In my recent article, I highlighted the benefits of maintaining composure during market sell-offs and shared a curated list of ten stocks I acquired during the dip. This disciplined approach enabled us to capitalize on the market's longest winning streak since 2004. I trust that the weekly data and insights I provide have empowered you to tune out the noise and reap the rewards of a calm, strategic mindset. As we look to the coming weeks, however, I urge a shift toward caution, as the market approaches a critical juncture that demands vigilance.

My perspective is evolving with the market's recent rebound. The indices are nearing a significant pivot point, which I outlined in my posts on X on April 25 and May 1.

The 575 level on the S&P 500 represents not only a robust volume profile but also the 200-day Simple Moving Average (SMA). A decisive break above this threshold could pave the way for a rally toward all-time highs. However, I anticipate consolidation or a potential rejection before any sustained breakthrough. A catalyst, such as a trade deal announcement, could propel the market past the 200-day SMA. Conversely, the Federal Reserve's decision on Wednesday looms large. A hawkish stance from Chair Powell, as seen previously, could trigger a sell-off. On the other hand, signals from the Treasury suggest a dovish approach, with plans to minimize government financing while enhancing the buyback program—a policy akin to quantitative easing.

The ongoing trade war narrative adds further complexity. Persistent rumors of an imminent deal have buoyed sentiment, but prolonged delays could unsettle even optimistic investors. Historically, trade agreements require 18 months to finalize and 45 months to implement. President Trump's push for a transformative shift in global trade underscores the need for clarity on the structure of these deals. Without it, market uncertainty may intensify.

The market's swift recovery has left many participants scrambling. Hedge funds that sold during the downturn now face pressure to re-enter, while retail traders, who bought the dip, have emerged as the "smart money" for now. Money managers must either chase the rally or hope for a pullback, though historical data suggests dips are often short-lived.

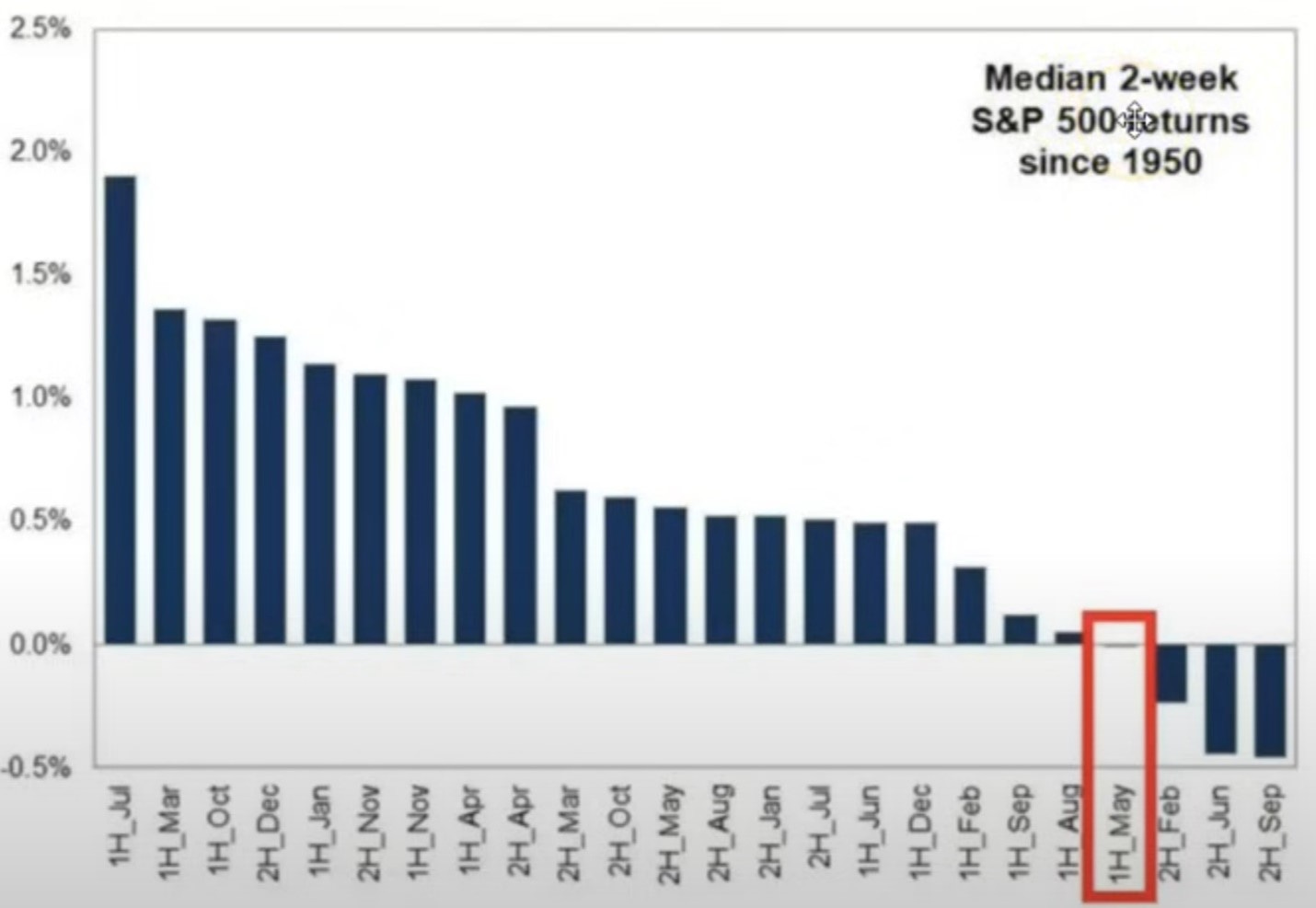

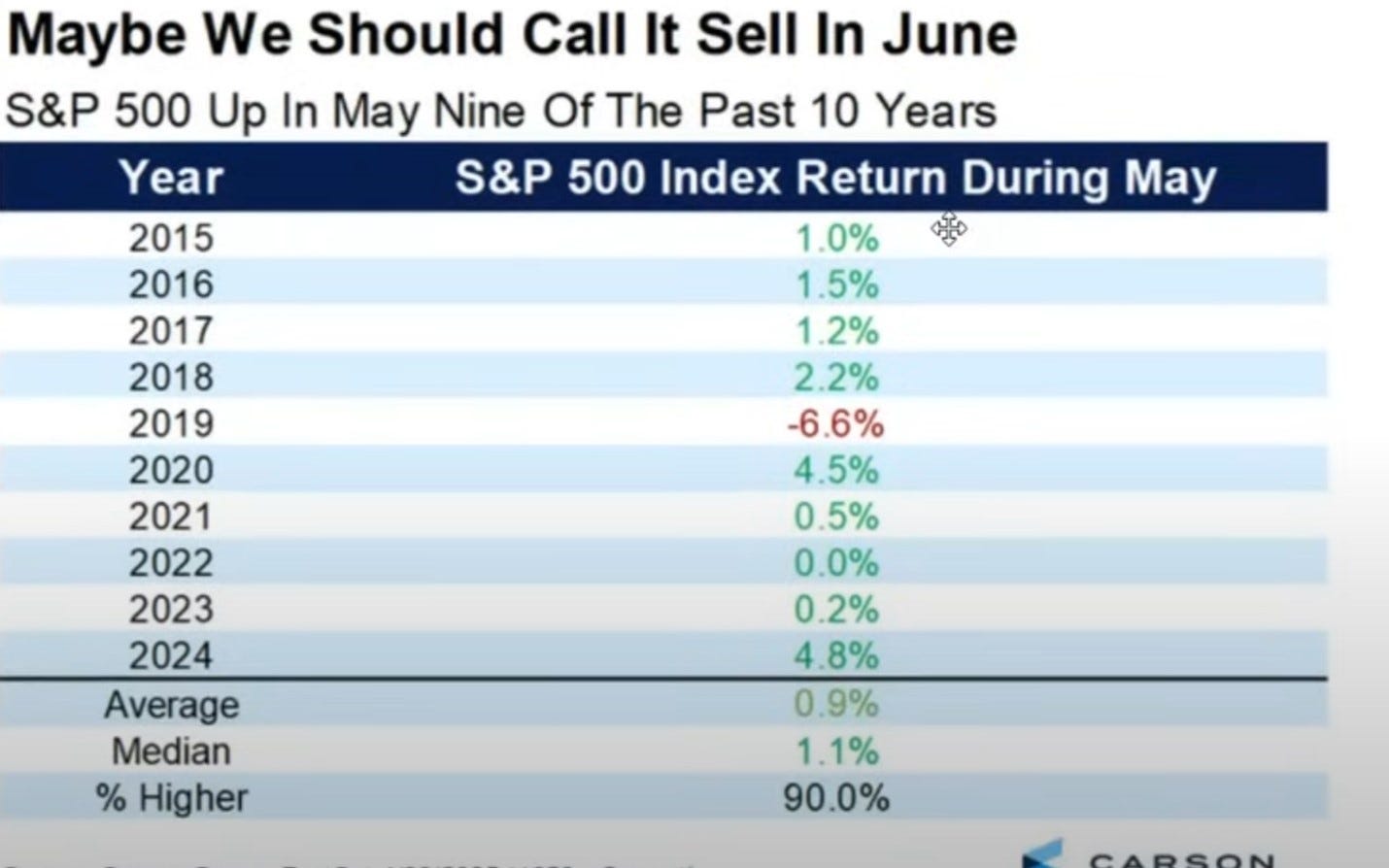

While I remain open to buying on weakness, historical trends indicate that the first half of May tends to be soft, despite the past decade's tendency to defy this pattern.

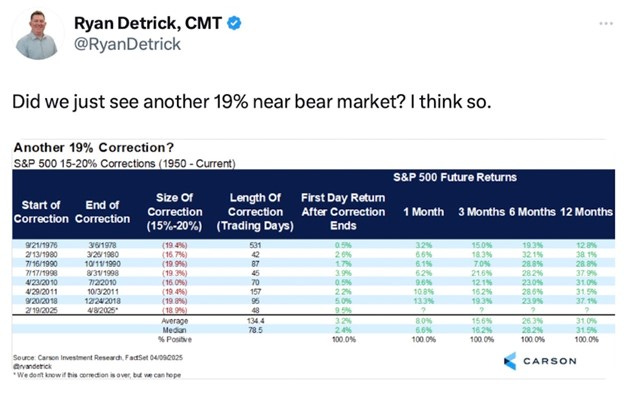

Analyzing corrections of 15% to 20% since 1950 reveals a consistent recovery pattern, with positive returns at one, three, six, and twelve months.

Notably, the recent 9.5% gain in the first month stands out as exceptionally strong, surpassing most subsequent monthly returns in similar scenarios. This rapid advance signals a need for caution, as the market may require time to consolidate.

Conclusion: A Time for Patience and Precision

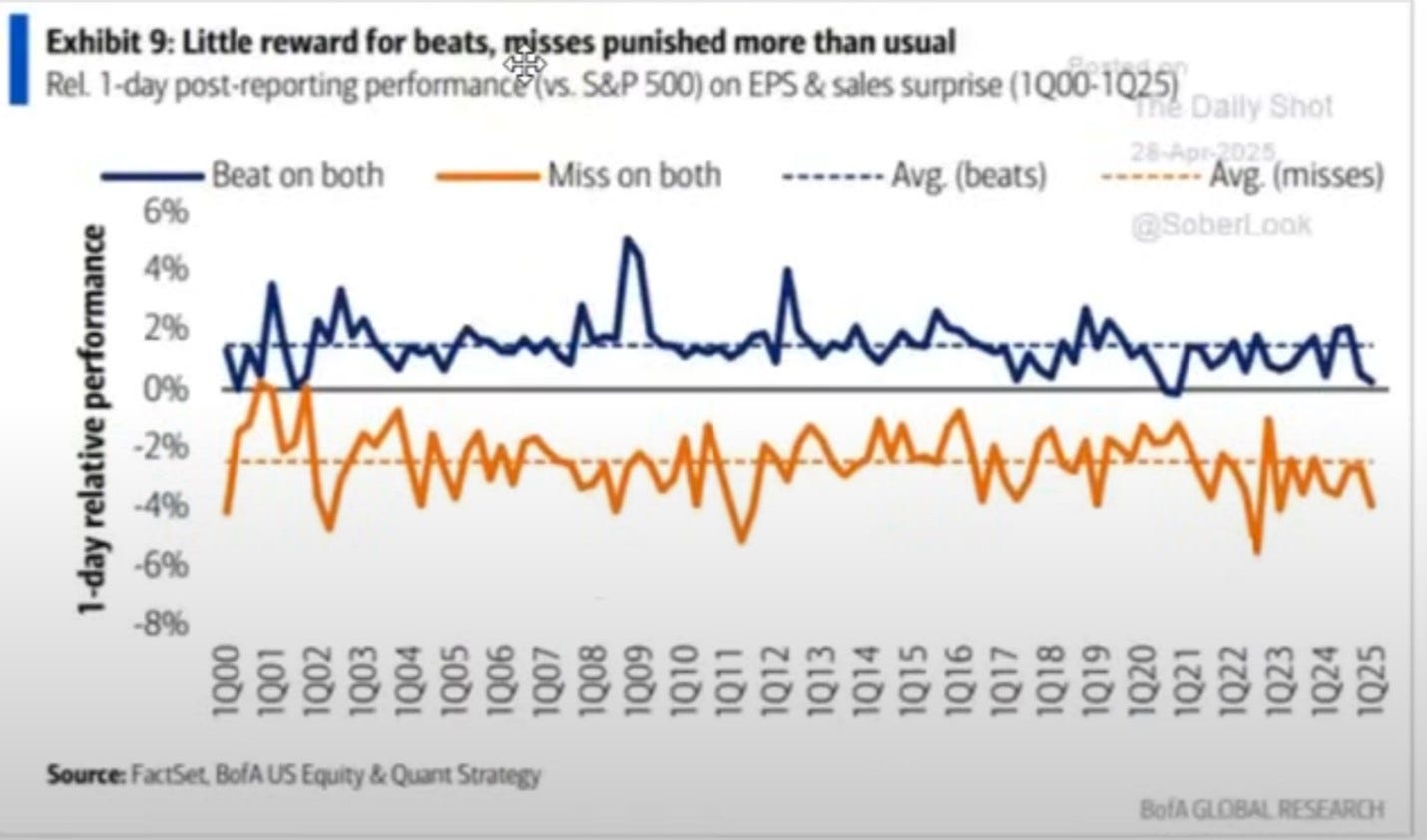

While bullish data and catalysts abound, the next few weeks call for prudent navigation. The market has priced in significant positive developments that remain unconfirmed, and upcoming earnings reports present additional risks. Companies exceeding expectations are receiving muted rewards, while those missing estimates face harsher penalties than usual.

For the week ahead, I will focus on short-term opportunities while limiting longer-term commitments. As legendary investor Jim Rogers once said, "I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime." Similarly, Jesse Livermore noted, "Money is made by sitting, not trading." Let us heed these words, exercise patience, and position ourselves wisely for the opportunities that lie ahead.

Another EXCEPTIONAL write up D-Man! Hope to see you next week on DPL! BobbyH