In Bear Markets, Stocks Return to Their Rightful Owners

On April 2, 2025, dubbed “Liberation Day,” President Trump unveiled a tariff framework that exceeded market expectations, triggering a sharp sell-off as some countries escalated trade tensions. While volatility spiked, the market has since stabilized, with the S&P 500 reclaiming levels above its pre-tariff announcement close.

This correction separated the “panicans”, investors who sold in fear, from disciplined traders who recognized opportunity. As a deep-value investor, I capitalized on the dip, reclaiming shares in fundamentally strong companies at attractive prices. Below are the stocks that “returned to their rightful owner”, me, and I expect up to 100% returns.

Stocks Reacquired During the Dip

Amazon (AMZN): As highlighted in my Equanimity article, AMZN’s robust cloud growth and logistics dominance make it a core holding. The tariff dip allowed me to add shares at a discount, positioning for long-term gains.

Alphabet (GOOGL): This Magnificent Seven stock delivered stellar earnings, reinforcing my confidence in its advertising and AI-driven growth. I expect steady appreciation as market sentiment stabilizes.

Cooper-Standard Holdings (CPS): A long-term favorite, CPS was reacquired at $11 in early April, surging to $22 within weeks—a 100% gain. Its cyclical recovery potential keeps it in my portfolio.

VF Corporation (VFC): Hit by inventory overhangs and margin pressures, VFC’s new CEO, Bracken Darrell, is driving a turnaround. Tariff fears pushed shares below $10, where I built a sizable position, targeting $30 if trade tensions ease.

Alibaba (BABA): Despite repeated mentions, BABA’s value remains undeniable. I repurchased 40,000 shares below $100, confident in its e-commerce. AI and cloud leadership for long-term upside.

PayPal (PYPL): Under CEO Alex Chriss, is prioritizing profitable revenue streams, accepting short-term sales hits for long-term gains. I see a path to $125-$135 as the turnaround matures.

iShares Russell 2000 ETF (IWM): Though currently underwater, IWM’s small-cap exposure positions it for mean-reversion outperformance over the next few years. Patience will pay off.

Walt Disney (DIS): Strategic dip-buying at lower prices, with partial sales at $100 and $120, has built a larger position for a push toward $160, driven by streaming and theme park recovery.

Intuitive Surgical (ISRG): Tariff-induced weakness brought this robotics leader to mid-2024 levels, offering a rare entry point. ISRG remains a top pick for its surgical innovation.

JD.com (JD): After locking in near-100% gains previously, I rebought JD in the $30s, anticipating another double as China’s e-commerce stabilizes and they push to turn their economy into a consumption economy.

These positions reflect a consistent strategy: I have invested in these companies in the past and I know them intimately, requiring no last-minute research during market chaos. When prices dropped, I saw value where others saw panic, a mindset that delivered substantial returns.

Market Dynamics: Earnings Strength Amid Uncertainty

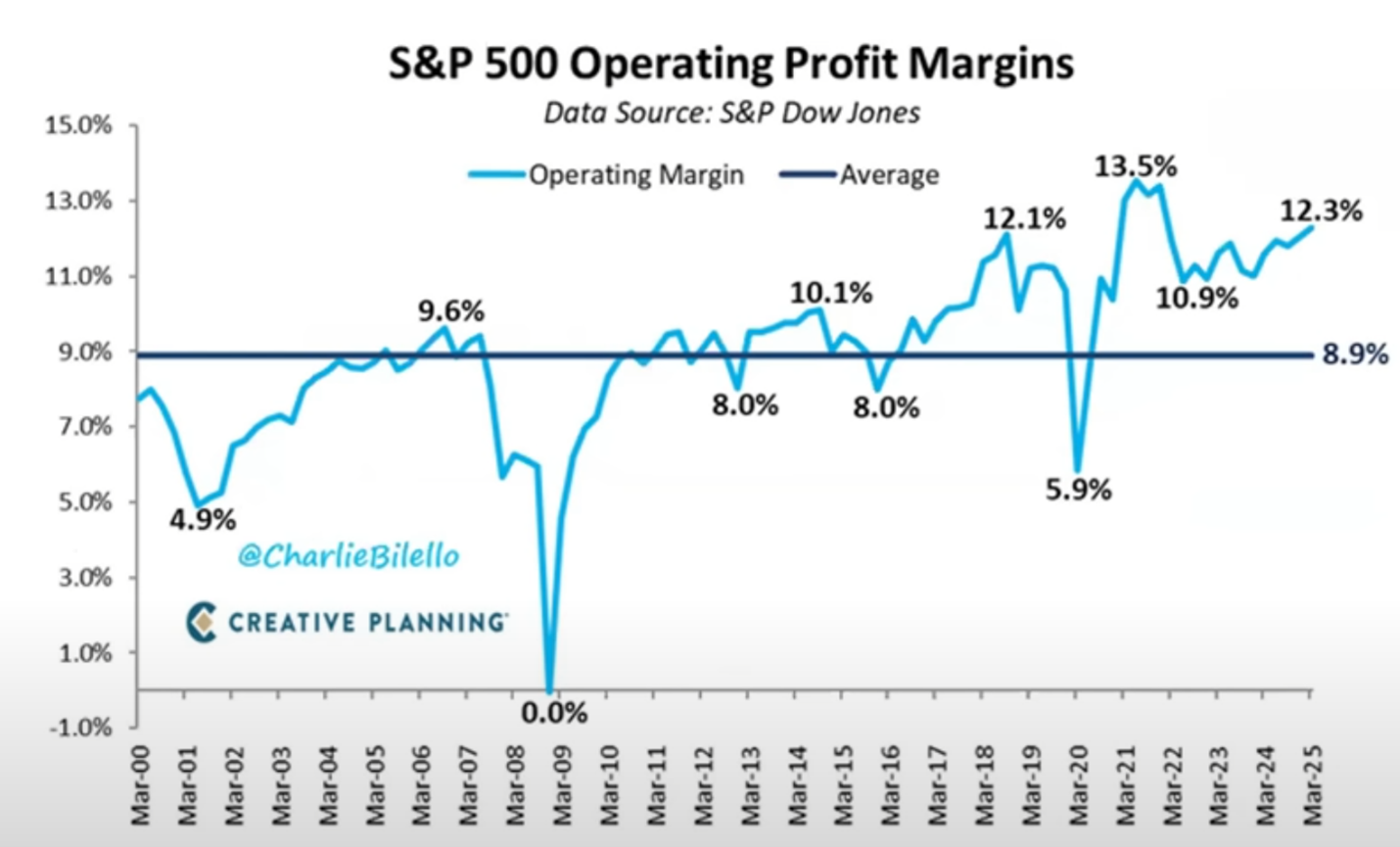

Corporate earnings have bolstered market stability, with many firms reporting solid results. However, forward guidance and growth metrics raise concerns. Year-over-year quarterly sales per share grew by just 2.9%, while EPS rose 9%, signaling aggressive cost-cutting amid trade war uncertainty.

This mirrors Meta’s transformation post-$88 lows, where leaner operations drove profitability. If trade tensions resolve swiftly, similar efficiency gains could propel margins across sectors, provided a broader recession is avoided.

Economic data presents a mixed picture on the surface. Government job cuts, previously a top contributor to employment reports under Biden, has slid to seventh place as Trump and D.O.GE slash government work, signaling fiscal tightening.

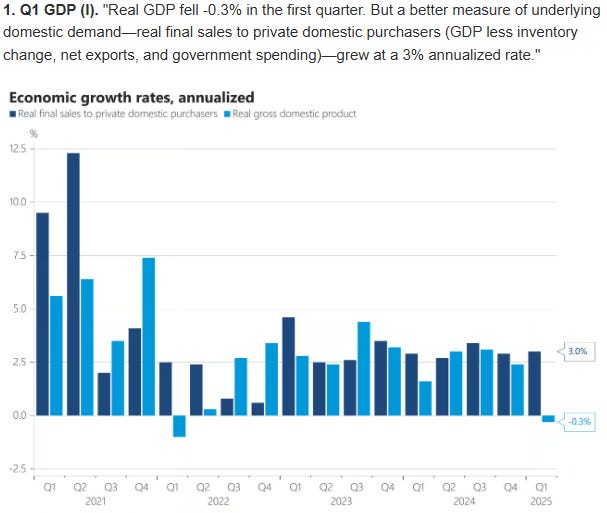

The economy contracted last quarter, driven by net export declines as firms pre-ordered ahead of tariffs.

Yet, real final sales to private domestic purchasers—a metric favored by Fed Chair Powell—expanded at a robust 3%, indicating underlying strength when import distortions are excluded. One more quarter of negative growth would technically signal a recession, but domestic demand suggests resilience.

Conclusion: Profiting with Poise

The tariff-driven sell-off underscores the timeless truth from my recent articles, Equanimity and Profiting from the Markets with Calm: bear markets transfer wealth from the fearful to the disciplined. Just as I wrote about maintaining composure to seize undervalued opportunities, this correction rewarded those who stayed calm, buying quality stocks at fire-sale prices. Whether it’s AMZN’s growth trajectory or VFC’s turnaround potential, my portfolio reflects a commitment to knowing my investments deeply and acting decisively when markets falter. As traders, we thrive not by predicting every twist but by embracing volatility with clarity and confidence. Stay focused, avoid the “panicans,” and let the market’s cycles work in your favor.