The Quant Savant

Navigating Financial Fables with Data

In the woods, Chicken Little was struck by an acorn and immediately feared the sky was falling. Her alarm spread like wildfire, convincing the likes of Turkey Lurkey, leading them all into the deceptive safety of Foxy Loxy's den. Foxy, under the guise of safety, harbored intentions of making them his meal. In various tellings, they either meet their end or narrowly escape upon recognizing their folly.

The financial world mirrors this tale, teeming with its own versions of Chicken Littles, Turkey Lurkeys, and, indeed, Foxy Loxys. Humans are wired to prioritize threat over reward, a survival trait that has served us for millennia. Yet, as traders, we must transcend this instinct, leveraging our rational pre-frontal cortex to see beyond the immediate alarms of our amygdala. My strategy? I delve into hard data, believing it will signal if the sky is truly falling long before collapse.

The media often plays Foxy Loxy, incentivized by clicks and views, where fear sells better than calm. Analysts who've been consistently wrong still command attention, driven by the public's fear. But I propose a different path.

Quiet the noise and let's focus on data. Act on what the data dictates. Let's not be swayed by Chicken Littles, Turkey Lurkeys, or Foxy Loxys. Instead, let us embrace the role of Quant Savant, navigating markets with unwavering equanimity through data-driven decisions.

As Quant Savants, consider the quantitative data at our disposal:

Monetary Policy: The Federal Reserve and global central banks are shifting towards an easing cycle.

Market Trends: The S&P 500 indicates we're in an expansion phase, as evidenced by earnings forecasts.

Historical Precedents: Rate cuts in non-recessionary periods have historically led to robust market returns over the following year.

Market Diversity: Beyond the 'Magnificent 7', other companies are also fueling market expansion.

Debt Levels: Household debt service payments as a percentage of disposable income are at historic lows.

Federal Reserve Actions: Rate cuts near all-time highs have previously been well-received by the market.

Political Climate: Regardless of presidential outcomes, sound investment principles prevail.

Market Performance: Strong first-half performances often predict robust second halves.

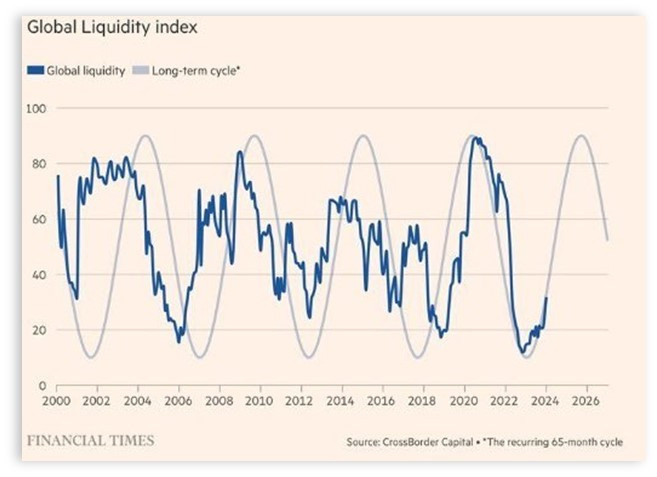

Liquidity: Global liquidity is on the rise and expected to continue.

Investment Readiness: There's significant capital still waiting on the sidelines.

This wealth of data empowers me to disregard the sensationalist articles and the doomsaying on social platforms.

Consider recent examples where market panic was contradicted by subsequent gains, aligning with my prediction at the start of 2024: a "Continuation of the Bull Run".

As a Quant Savant, I'm dismissing the October pullback prophecies, the election-year jitters, and apocalyptic forecasts of global conflicts. Instead, any dip will be my cue to invest in undervalued quality stocks, like I recommended with BABA a year ago.

One of my key focuses has been the substantial energy required for AI data centers.

This demand for power introduces a unique opportunity for nuclear power to rebrand itself as both safe and clean. Local communities are increasingly reluctant to reroute energy supplies to the burgeoning mega-data centers. BWX Technologies (BWXT) is at the forefront of the Small Modular Reactor (SMR) race. Companies like AWS, Google, and those led by Elon Musk require these reactors to fuel their AI ambitions. I anticipate announcements soon regarding which company these tech giants will select for their SMR designs. BWXT has surged over 50% this year, but like BABA, I believe there's considerable room for growth in the coming years.

A more speculative investment is NuScale Power Corporation (SMR), which focuses on developing Small Modular Reactors. As of July, NuScale was the sole company to receive U.S. Nuclear Regulatory Commission Design Approval and Certification, positioning them with a first-mover advantage.

Another avenue to meet soaring energy demands is through natural gas. Comstock Resources (CRK) is another of my long-term picks. The primary shareholder? Jerry Jones-yes, that Jerry Jones of the Dallas Cowboys fame. He's been acquiring more CRK stock recently, perhaps with intentions to take the company private to retain all profits. Jerry has stated that he believes CRK could be worth more than his Cowboys franchise. Even with a 30% increase this year, I consider CRK a compelling value play. Its market cap now stands at about $3.5 billion, offering what I call a "free option" worth $10.4 billion when looking at their total reserves.

In navigating this financial landscape, my approach as a Quant Savant remains steadfast:

Ignore the Noise: Media-driven fear and sensationalism are not reliable indicators of market health.

Focus on Data: Quantitative analysis provides a clear, objective path through the fog of market speculation.

Invest in Opportunities: Dips in quality stocks are opportunities, not omens of doom.

Stay Informed: Keep abreast of technological advancements and shifts in demand, like the rise of AI and the consequent energy needs.

The essence of being a Quant Savant isn't just about numbers; it's about understanding the story behind the data, crafting a narrative that leads to informed decisions. While the world might be filled with Chicken Littles and Foxy Loxys, by grounding ourselves in data, we can navigate through the noise, making choices that echo reason over fear.

Thank you very much for putting this together.

Great article and very informative. It all makes perfect sense. Thank you! 👍😊