, IBKR – On watch for second-day continuation plays.

CW – Beautiful chart with a daily TPS

Sector & Theme Updates

Nuclear – SMR, LEU, CCJ have all moved significantly. I’m locking in gains and rotating into laggards like BWXT.

Crypto – Taking profits in GLXY, COIN, and BTC.

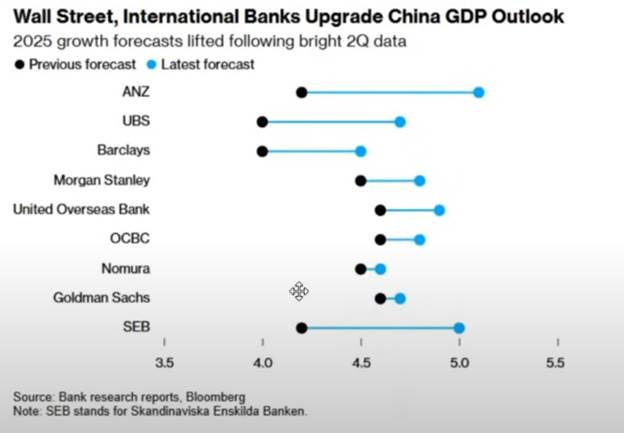

China – MSCI China index is nearing breakout. The economy is growing above 5%, exports are at record highs, and global GDP outlooks for China are being upgraded.

China's economic growth has led to Wall Street and international banks upgrading China GDP outlook.

I’ve begun rotating out of many winners and reallocating to small caps, China, and even new energy plays in oil and gas.

Conclusion: Look Below the Surface

While mega-cap stocks may continue to shine if earnings exceed expectations, the market’s true potential lies beneath the surface. Equal-weighted indices, small caps, and overlooked sectors like China offer compelling value, amplified by low earnings expectations that set the stage for surprises. As earnings season unfolds, flexibility and a keen eye for undervalued opportunities will be key. Dig deeper, stay nimble, and let earnings illuminate the path to outperformance in this dynamic market.