The Republican Party has secured a clean sweep in the House, Senate, and the presidency, setting the stage for business-friendly policies. This political shift could usher in a self-fulfilling prophecy where optimism about economic conditions spurs increased spending and risk-taking, leading to job creation and GDP growth. If even half of the Republican goals are met, we can anticipate a reduction in government spending alongside a surge in private sector activity.

Currently, we are seeing individuals and companies willing to spend more. Strong retail numbers suggest we will likely see a robust holiday spending season. Below is Bank of America’s Consumer Checkpoint key takeaways.

All Cohorts are increasing spend YoY as stated above.

Consumer confidence has broken out of the sideways trend.

Challenging the Bearish Outlook

Those predicting a significant market downturn are overlooking the vigor of the current economy and the anticipated economic upswing for the coming year. Despite equities reaching historic highs, there's a considerable amount of cash on the sidelines, with FINRA margin debt remaining low.

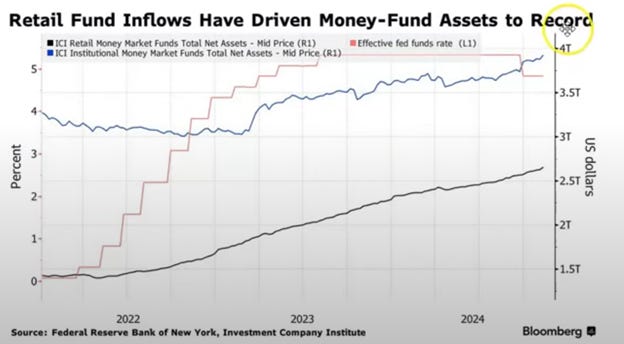

Consumers are financially robust, holding approximately $4-5 trillion in cash, ready to be invested (see image below).

Similarly, companies have amassed around $8 trillion in cash reserves. With central banks moving towards an easing cycle and a president focused on raising income across all economic strata, we're looking at a potential economic explosion.

The Coming Explosion: IPOs and Mergers & Acquisitions

This economic boom is poised to increase the number of initial public offerings (IPOs) and mergers and acquisitions (M&A). Currently, we're at historic lows in terms of equity supply and the number of U.S. public companies, which suggests a ripe environment for growth.

Bank of America listed five reasons to own common stocks, and I agree with all of them. These reasons are detailed in the image below.

Mega-cap stocks might currently offer "poor value," suggesting that investors should explore opportunities elsewhere. Equal-weighted stocks are historically undervalued, presenting a golden window for investors. (see image below).

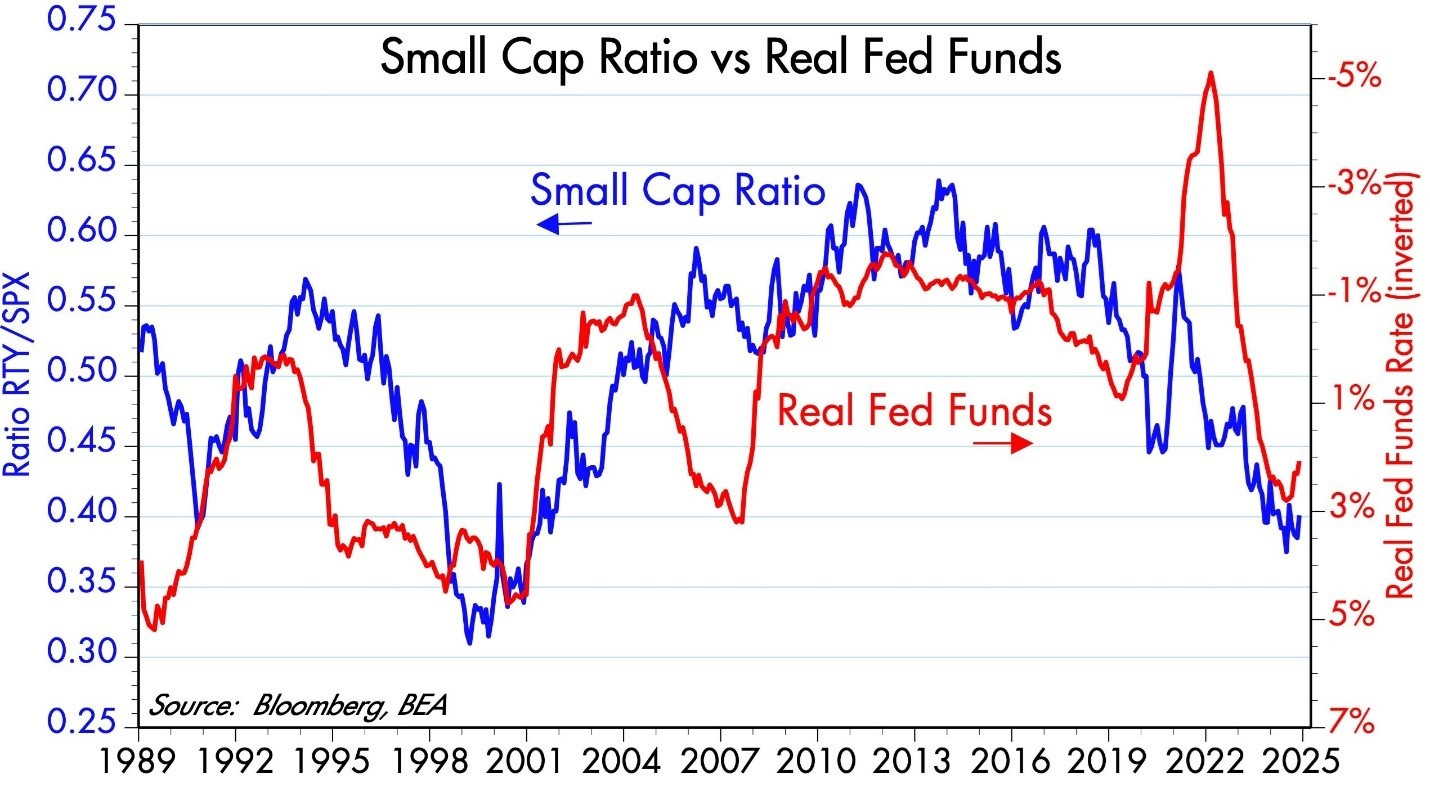

Small Caps on the Rise

Historical data shows that when real Fed funds rates decrease, small-cap stocks tend to outperform large caps. I'm on the lookout for opportunities in the Russell 2000 (IWM) and will seek value in small and mid-cap (SMID) companies (see image below).

This economic boom will not only increase revenues and profits for U.S. companies but will also benefit emerging markets like China. When America wins, the world wins. For example, as shown in the image below, China’s foreign direct investment is starting to rise again, like the upward trend seen in mid-2016.

Positive Economic Indicators

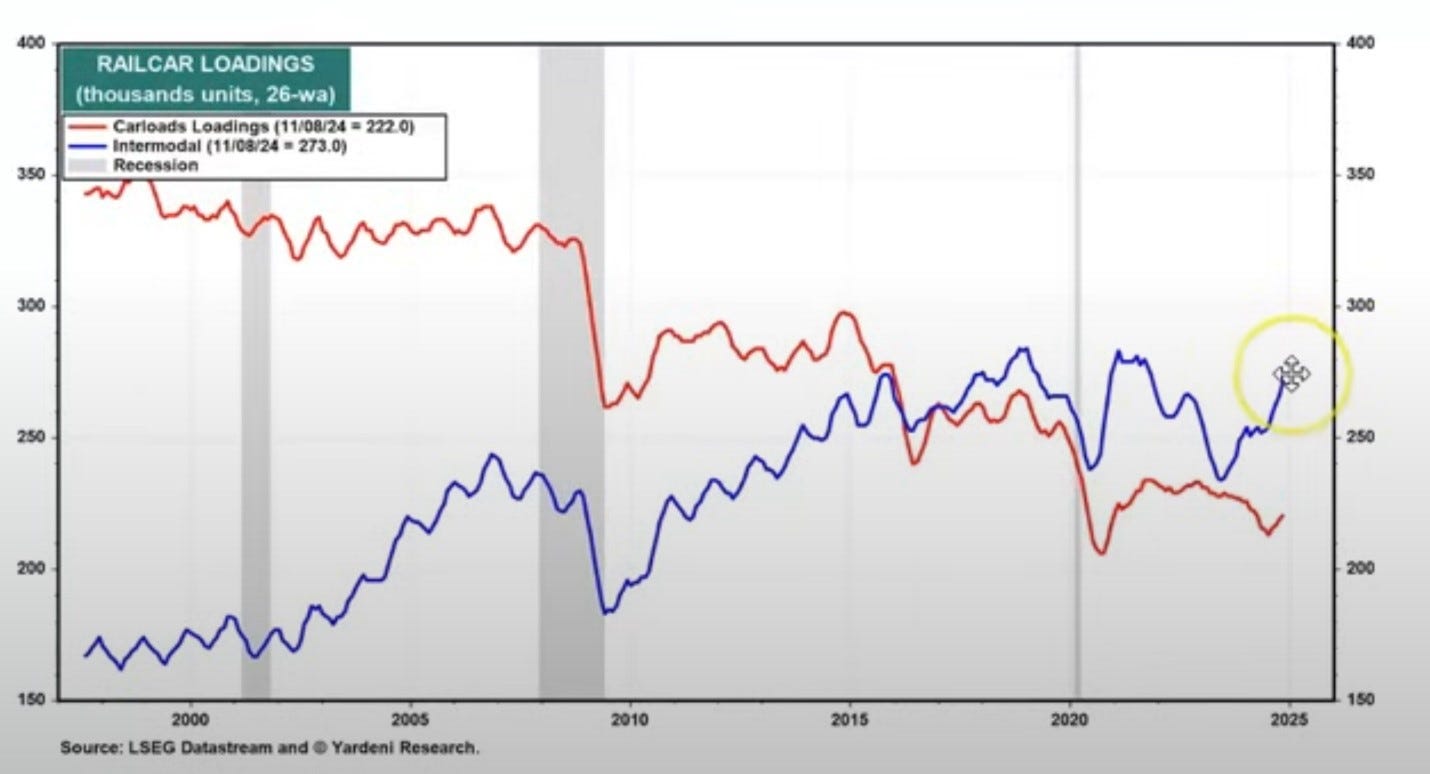

We're already seeing signs of growth, with freight activity recovering from its previous downturn and beginning to rise again (see image below).

Railroads are showing similar strength (see image below).

Even with higher interest rates, motor vehicle sales are climbing and are poised for further growth, as indicated in the chart below.

President Trump has proposed making interest on car loans for U.S.-made vehicles tax-deductible, further boosting this sector. My strategy involves investing in "picks and shovels" rather than dealers, hence my interest in companies like Cooper-Standard Holdings Inc. (CPS).

Pre-Ordering and Tariff Concerns

With Trump’s policies in place, we’re also seeing companies pre-ordering goods to front-run potential tariffs. This is reflected in China’s export growth, which saw its fastest pace since July 2022. California’s Port of Long Beach also saw record high imports in October.

Investment Strategy for the Coming Months

I plan to deploy my cash reserves into companies I believe will outperform over the next 12-24 months. My master watchlist will guide shorter-term investments leading up to the inauguration. Post-inauguration, expect some market consolidation, setting the stage for a rally in March-April.

At that point, stock picking will be key; don’t follow the herd but seek out overlooked opportunities. Over the next 30 days, expect a chase for financials and IT stocks.

While I’m open to playing these sectors on a shorter time frame, I’m focusing on better value plays for my long-term investments. As shown in the chart below, small- and mid-cap companies currently have a price-to-earnings (P/E) ratio of about 16, compared to 22 for the S&P 500 and 30 for mega-caps.

The Shift from Mega-Caps to SMID Stocks

The earnings dominance of the "magnificent seven" is diminishing, likely leading to a revaluation where SMID stocks could see an increase in multiples relative to mega-caps (see image below).

In conclusion, it’s important to ignore the noise and distractions in the market and recognize that we are currently in the midst of a powerful bull run. With Trump’s victory in the White House, we’ve just thrown gasoline on the fire. The policies and economic shifts we’re witnessing are setting the stage for a massive expansion, one that will drive growth across industries and markets. The conditions are ripe for significant economic acceleration, and those who remain focused and invest wisely will reap the rewards of this unprecedented boom.

Thank you for the thorough debrief, DMAN! Excited to open up another great week tomorrow, hope to see you around the rooms!