The Art of Making Money in the Stock Market.

When I embarked on my day trading journey in the late-1990s, Datek introduced an unprecedented pricing strategy at $14.99 per transaction, doubling that to $30 for a complete buy-sell cycle. At the time, this was nearly unheard of, prompting me to seize the chance to make money while in college through day trading. However, my strategy differed from typical day trading: I preferred what's now known as swing trading, aiming to buy and sell stocks over several days or weeks. I invested in a few hundred shares of AAPL at a price of $0.14 (adjusted for splits). This decision was influenced by Microsoft's recent $150 million investment into Apple, which I believed would at least double the stock price. And it did; we doubled our investment, and with what I thought was my strategic foresight, I took my profits and set out to double my money again. Had I held onto those few hundred shares of AAPL, I would now possess 33,600 shares, which at the last closing price of $237.33, would equate to $7,974,288 in my portfolio—a stark reminder of the potential in looking beyond short-term gains.

This experience taught me a fundamental lesson: the simplest way to generate wealth in the stock market is by investing in outstanding companies at reasonable prices. This principle guided my subsequent investments in companies like VF Corp (VFC), Generac (GNRC), PayPal (PYPL), Citigroup (C), Bank of America (BAC), and 3M (MMM), among others. As I've refined my trading strategies over time, I consistently return to this straightforward concept—buying into quality companies when they offer value because there's always a demand for good deals on great stocks.

I apply this principle across various trading strategies, including the ICB (Inside Candlestick Breakout) and TPS (Trend Pattern Squeeze), tailoring my approach by maintaining watchlists of promising companies. This meticulous tracking enables me to capitalize on opportunities as they arise, adding to my positions as the stock ascends, rather than chasing after it has already moved.

I've shared some of my strategies for gaining an edge, but here, I want to illustrate how I leverage insights from others, adapting them to fit my own trading style. This adaptability is crucial for becoming a successful trader. There's a widely recognized trading adage: "You can’t trade on someone else's conviction." This means that those with strong belief in their analysis are better equipped to weather the market's natural fluctuations, whereas those lacking conviction might exit positions prematurely or at inopportune times.

I've come to connect with individuals who share my perspective on the stock market, one of whom is Tom Lee, the founder of Fundstrat Global Advisors. Tom employs a methodology rooted in evidence-based research, a principle that's at the core of my trading philosophy as well. While I utilize Tom's research, I customize the insights to tailor my own trades.

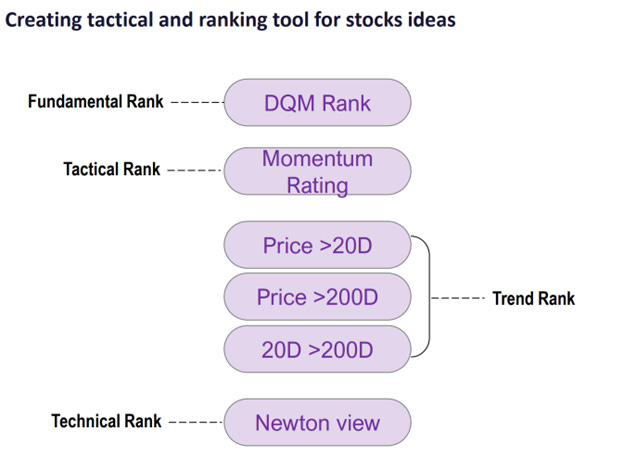

Here’s how Tom Lee refines his watchlist of stocks:

He starts with the 100 most widely held stocks by investors.

He removes ETFs to focus solely on individual companies.

He excludes any company with a market capitalization under $50 billion, ensuring focus on substantial entities.

The result is a curated list of stocks that meet these criteria, which is listed in the image below.

He then uses his own rankings of fundamental, technical, and other factors to identify the most promising opportunities. Below is an image of this process.

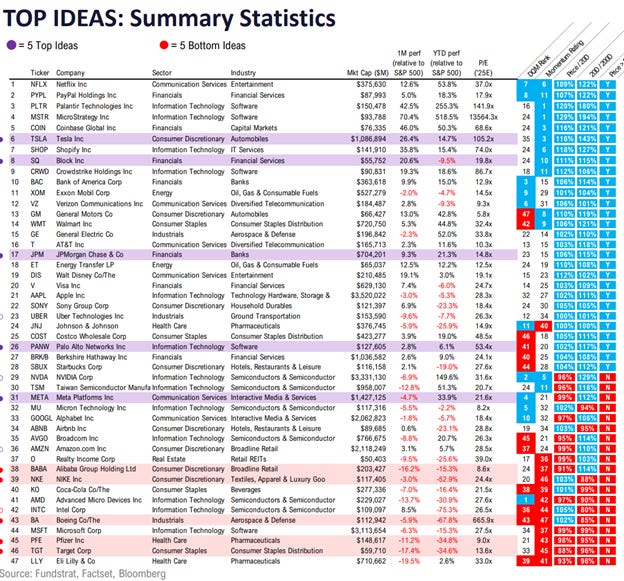

He uses the above to rate the top 5 and bottom 5 to play for the next month. That is shown below.

His top and bottom five picks for the next month are then selected, which for this month include Tesla (TSLA), Palo Alto Networks (PANW), Square (SQ), JPMorgan Chase (JPM), and Meta Platforms (META).

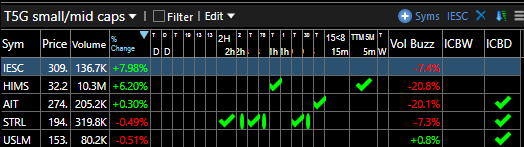

Using Tom's research, I don't simply buy these stocks; instead, I watch for setups that fit my edge. For instance, after putting these stocks into my watchlist, I look for edges like the TTM squeeze or inside candles:

The green check marks indicate that there is a TTM squeeze at that time frame, and the green check marks within the ICBW and ICBD indicate that there are inside candles on those time frames. So, I simply take Tom's research and create my own plays. One of my favorites is this 195M in TSLA.

We're only one dot in, but I think it's still worth taking a shot. Once I've identified the edge I want to play, I then go in and find the "zones" (using VP). The zones are shown in the image below. (If you want to learn how to draw the zones click here.)

Now we bring this back to the 195M to set up a plan. Here is the 195M chart with the zones.

The entry rule for the TPS/TTM strategy involves waiting for a price pull back to the 8EMA on that timeframe. Thus, our earliest entry point would be around $341.50. The risk for this setup is defined by a close below the lower Bollinger Band. As you can see, this aligns well with my designated zone from $327 to $330. Now that we've identified both entry and risk parameters, we can proceed to define our buying strategy. Initially, buying would occur within the $327-330 range, followed by additional buys in the $315-320 range. Personally, I would make three purchases within each of these sections, aiming to lower my overall cost basis through scalping.

(If you want to understand the TPS edge click here.)

The next step is to ask yourself, "If the stock price pushes up without pulling back to the 8EMA, is there a way I can play this safely?" This implies using an edge. I then look for an inside candle on a smaller timeframe to attempt a breakout play; however, with TSLA, I couldn't find any immediate breakout opportunities, so I must wait for either a breakout setup or for a pullback.

The following question to consider is, “What happens if I get stopped out of this play? Does that mean the trade is over?” For me, the answer is not at all! In fact, now you're getting a bargain, and you can focus on playing VP levels, looking for an oversold bounce. My target zone for this bounce is between $315 to $320. No matter what TSLA does, I intend to trade it within the edges which allows me to stay safe.

Remember, I am already holding TSLA from our “Trump trade,” and now I continue to add to a winning trade by finding edges within a great company.

Looking at our WL we can see JPM has some stacked squeezes on the 2H, the 78M and the 1H.

Using that same method I showed you in TSLA, below is what I have come up with.

I also noticed that PANW has a decent 195M TPS/TTM.

I am using the same technique on PANW that I described on TSLA.

Other edges within my watchlist include the weekly inside candle patterns for PANW and SQ, both of which also feature inside days. If you're unfamiliar with how to trade these setups, click here.

I've now adapted Tom Lee's ideas to fit well within my trading edges which gives me the conviction needed to execute my trades. I follow this process consistently.

I ensure that the companies I trade are solid, whether they're large-cap or small-cap. The simplest way to profit is by investing in these companies and holding onto them for extended periods. My aim is to establish a cost basis that I'm comfortable with, allowing me to add to my position as the stock price rises. For example, with META, when Mark Zuckerberg was spending recklessly and its stock price plummeted, I began investing once Zuck decided to manage expenses more tightly. This strategy enabled me to establish a cost basis as low as $105, which I then scaled up to $350. Ultimately, I sold my holdings in the range of $500 to $520.

Tom Lee also does the same thing in Small/Mid cap stocks as well, and his picks for this month are in the image below.

With SMID companies, I am quicker to take profits overall unless I believe in the company. If you wish to subscribe to Tom Lee, click here. (You can email me as well and I will give you more info on what Tom offers.)

The key takeaway from this discussion is learning how to utilize insights from others and tailor them to your trading style to foster conviction in your decisions. It's inherently more straightforward to maintain conviction when trading fundamentally strong companies. By integrating additional factors such as seasonality, momentum, and technical analysis, you can significantly enhance your winning probability, leading to a more pronounced upward trajectory in your profit and loss statement. Remember, the art of making money in the stock market involves not just following strategies but adapting them to create a personalized approach that resonates with your trading philosophy.

yep I can do you have my email? its pgsubway at gmail . com

Are you looking for the columns that show TTM and inside candles?

Would u be willing to share your tc2000 setup? I also use it to scan for stuff