The February Pullback Playbook

The latest earnings season has been a mixed bag for the Mag 7, with all but NVDA having reported their results. Among them, only META saw a positive stock price reaction, driven by a stellar 21% year-over-year revenue increase that easily exceeded expectations. Operating income also outperformed, reaching $23.7 billion against a forecasted $20 billion. For the Mag 7 to sustain upward momentum post-earnings, their reports must be truly exceptional—META delivered, but the rest fell short. Now, speculation is growing that the Mag 7 may not lead the market this year.

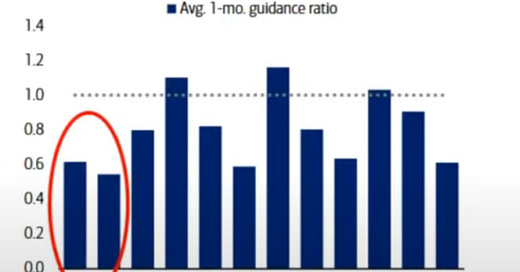

It's important to note that January to February is typically the weakest guidance period seasonally.

Despite some underwhelming stock reactions, many companies posted strong earnings, and I plan to focus on these over the next quarter. NFLX, PLTR, NET, PINS, TEAM, IBM, RCL, and GE are just a few that should be on your master watchlist. Identify strategic opportunities within your playbook that allow you to trade these safely.

As for NVDA, I believe its earnings will be outstanding and will continue to impress. Buying dips in this company remains a smart strategy. The emergence of DeepSeek will not deter CAPEX spending from META, MSFT, and GOOGL—all three have already committed to increasing their CAPEX budgets in 2025.

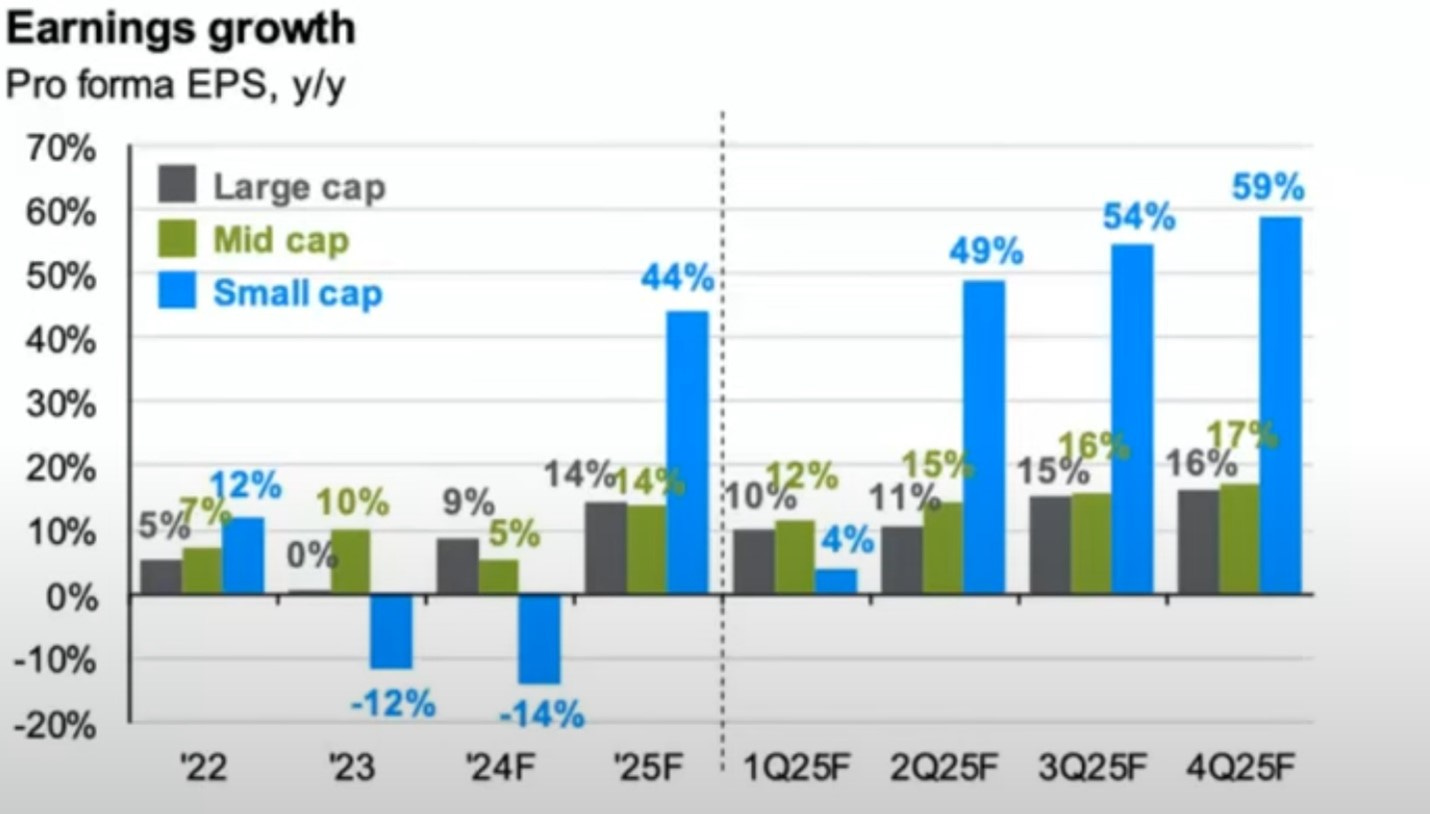

Earnings growth will continue to favor other sectors, particularly small caps.

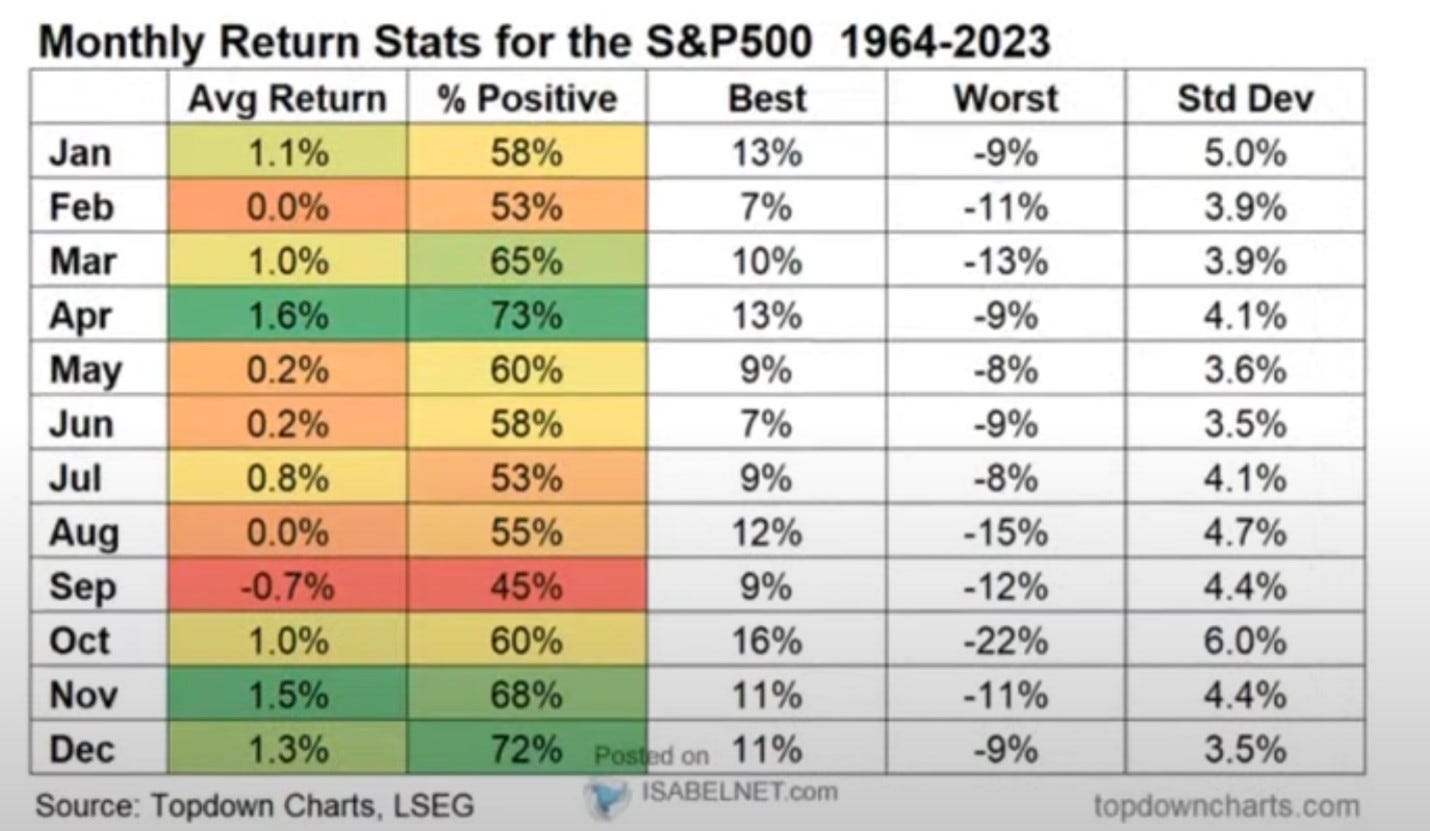

February is generally one of the worst months for the market.

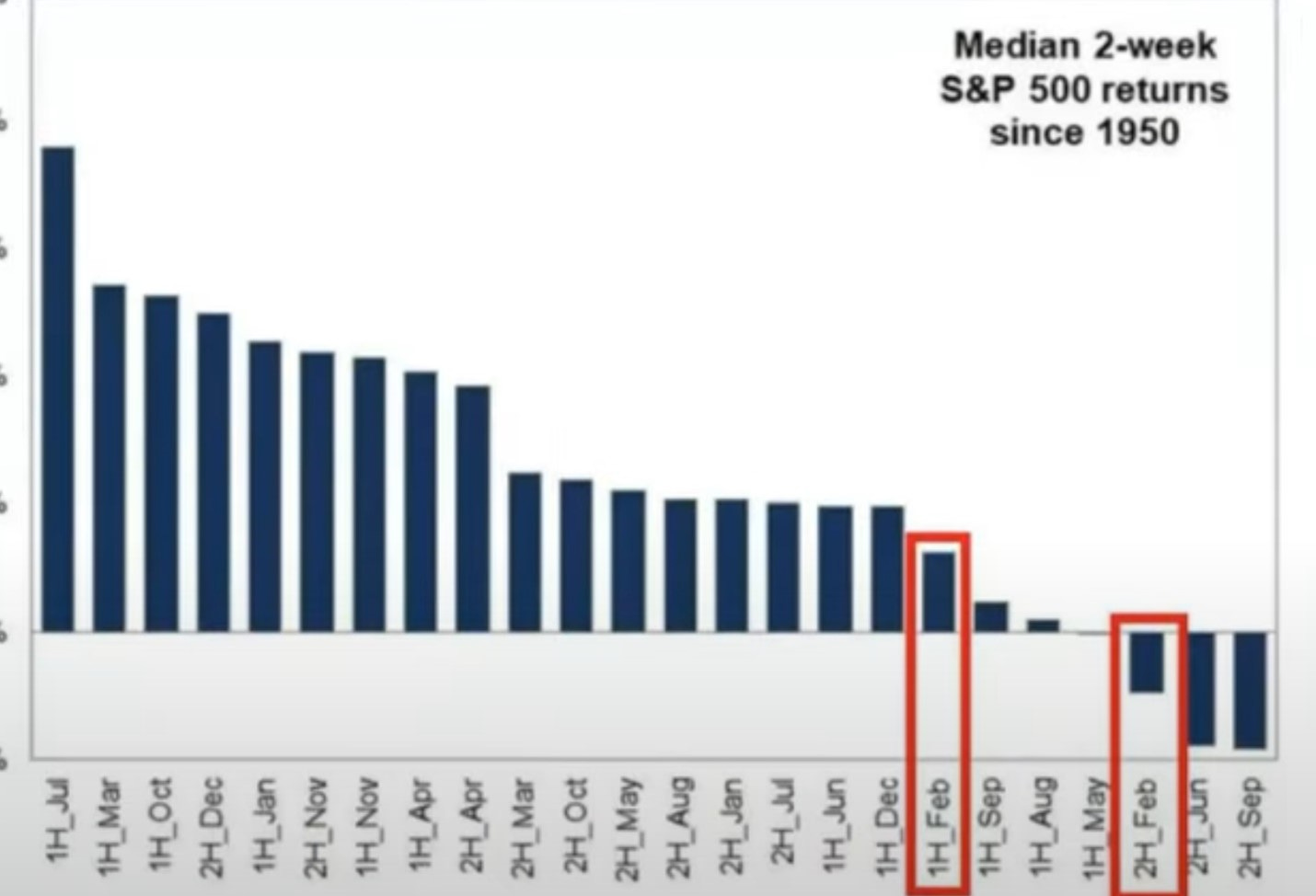

The decline usually starts in the second half of February.

Whenever weakness appears, remember that volatility is the price we pay to invest.

My approach to pullbacks involves identifying volume profile zones that could act as potential bounce points. Once identified, I look to absorb within these zones. Typically, there is at least one bounce within the zone. When that bounce occurs, I take partial profits and tighten my stops.

Currently, an example of this strategy is unfolding around the 600 range. I bought the dip on Friday and will continue buying down to the 597.50 area. If that level breaks, my next bounce attempt will be in the 589-592.50 range. Should that level fail, we move lower to close the gap.

Ultimately, a bounce will come, as I do not believe we are heading into a recession—earnings data does not indicate a significant slowdown in economic activity.

In terms of individual stocks, I don’t see a lot of setups I love for this week, but ISRG stands out. The chart looks strong, and I am willing to play this one with a medium-sized position. It has a 195 TTM squeeze with a retest of the breakout levels.

DDOG is another stock I am buying on dips with the intention of running it into earnings. It also has a daily TTM squeeze. If it starts breaking down near the VAL at 138, I will stop out.

LULU is another potential dip-buy candidate. My strategy here is to buy shares and sell-to-open (STO) calls against them to hold through earnings, but only if I can profit enough from dip buys. I am entering at the 398 level but will stop out quickly if the trade doesn’t work. I will look to re-enter around 385-390 if needed.

If Chinese stocks continue gaining traction, SE has an excellent chart with stacked squeezes.

UAL and DAL both have attractive setups with stacked squeezes as well.

That said, my primary focus remains on companies with strong earnings reports.

Stay safe this week and concentrate on executing dip buys with proper risk management. We don’t know when the next 5-10% pullback will come, but by training ourselves to take calculated shots and manage risk effectively, we can position ourselves to capitalize whenever the opportunity arises.