GXO Logistics: A Value Investment Opportunity in a Post-ZIRP World

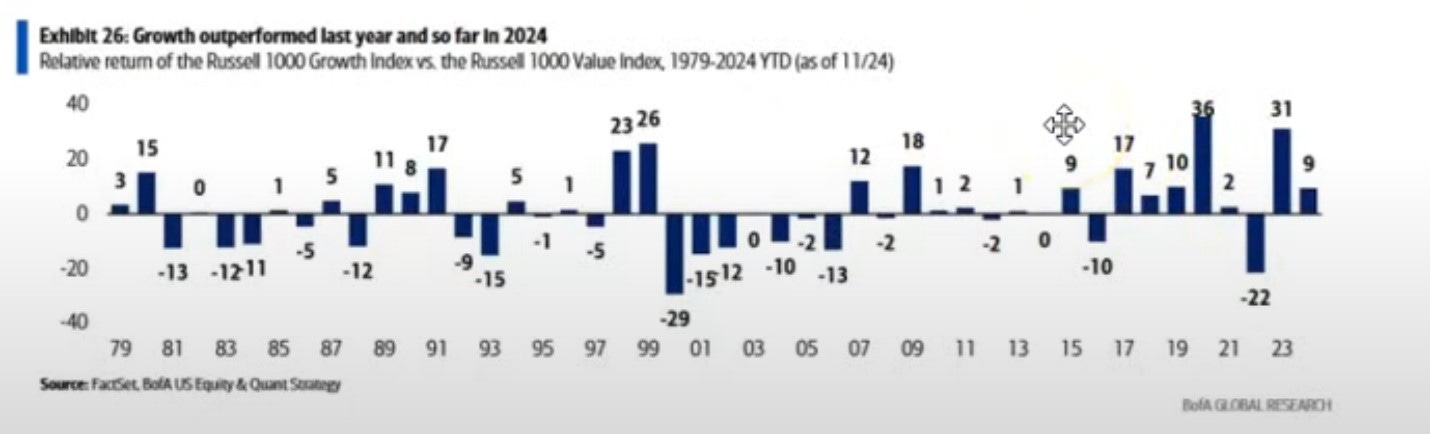

The last two years have been exceptional for investing in the biggest names in the market like the "Mag 7”; however, I believe that 2025 will demand a different approach, requiring investors to look beyond the surface. While value stocks have been significantly outperformed over the last 10-15 years, we are entering a more normal rate environment, and I don't expect a return to zero interest rate policies (ZIRP).

Since 1927, value stocks have historically outperformed growth stocks by an average of 4.4% annually. I will be sending out an article soon that will delve deeper into the cycles of value versus growth stocks.

One value company I've been closely watching is GXO Logistics:

Overview: GXO is the world's largest pure-play contract logistics company, offering comprehensive supply chain management solutions including warehousing, distribution, order fulfillment, e-commerce, and reverse logistics.

Operations: Operating in over 27 countries, GXO manages approximately 869 warehouses, totaling more than 208 million square feet. It serves a diverse, blue-chip customer base across industries like technology, consumer electronics, retail, and manufacturing.

Formation: GXO emerged from XPO Logistics in a spin-off in August 2021 to focus solely on logistics.

Market Position: The company utilizes advanced automation, robotics, and data analytics to improve supply chain efficiency, capitalizing on e-commerce growth, automation demand, and the trend toward outsourcing logistics services.

Recent Developments:

Takeover Interests: GXO has been considering a potential sale after receiving interest from competitor logistics firms, who argued that GXO was undervalued. The company reportedly rejected an offer in the $75 per share range.

CEO Retirement: Malcolm Wilson, named CEO in August 2021, has led significant growth and acquisitions but will retire. He is turning 65.

Wincanton Acquisition: The Competition and Markets Authority has set an April 2025 decision date for its investigation into GXO's £762 million acquisition of Wincanton.

Despite these developments causing a stock price drop, I see two out of the three as positive signs. The rejection of the buyout suggests that GXO's value might be well above $75, potentially reaching $100 in a couple of years. The Wincanton acquisition moving to phase 2 is a standard regulatory step. The CEO's retirement, while not ideal, isn't necessarily negative; it's a natural transition given his age.

Financial Performance for Q3 2024:

Revenue increased by 28% year-over-year to a record $3.2 billion, with organic growth at 3%.

GXO signed approximately $750 million in annualized revenue year-to-date, on track for a record year in new business wins for 2024.

The sales pipeline grew by 30% year-over-year to $2.4 billion, reaching a two-year high.

Full-year 2024 guidance reaffirmed:

Organic revenue growth of 2% to 5%

Adjusted EBITDA of $805 million to $835 million

Adjusted diluted EPS of $2.73 to $2.93

Adjusted EBITDA to free cash flow conversion of 30% to 40%

GXO's strong cash flow and solid balance sheet support its growth strategy. (see images below)

Much like XPO, GXO is poised for double-digit growth through acquisitions and organic expansion. An additional advantage is that 41% of its revenue comes from the UK, offering international value opportunities as U.S. market multiples become "frothy."

A key figure in GXO's narrative is Brad Jacobs, known for his focus on cost control and shareholder value. Jacobs, who founded GXO and still owns 1.7 million shares, has a track record with companies like United Rentals and XPO Logistics. His book, How to Make a Few Billion Dollars, outlines his success strategies.

AI is another factor set to boost GXO's profit margins. As AI technology advances, logistics firms can save significantly by transitioning from human to machine labor in warehouse operations.

The fourth quarter is peak season for GXO, and during the conference call, the CEO noted, "We're seeing inventory levels returning to normal, and demand for e-commerce capacity is accelerating," alongside comments on the efficiency gains from automation and AI. GXO was also honored with a Supply Chain Excellence Award for its leadership in warehouse AI by Logistics Manager.

Conclusion:

Despite recent volatility, GXO Logistics presents a compelling case for value investing in 2025. The combination of a robust operational framework, strategic leadership, and the potential for significant growth through technology and international expansion makes GXO a noteworthy addition to any value-oriented portfolio. With a proven track record under its belt and a forward-thinking approach, GXO is well-positioned to capitalize on emerging trends in logistics, making it an exciting prospect for investors looking to diversify beyond the usual suspects.