One of life’s most valuable lessons, learned through years of trading and life, is that most people follow the crowd, driven by emotion rather than reason. Emotional trading often has people entering and exiting the markets based on political fear. I have friends across the political spectrum who predict catastrophes whenever their opposing party gains power. Their concerns often have political merit, but I remind them, as I’ll remind you: emotions cannot guide your market decisions.

If hearing terms like “MAGA” or “a woman’s right to choose” sends you into a spiral of anger or frustration, the market may not be the place for you to manage your own trades. In such cases, consider hiring a professional to handle your investments. Equanimity, the ability to remain calm and balanced regardless of circumstances, is one of the greatest traits a trader can possess.

To illustrate equanimity, consider a Taoist parable I’ve always cherished:

A farmer’s horse runs away. His neighbors exclaim, “What bad luck!”

“Maybe,” the farmer replies.

Days later, the horse returns with two wild horses. “What good fortune!” say the neighbors.

“Maybe,” the farmer says again.

His son breaks his leg trying to tame one of the horses. “What misfortune!”

“Maybe,” the farmer replies.

Then, the army comes through, but they pass over the son due to his injury. The neighbors rejoice.

Once more, the farmer says, “Maybe.”

This story captures the mindset I strive to embody. When people passionately decry fear-driven political rhetoric about the markets, I calmly reply, “Maybe.” I refuse to let emotional noise drive my positions. I’ve watched traders I once respected flip-flop endlessly—selling out during Trump’s trade war because they “can’t take it,” then jumping back in, only to sell again. These individuals lack emotional discipline and are swayed by headlines and hearsay.

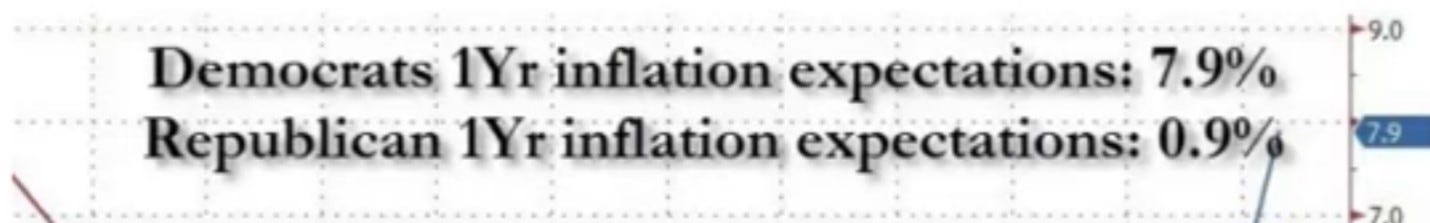

This emotional volatility is even starting to distort data collection. For instance, recent inflation expectations have shown a widening divide between different political groups which is less about reality, more about sentiment.

What is the truth?

It’s likely somewhere in the middle. My focus is always on reading data objectively and interpreting its implications with as little bias as possible.

A few weeks ago, I shared my strategy for tackling this bear market with confidence, trusting in my process. I shared a moment in Tennessee when my wife and I encountered a bear. Despite the danger, I approached it. That’s how I approach the markets. I don’t want to look back and think, “I should’ve taken that shot.” That mindset not only helped me navigate the downturn—it led to my best P&L day ever. I stayed focused, turned challenge into opportunity, and rode the bear market to a personal high.

This isn’t a boast—it’s a reminder:

Stay calm. Ignore the noise.

Focus on fundamentals because, in the end, the market’s weighing machine always wins.

We Must Ask the Right Questions

With the recent bounce in the market, it’s critical to ask:

Has anything fundamentally changed in the economy?

Will those changes persist?

What will they mean for corporate earnings?

Could we see a recession?

What are the incentives of the parties involved?

Do you know your holdings well enough to commit for long-term rewards?

Have Fundamentals Changed?

The Trump administration’s trade policies have disrupted global markets, creating uncertainty. Contradictory White House statements have fueled record volatility and a historic outflow of foreign demand for U.S. stocks.

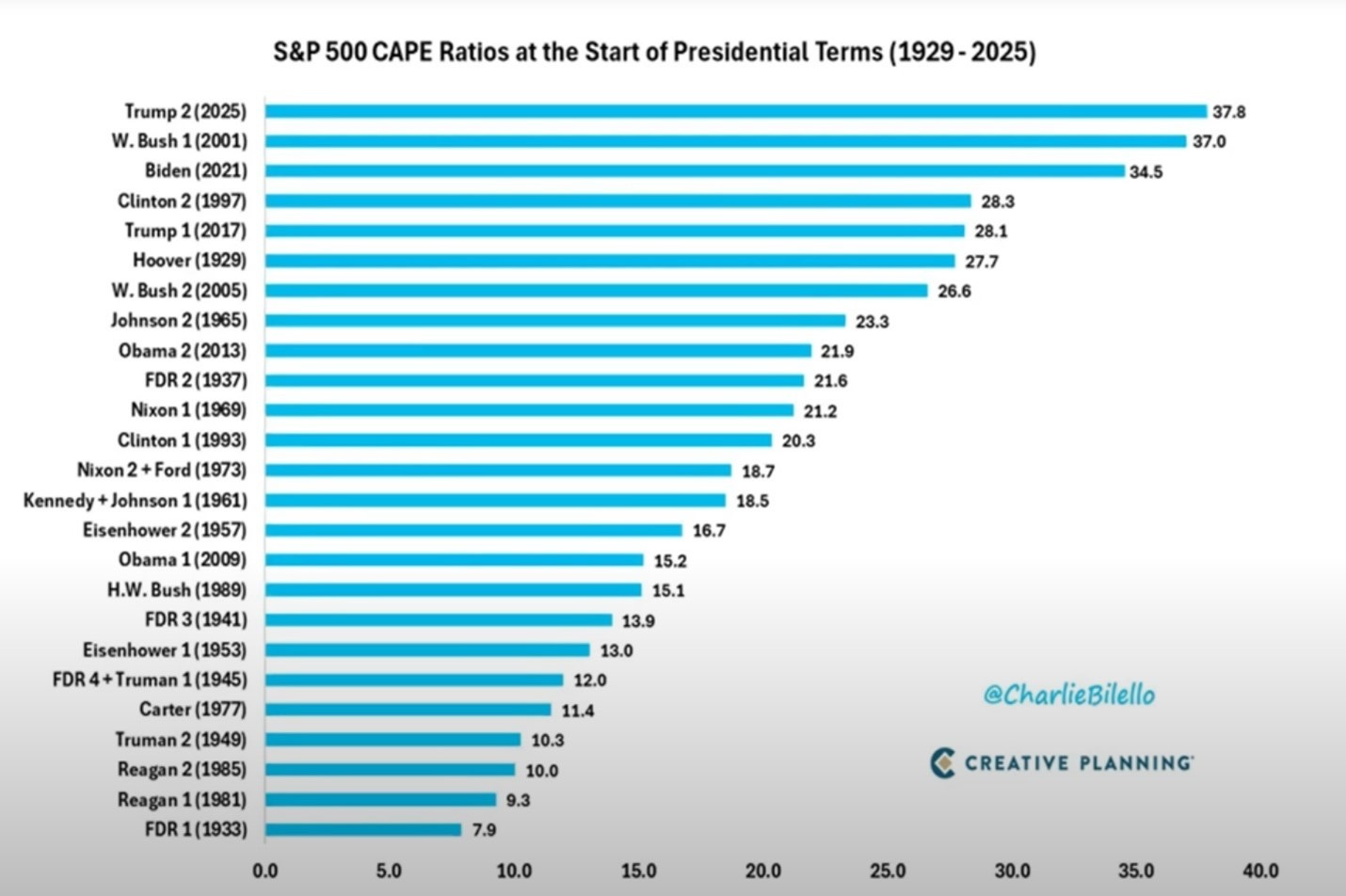

Still, this turbulence appears to stem more from fear than fundamentals. The central shift is tariffs, first imposed by the U.S., then met with retaliation. Trump inherited an overvalued market, and these policies may have accelerated a necessary revaluation, especially among the “Magnificent 7” tech giants.

What permanent changes will emerge? It’s unclear, but Trump may push for increased U.S. goods consumption globally while maintaining moderate tariffs (e.g., 10%) on select nations. If tariffs escalate, further equity price adjustments may be needed. Ultimately, these changes hinge on one individual and could be resolved swiftly.

Impact on Earnings

Goldman Sachs estimates that a 5% tariff increase could reduce S&P 500 earnings by 1–2%, while Bank of America predicts up to a 10% cut. With 41% of S&P 500 revenue coming from overseas, multinationals face heightened risks from higher costs and retaliatory tariffs. Consider VF Corporation (VFC), which sources Vans shoes from Vietnam for $10 and sells them for $65. A 10% tariff per shoe ($1) could be passed to consumers (raising the price to $66) or absorbed by VFC. For a $65 product, passing on the cost is feasible, but for higher-priced goods, the decision becomes complex because raising prices could run off customers but you also cannot chose to eat such an exorbitant cost. While tariffs will dent earnings, I believe the impact will be less severe than 10%.

Will it lead to a recession?

While the trade war has heightened recession fears, I don't foresee one, at least not a severe one. If it comes, it’ll likely be mild and technical.

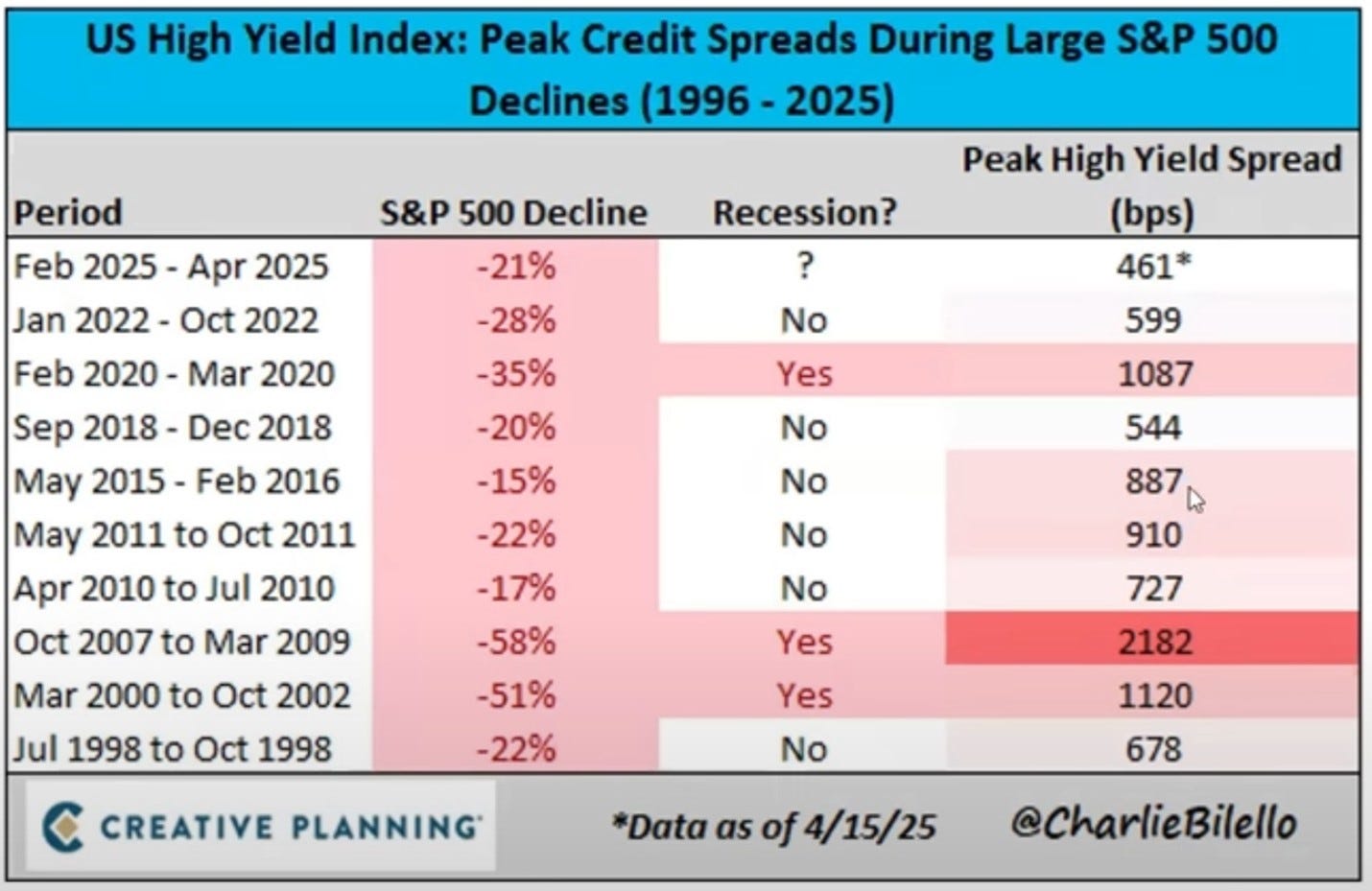

Bond markets support this. High-yield credit spreads, which reflect the risk premium investors demand on junk bonds over Treasuries, remain below recession-warning levels.

When spreads widen, fear is taking over. When they narrow, investors are calm. Right now, they’re relatively narrow.

Let me clarify what high yield spreads represent:

If a high-yield bond yields 8% and a Treasury 3%, the spread is 500 basis points (bps). Wider spreads = fear. Narrow spreads = confidence. We’re not yet at panic levels as you can see from the chart above.

Incentives of the Parties Involved

America’s reliance on cheap global labor has fueled unprecedented wealth, enabling consumer spending and infrastructure growth in countries like China; however, it has also funded endless U.S. wars and enriched elites. Trump aims to adjust this dynamic, prioritizing the middle class through tax cuts for those earning under $150,000 and fostering economic productivity. Tariffs are central to this plan, but he cannot afford to crash the economy. China, grappling with youth unemployment and property issues, is shifting toward a consumer-driven economy under Xi Jinping. Both nations need each other and will likely negotiate a deal. Other countries have tried negotiating deals with Trump as well, and I expect to hear news on these deals soon. If this does not happen, it will show an unwillingness for Trump to budge and could lead to lower equity prices

Where do rational thinkers believe we are heading?

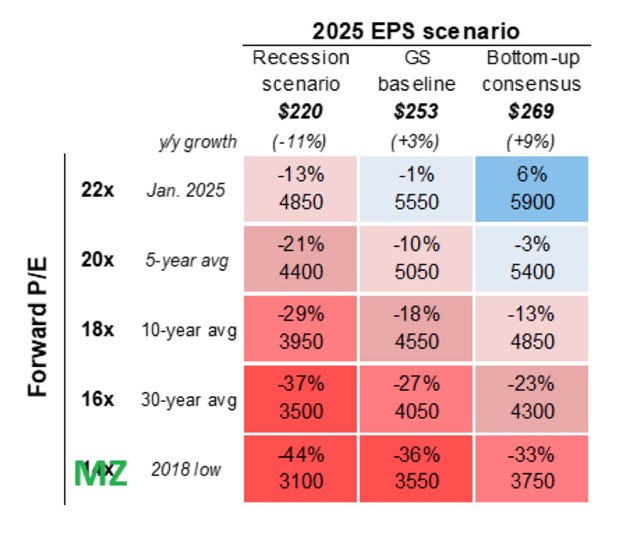

Goldman Sachs has outlined scenarios suggesting a return to historical market averages, which some view as alarming.

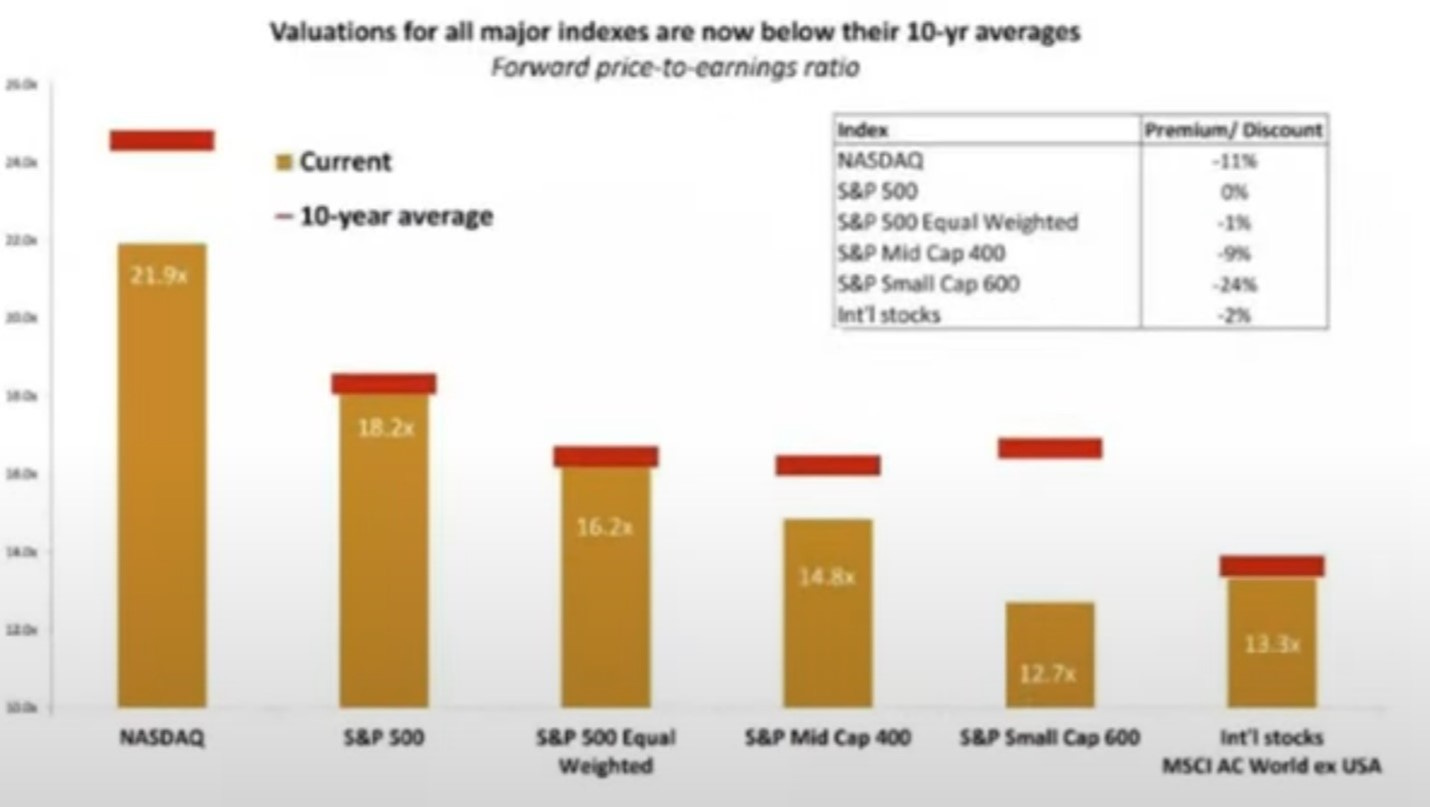

I see this as sensationalism—our economy has evolved, and reverting to 20–30-year norms is unlikely. A return to 10-year averages is more plausible, and if it occurs, I’ll increase my investments. The S&P 500’s price-to-earnings ratio is already at or below its 10-year average.

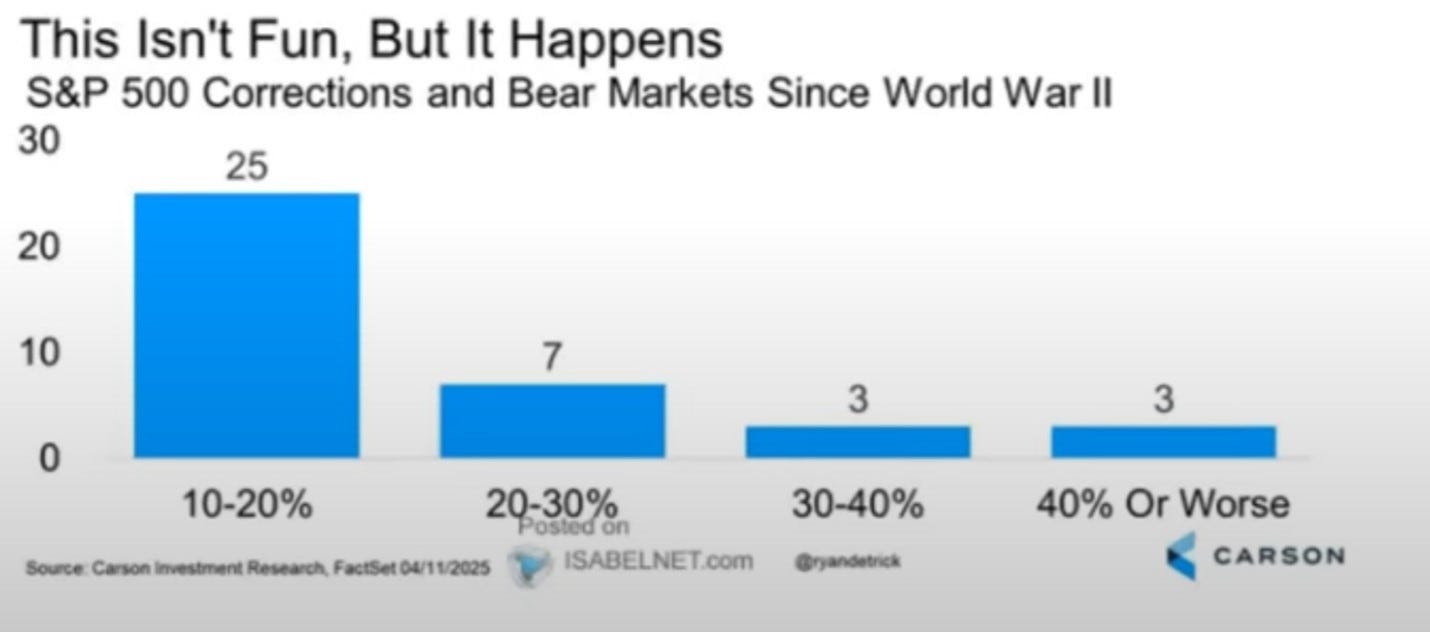

Recent drawdowns (28% in 2022, 35% in 2020, 20% in 2018) felt catastrophic but recovered quickly.

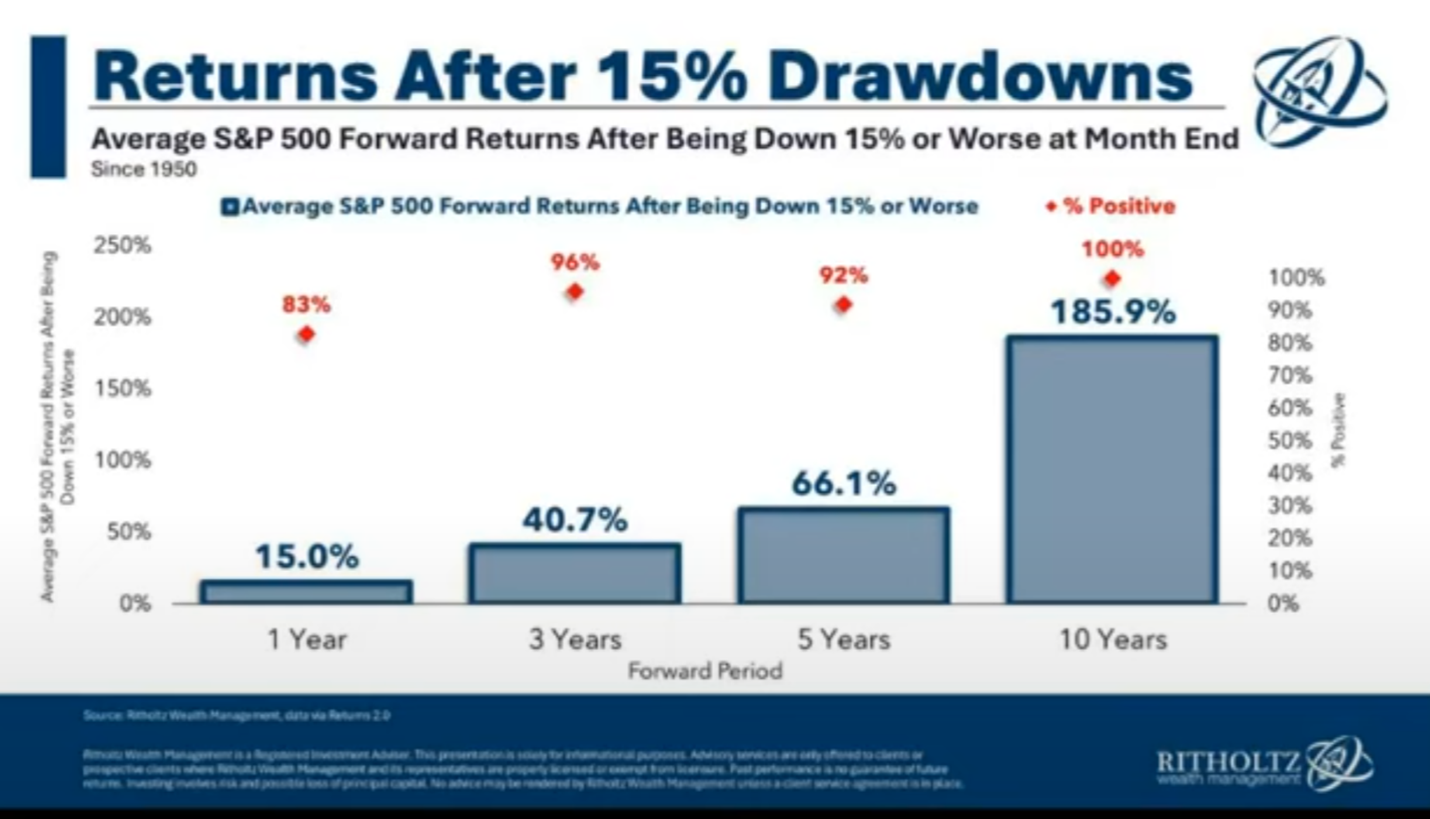

The question we should be asking as rational thinkers is, “What happens after these painful moments?”

History shows strong returns after 15–25% declines, especially when sentiment is low, as it is now.

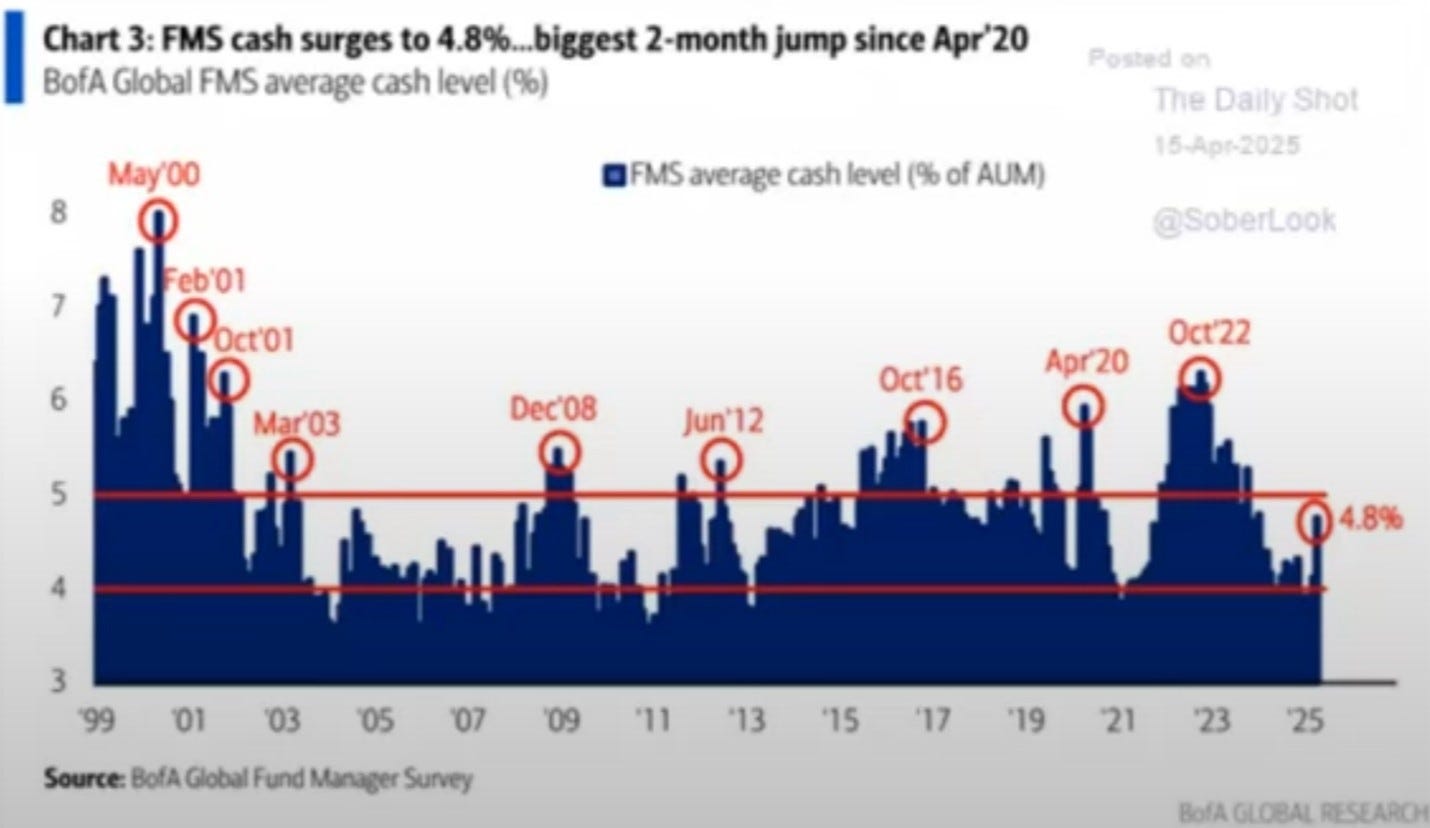

While many (including fund managers) are running for the exits, I see a rare opportunity to buy great companies.

Cash just had its biggest 2 month jump since 2020.

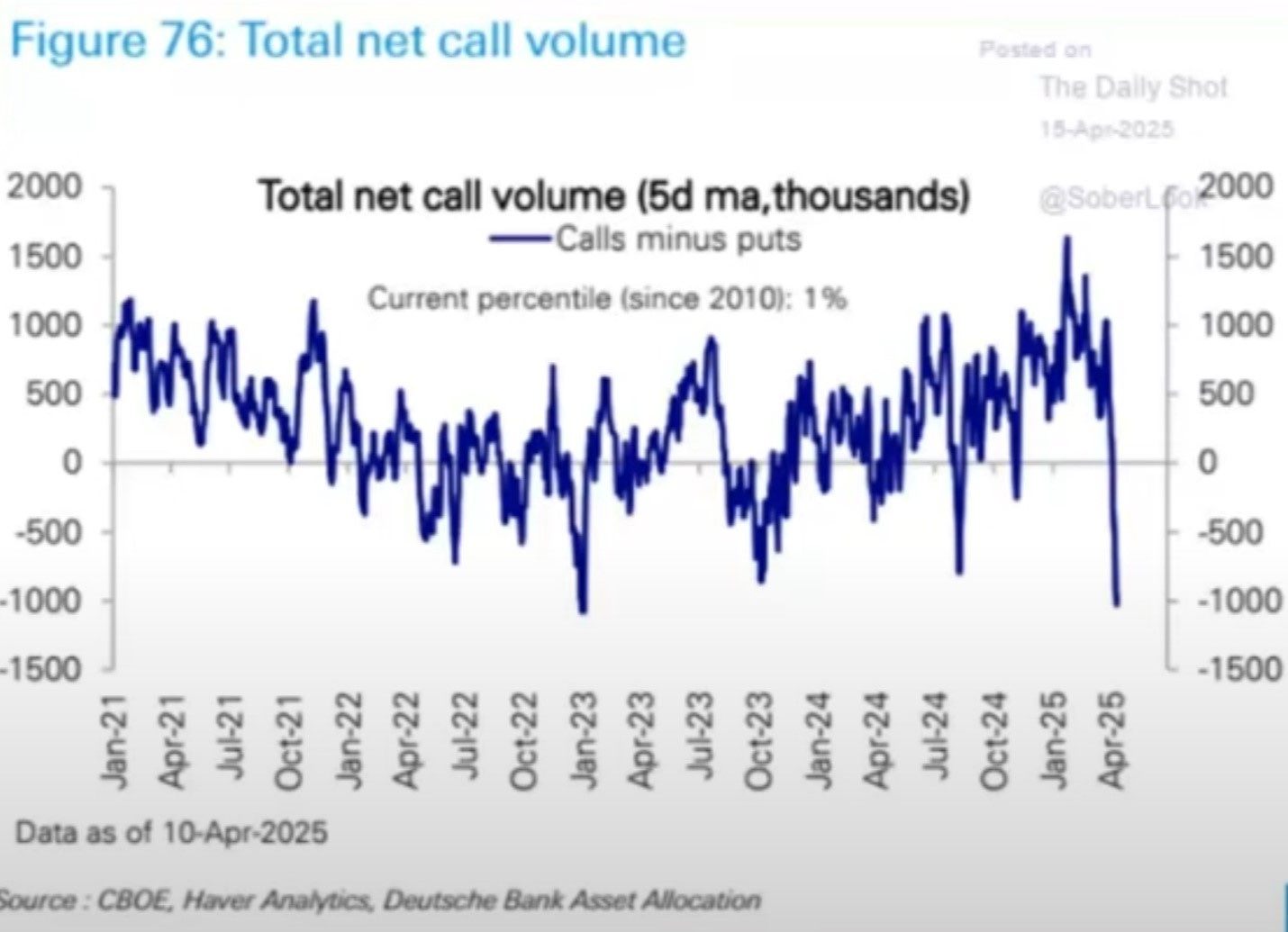

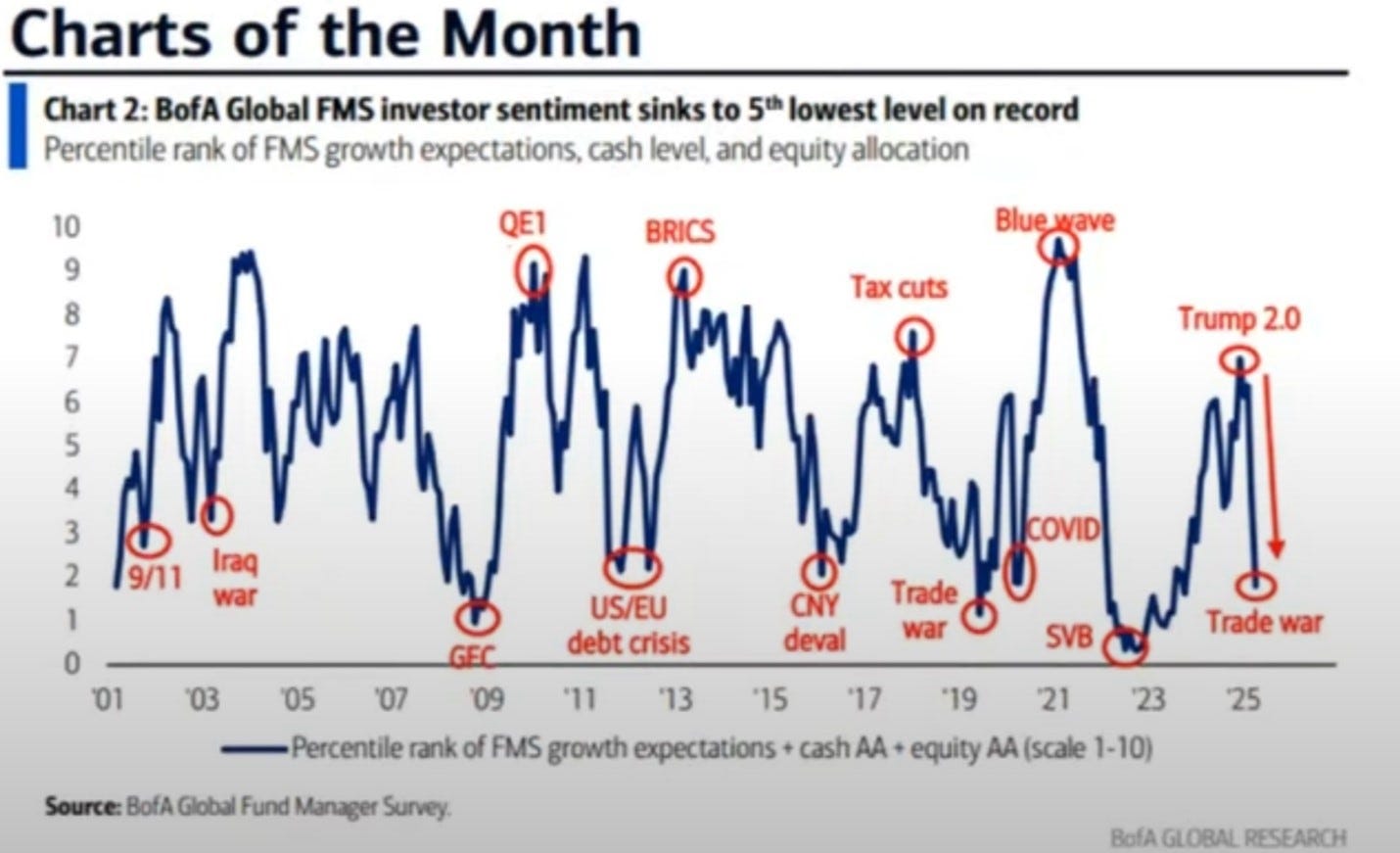

These charts show that hardly anyone is positioned for a possible rally.

You can see the last time we got this low marked the beginning of the low for the latest bear market.

The last time FMs investor sentiment was this low, it led to a bounce.

Sentiment & Stats

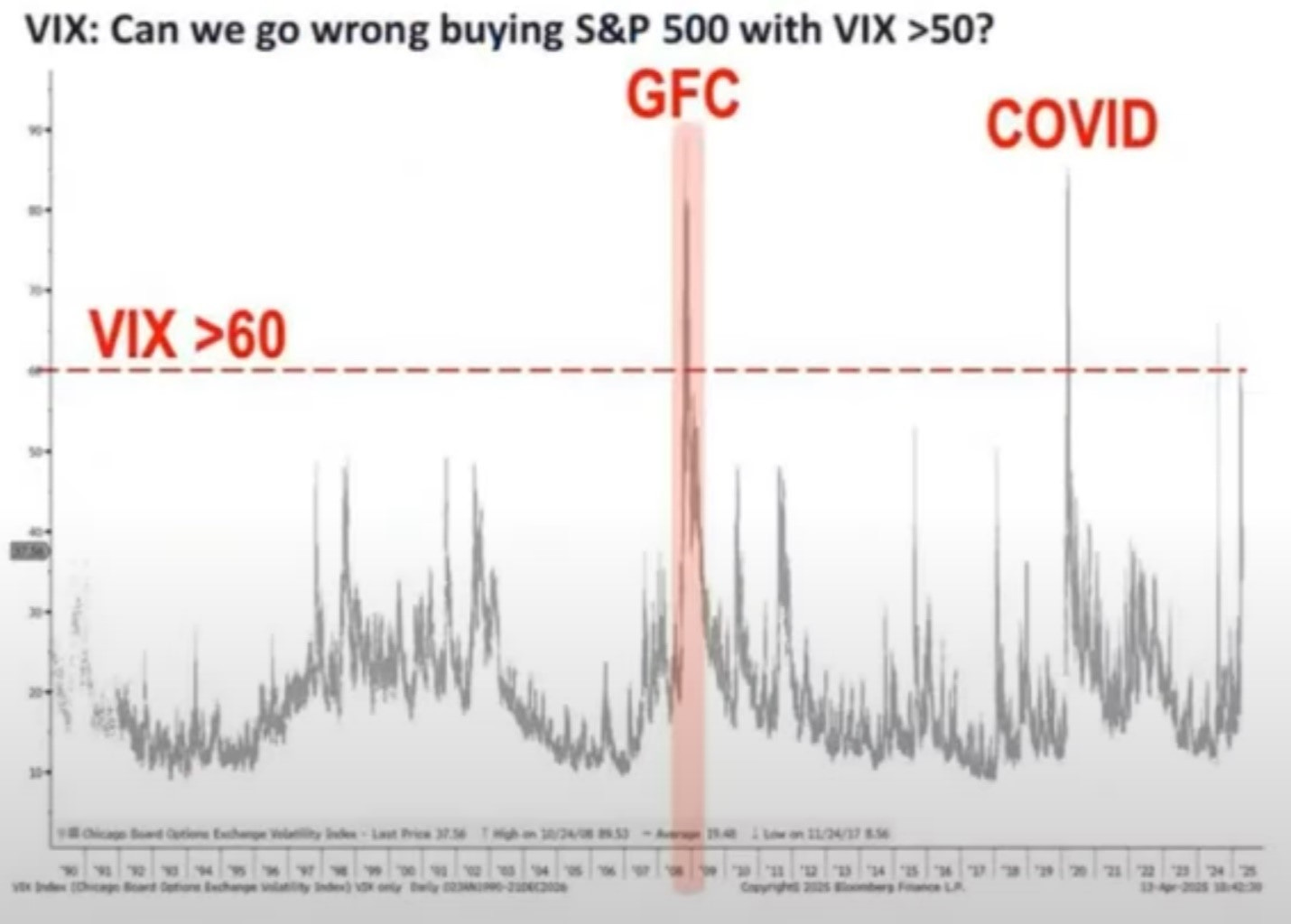

The data shows that we should be a buyer when the VIX gets above 50. We just hit 60 on the VIX.

When the VIX closes above 45 on a weekly chart (as it did recently), future returns are striking:

- 1 year out your return is 34.2%

- 2 years out it is 51.4%

- 3 years out is 50.6%

- 5 years out is 112.7%

- 10 years out is 220%

Compare that to the average return from all VIX weekly closes:

- 1 year out your return is 9.6%

- 2 years out it is 19.9%

- 3 years out is 31%

- 5 years out is 56.9%

- 10 years out is 114.9%

The advantage is clear.

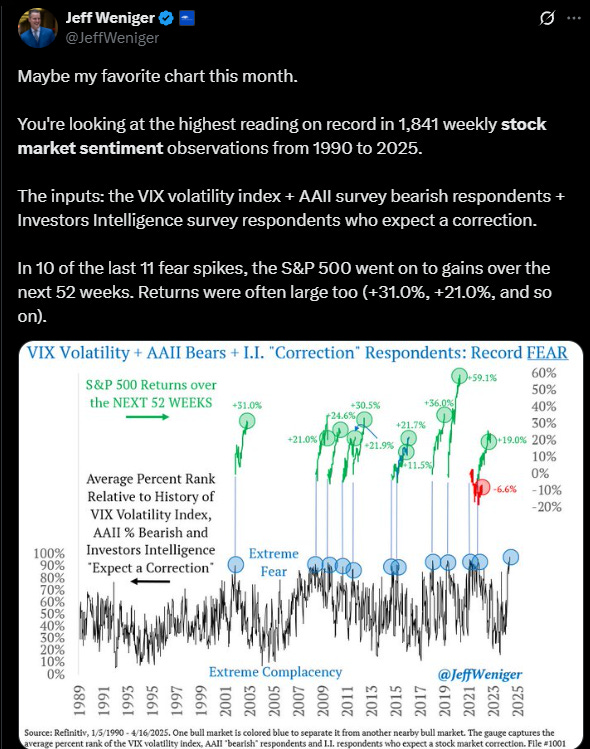

A great tweet from Jeff shows the power of being able to see beyond the current fear driven headlines in times like these.

Know what you own

The weighing machine always wins. The challenge? Timing.

With the structural change I believe Trump seeks, I don’t expect a rapid return to all-time highs—though I’d love to be wrong. We’re likely facing months of sideways action. It could be 3–4 months, or maybe 8–9. I don’t care. I know what I own, and I’ll keep buying as better prices appear.

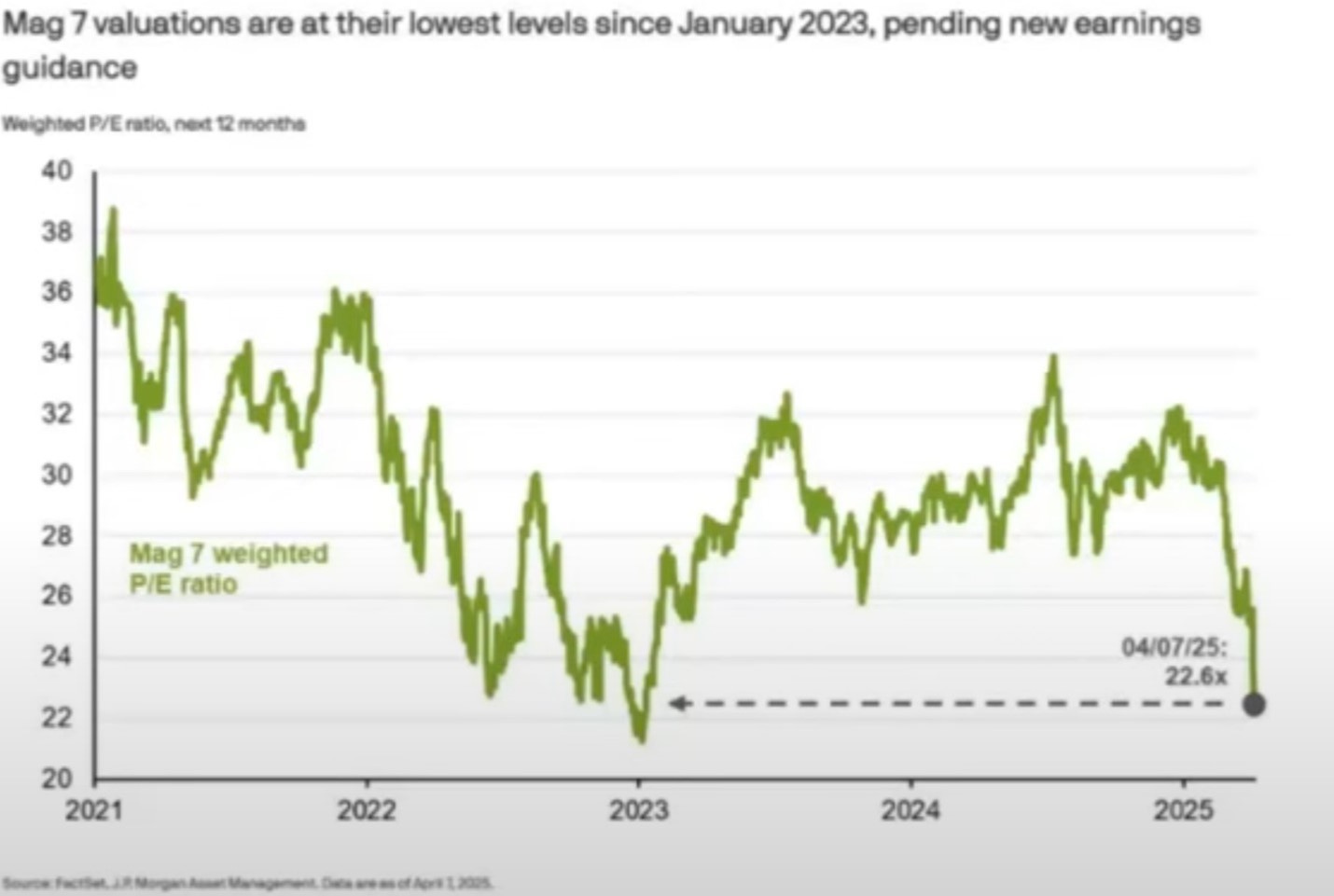

The Mag 7 valuations are at their lowest levels since Jan 2023.

This doesn’t mean we should rush out and buy every stock in sight. It means we need to be selective and focused in our search for true value. Take Apple (AAPL), for example. The stock is currently down around 25%. Could this be a decent level to try for a short-term bounce? Maybe. But from a value perspective, it still looks expensive, especially when you consider its price-to-sales ratio.

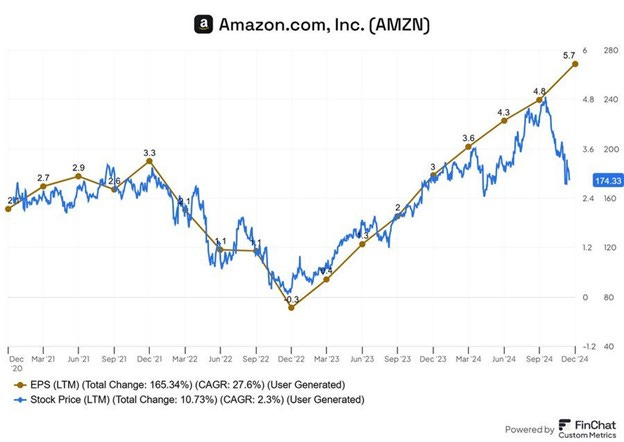

I prefer AMZN from a value perspective. Their price to sales ratio is about 2.9, and over the last 5 years its average was 3.25. Their price has followed their EPS remarkably well, and when we get deviations from this, I tend to be a buyer.

Even though I have already begun buying AMZN, I would love for the price to go lower. I have a long-term view, and I believe AMZN will continue to dominate and return to all time highs sooner rather than later.

Other Examples:

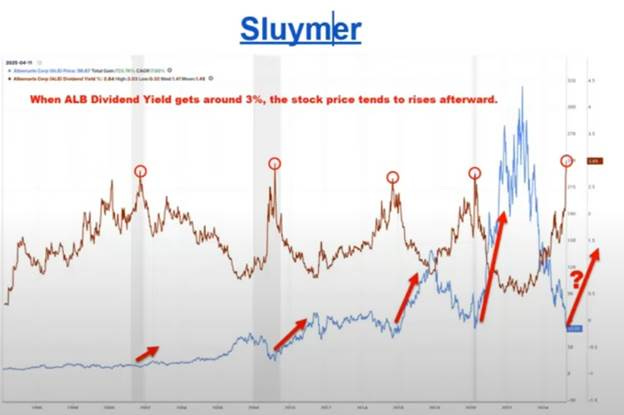

· ALB (Albemarle)

ALB has reached a level where I believe it could easily double over the next few years. Some of you asked me about this one, and after digging in, I really liked what I saw—I just wanted a better entry point. This recent pullback gave me that chance, and I’ve been able to size in more meaningfully.

· INTC

INTC is back in the $19–$20 range, and every time it dips here, I either buy shares outright or sell-to-open (STO) puts for future dates. It’s going to take time for Intel to fully turn things around, which gives us multiple opportunities to buy the dips and sell the rips. As we get closer to the $24–$25 range, I plan to start selling calls or trimming the position. From this level alone, that’s a potential 30–35% gain just on share price.

· ALAB

I picked this one for its exposure to the AI revolution and was happy to load up on the $50–$55 dip. That said, I’ve heard there could be a negative catalyst coming up around earnings, so I’m keeping that on my radar. Still, I’m holding through for now.

· IWM (Russell 2000 ETF)

Small caps have tested my patience over the last couple of years. I nailed the bottom in 2023 and thought we were off to the races, but we’re only about 5% up from those lows. Still, IWM is trading at just 12.7x earnings, while its 10-year average is closer to 17x earnings; that’s a 24% discount. I believe this is a solid opportunity, even if the timing is tricky. If Trump manages to ignite the private sector, IWM could take off in a big way.

· VFC

I added 5,500 shares on Friday. I will continue to buy dips and sell partials into rips on this company. I expect an easy 100% return from the $10 levels.

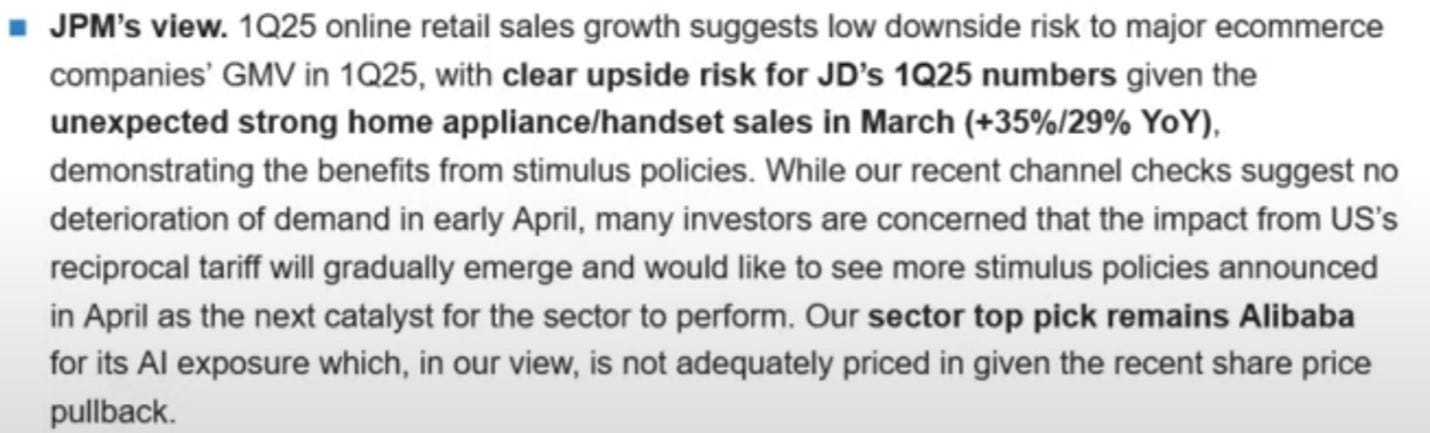

· BABA & JD: BABA is my favorite value play. I bought back 40,000 shares under $100. JD is my second favorite if you can get it at $25. Earnings should pop with renewed consumer activity.

Conclusion

In markets—as in life—nothing is ever as good or as bad as it seems in the moment. We ride waves of fear and euphoria, but long-term success belongs to those who stay grounded. Equanimity isn’t just a nice idea, it’s a necessity. It allows you to remain focused while others react, to think clearly while others panic, and to seize opportunity while others are frozen in uncertainty.

When someone asks, “Is this the bottom?” or “Are we heading into a recession?” my response echoes the wisdom of the Taoist farmer: Maybe.

That one word holds immense power. It acknowledges uncertainty, respects the unknown, and keeps us centered in our process. It doesn’t mean inaction—it means action without panic.

Right now, monthly momentum may be peaking, but weekly momentum shows deeply oversold levels—suggesting the lows are likely in place, unless we get a major new catalyst. In my view, we’ll need one of two things to break out of this range and head back toward all-time highs: either Powell begins signaling rate cuts under pressure from Trump, or we get meaningful clarity—or resolution—on the ongoing tariff war.

Until then, expect chop. Rallies may be sold into as fund managers rebalance toward more defensive positions. That’s the environment we’re in—uncertain, reactive, messy.

But for those who know what they own, who focus on fundamentals, and who can maintain equanimity amid the noise, this is not a time to retreat. It’s a time to prepare. A time to build positions in great companies at good prices and good companies at great prices.

Markets will always test your discipline. Your edge lies in how you respond. So, stay calm, stay patient, and when the noise gets loud, smile and say, “Maybe.”

While you might be the odd duck, you have been clean with your analysis and offered what you have learned and endured. I like that about you. A appreciate you made a decision to help us. Happy Easter to you and you family. How's tha Achilles?

Equanimity is one of my favorite words and is the core of the Buddhist meditation practice. It’s good to be reminded to practice it in all areas of life.