For as long as I can remember, I’ve carried an unshakable belief that I could conquer anything I set my mind to. I’d aim for the stars, often falling short but occasionally nailing the mark. Confidence has been my double-edged sword—propelling me forward in some moments and tripping me up in others. My wife got a front-row seat to this trait shortly after we tied the knot. We were winding through the mountains of Tennessee when we spotted a crowd peering into a gully. Curious, we pulled over and saw the draw: a black bear, not massive but striking, nonetheless. Instantly, I envisioned myself as a National Geographic photographer, capturing an up-close masterpiece. Without hesitation, I scrambled down the slope, camera in hand, closing in until I was just five feet from the bear. It barely flinched—until I edged within arm’s reach. I could’ve stroked its fur. Zooming in, I locked eyes with the beast, its gaze seeming to challenge me, asking me, “You sure about this, pal?” My love for animals and my boundless self-assurance convinced me I’d radiate harmless vibes. The bear disagreed. In a flash, it lunged, swiping a paw my way. Panic hit hard—my confidence shattered as I realized this creature could end me without breaking a sweat. I bolted back up the hill, the crowd’s stares screaming “idiot” louder than words. They didn’t know the half of it: my so-called “uncanny abilities” had just met their match under pressure I hadn’t bargained for.

That same self-confidence has driven me to remarkable heights, building a thriving career as an entrepreneur, trader, and investor. I’ve often pondered what sets my mindset apart, why I push forward while others falter and fold. What forged this ironclad belief in myself? One defining, tragic moment towers above the rest. It forged an indelible mark on my life, leaving behind tragedy but also a firm resolve: when I was nine, my sister and I raced home, bounding up the stairs, only to freeze. There, halfway up the staircase, was my father, lifeless. He had succumbed to years of mental health challenges and had taken his own life. Screams tore from our throats, tears blurring the horror we couldn’t unsee. That day branded itself into my mind, a scar that never fades. As I grew, I wrestled with questions. Why did he quit? Dad battled mental illness, haunted by demons I’d only later understand, such as PTSD from Vietnam, where he watched a close friend die a horrible death right beside him. Still, what could break a man so thoroughly that he’d abandon life? In my youth, I’d call him weak, a quitter, harsh words, maybe a shield for my pain. But that judgment lit a fire in me. I’d never give up, never surrender. I refused to mirror what I saw as his failure, leaving behind people he claimed to love. Was this the crucible that forged my unshakable faith, the belief I could tackle anything, even a wild bear that could shred me without effort? Absolutely, I’d say. Yet strengths born from scars often cut both ways. This drive convinces me no goal is out of reach, but it also blinds me to dangers I don’t always clock.

Now, as markets crash around us, I’m buzzing with excitement. My portfolio’s taken a hit, but I see it like that bear, a rare chance to seize what others can’t. I’m buying the dip, dollar-cost averaging into stocks I trust, SPY, QQQ, IWM, and select companies, doubling down with every 5% drop. The last bear market saw SPY tank 27%, and if a recession hits, we could be headed there again. Am I striding toward another bear, oblivious until its eyes lock on mine? Or will I emerge with a win, similar to the prize-worthy photograph of the bear to flaunt to the world? I can’t say yet. Right now, all I can do is lay out the data, let you sift through it, and then decide for yourself.

We just had the 6th worst performance through 64 trading days and the stats don’t give a lot of hope for the near-term future.

When the SPX breaks a quarterly streak of exactly 5 up quarters, forward returns are negatively skewed.

Long bull markets have shown vulnerabilities that often morph into deeper trouble.

If we are going to recession level ratios, we still have a long way to go. I would expect around 15-16 PE ratio.

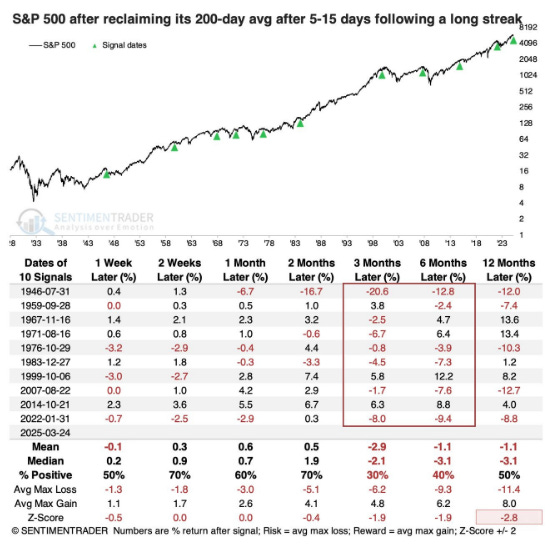

Some more positive stats will follow.

This is only a sample size 3, but 2 of the 3 were up a good amount after 1 year.

The S&P 500, after two consecutive days of 4.5% declines, are positive in the short-term.

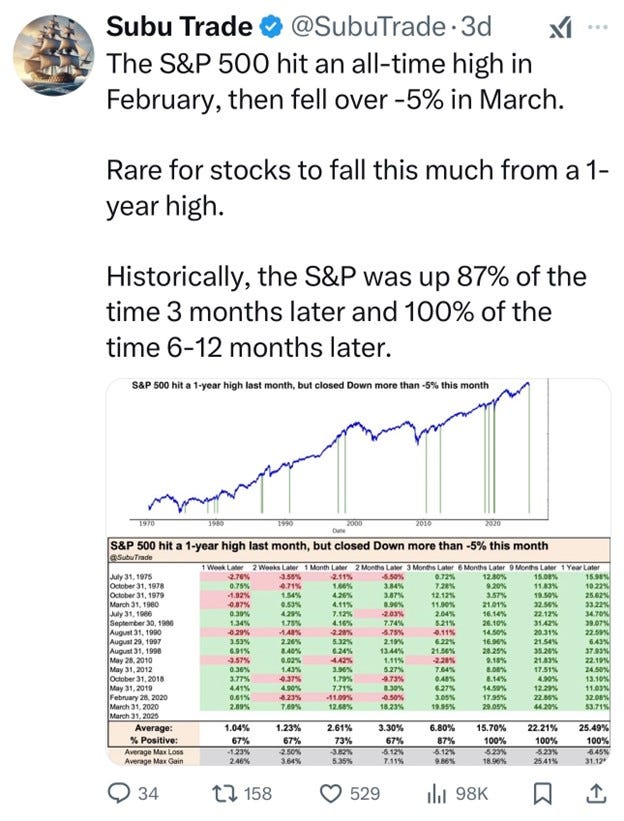

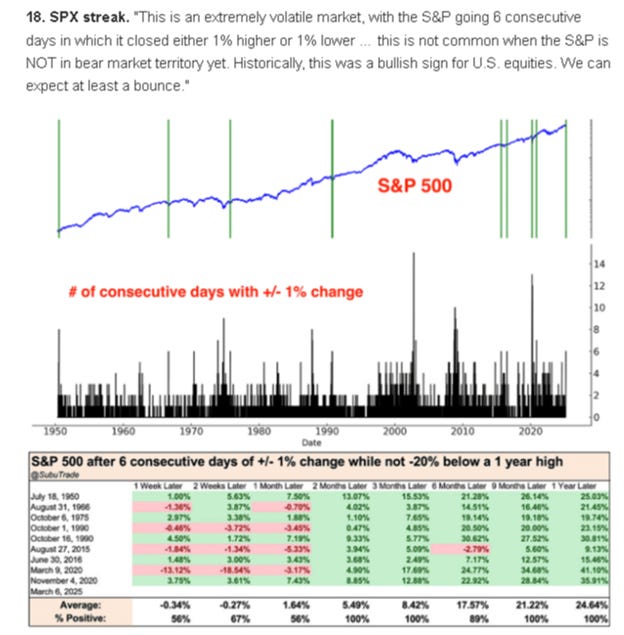

This analysis is from a random poster on X.

And

From Charlie Bilello. Long-term usually plays out very positively.

Also, from Charlie you can see the high VIX closes often lead to a great investment opportunity.

Nasdaq was up 3% then dropped 10%.

Thanks to my good friend for helping me gather this info – give him a follow on X - @chicagotraderrr

You’ve seen the data, the risks, and the rewards laid bare. Now the choice is yours: do you step into the fray, betting on the world’s finest companies, or watch from the sidelines as the moment slips by? I’m all in on American exceptionalism. Tariffs may jostle us, lifting some and bruising others, but I don’t see a prolonged bear market clawing us down. My plan is steady and deliberate: I’m adding to my positions as top-tier names like VFC dip below 13, scooping up the indexes with every 5% drop. A year from now, I’d love nothing more than to look back with you, swapping tales of how we faced the bear head-on and walked away with a shot so stunning it’d make National Geographic jealous. The opportunity’s here. Let’s seize it.

Man oh Man! Great article! I'm sure it's hard to lay bare and relive such terrifying moments from life and I truly appreciate the context and how you decided to draw strength and resilience from it. As always very much appreciate your teaching and encouragement!

My question is, historically, the business cycle and other instrinsic factors caused the breakdowns. Not self-inflicted wounds that cripple the reputation of the country. When business leaders go down to Florida and beg for relief for the industry — and get a tariff repealed for a bribe — how do the markets factor that in?