Last Thursday, I walked away from my trading desk and made no trades. I was caught in a self-sabotaging mindset, one that could have led to reckless decisions harming my portfolio—and my family. Growing up, my father battled manic depression, and I’ve inherited traces of that emotional turbulence. When I push myself to grow, my nervous system, wired for survival, sometimes triggers panic instead of progress.

As traders, we know this feeling all too well. The market’s volatility can mirror our inner chaos, tempting us to act from fear rather than strategy. But I’ve learned that courage isn’t the absence of fear, it’s acting despite it. Let me share a personal story to illustrate how mastering your emotional state can transform both your life and your trading.

I pride myself on being a great dad—it’s central to my identity. But I struggle with agoraphobia, which makes leaving the house a battle against panic attacks. My nervous system screams “danger” every time I step out. As my kids grow, I’ve become their taxi service for school events and activities. Last week, I forgot my daughter’s singing lesson, and she missed it. In the grand scheme, it’s minor, but it hit me hard. I spiraled into self-criticism: “What kind of father can’t manage his kids’ schedules?” That shame attacked my core identity, pushing me into self-sabotage mode.

After wallowing, I paused. I recognized this negative energy as my old self trying to keep me small and “safe.” Healing doesn’t mean banishing fear, it means moving forward despite it. Courage rewires our brains, helping us achieve our goals, whether it’s being a great parent or a disciplined trader.

Rewiring Your Mind for Success

Every thought carries energy. By intentionally visualizing success and feeling it as if it’s real, you can transform immaterial thoughts into material outcomes. Neuroscience backs this: focused mental activity shapes neural pathways in your brain. So, ask yourself: What are you mapping in your mind today?

To break my self-sabotage cycle, I visualized driving my daughter to her next appointment, focusing on her joy and my gratitude for being there. My energy shifted from shame to peace, from guilt to love. I wasn’t just managing a calendar—I was managing my emotions. Fear attracts more fear; peace attracts opportunity.

The Market’s Lesson: Emotion Drives Results

This brings me to the market. Recently, we saw a rare opportunity to profit big on a sharp upswing. How many of you seized it? How many made more on the way up than you lost on the way down? The truth is, you don’t get what you want in trading, you get what you accept. If fear or self-doubt controls you, you’ll hesitate on entries, exit too early, or give back your gains.

To succeed in the markets, you must master your emotional state. A to-do list won’t make you a better trader, but managing your emotions will. Fearful traders chase losses; peaceful traders ride trends. I showed discipline by not trading on Thursday until I had mastered my emotional state.

Your Invitation: Trade as a New You

Tonight, decide to wake up as a new trader—one who faces fear head-on and trades from clarity. Here’s how:

Visualize Success: Before trading, picture yourself executing your strategy flawlessly. Feel the confidence of a winning trade.

Shift Your Energy: When fear creeps in, pause. Breathe. Replace doubt with gratitude for the opportunity to trade.

Act with Courage: Fear will always be there. Let it be a signal to act deliberately, not a barrier to success.

Your mind shapes your reality. Create wealth with intentional thoughts. Don’t let self-sabotage derail your trades or your life. Join me in trading from a place of peace, you too can fly.

If you need more help on learning how to do this, watch these 2 videos.

Market Update: Bullish Signals and Strategic Plays for Earnings Season

The market is sending strong bullish signals, and I’m excited to share why this is a great time to stay engaged. One key indicator, the Zweig Breadth Thrust, recently triggered, surging from below 40% to above 61.5% within a 10-day period.

I highlighted this same indicator in November 2023, and the subsequent market rally proved its reliability. Historically, this signal points to higher market levels 12 months out, giving us confidence in the current uptrend.

Adding to this optimism, Carson provides compelling data supporting a bullish outlook.

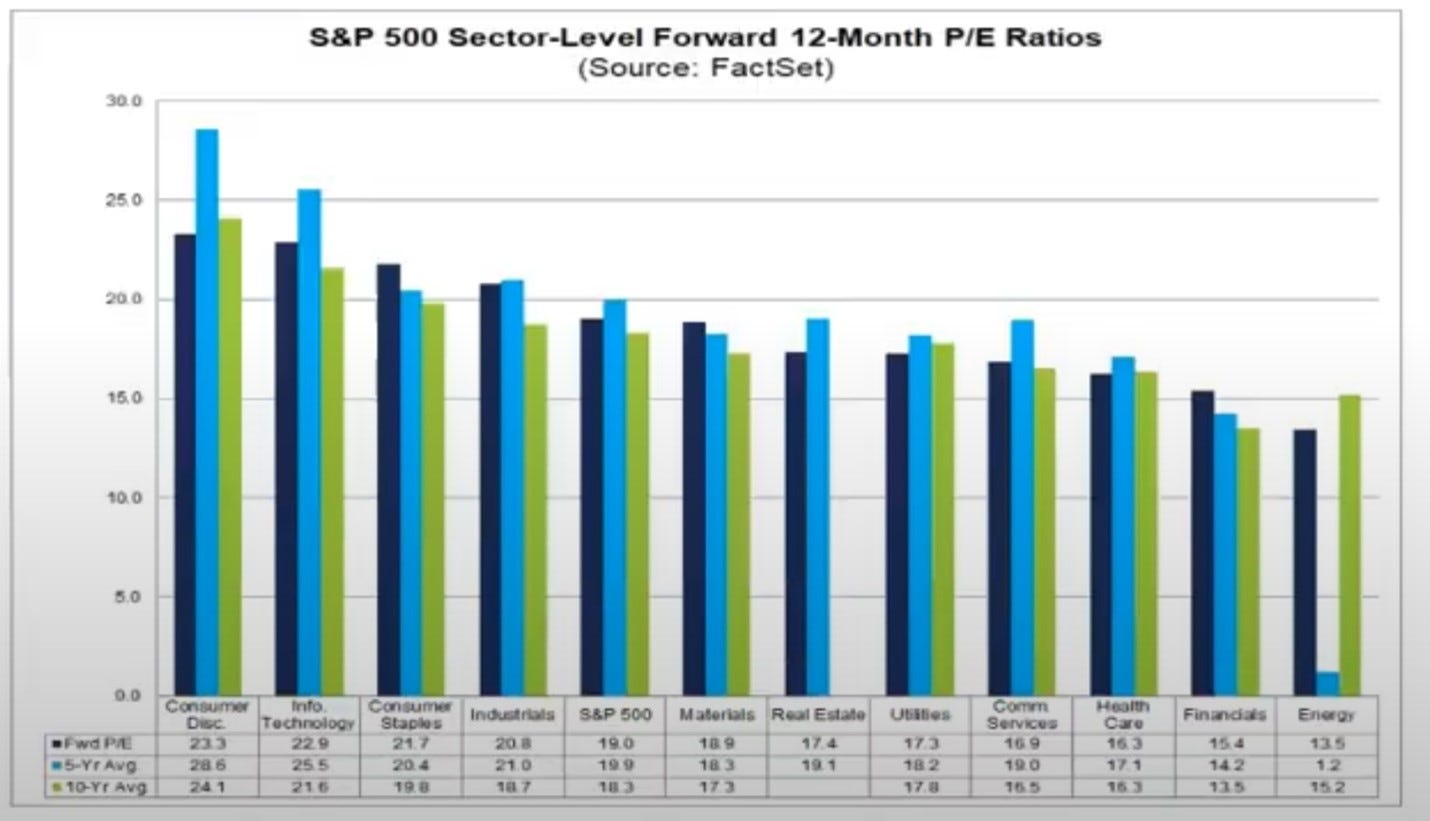

While last week’s market bounce was a win for many of us, it has pushed valuations higher. The S&P 500’s P/E ratio, which dipped to 18, has climbed back to its 5-year average of 20. This suggests that while opportunities still exist, value is becoming harder to find.

As a contrarian, I’m cautious about potential stall points. Earnings season could introduce volatility if companies issue weak guidance, potentially inflating P/E ratios further.

From a technical perspective, the SPY faces resistance around the 575 level, which aligns with the 200-day moving average. Weak earnings could prevent us from reaching this level, though I don’t expect broad-based disappointments; however, a significant catalyst like a trade deal announcement could override technical resistance, so stay nimble.

Earnings Plays: Where I’m Focusing This Week

Earnings season is my favorite time to trade, and I’m leveraging my proven strategies to capitalize on opportunities. Using my earnings sheet, I’ve identified several stocks with strong pre-earnings momentum: DASH, UBER, VST, DIS, and AMD. Stocks like APP tend to perform well on earnings day, while MNDY shines three days prior. My approach is to wait for a support level, buy options or shares for the pre-earnings run, and exit options before the report. If profits are substantial, I may hold shares through earnings, as I successfully did with GOOGL and NFLX.

Post-earnings plays are another edge. Stocks like NFLX, VRT, GEV, and BSX often see a bounce within days of their reports, and I expect GOOGL to attract more buying after its strong results. Keep in mind that sector-wide effects are common—strong or weak reports from one company can lift or sink related stocks.

Trading with Confidence

This week, I’ll be highly active, executing plays based on my decade-long experience trading earnings. The key to success is trading from a place of peace, not fear. This means relying on tested strategies, staying disciplined, and accepting outcomes without emotional attachment. Earnings season is where I make the bulk of my profits, and I’m excited to apply my hard-earned edges.

Conclusion: Trading from Peace, Not Panic

At the start of this article, I shared a moment of vulnerability—walking away from my trading desk last Thursday, paralyzed by a self-sabotaging mindset rooted in fear and shame. That experience, tied to my struggles with agoraphobia and the weight of being a present father, reminded me that trading, like life, demands emotional mastery. Just as I visualized driving my daughter to her next appointment with joy and gratitude, shifting my energy from fear to peace, we must approach the markets with the same intentionality.

The Zweig Breadth Thrust’s recent trigger (a signal that sparked a rally when I shared it in November 2023) underscores the market’s bullish potential over the next 12 months. Coupled with the opportunities in earnings season—stocks like DASH, UBER, and AMD poised for pre-earnings runs—this is a moment to act with courage, not hesitation. By trading from a place of peace, using proven strategies like pre- and post-earnings plays, we can seize these opportunities without letting fear derail us.

Just as I chose to move forward despite my nervous system’s panic, you can choose to trade as a new you, one who visualizes success, shifts energy from doubt to gratitude, and acts decisively. The market rewards those who master their emotions and trust their edge. Let’s harness this bullish momentum, trade with clarity, and soar to new heights together. The view is different up here. Come fly with me!

Nicely done Dman! Very interesting reading. Thanks!

Great job Dman! Thank you for sharing