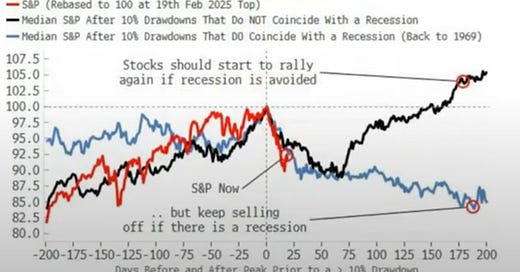

Over the past few weeks, I’ve shared data supporting my view that a recession isn’t on the horizon and why I’m buying the dips. If you’re in the recession camp, though, you’re likely bracing for stock prices to keep sliding. The chart below illustrates where we stand today and the two potential paths ahead: one with a recession, one without.

I suspect Trump is pushing Fed Chair Powell to slash interest rates, even if it means tipping the U.S. economy into a downturn to force his hand. The real question is whether Powell will hold off on rate cuts until a recession hits. History suggests he’s reactive, not proactive—always “waiting for data” instead of anticipating trends and adjusting preemptively. I see him moving slowly again.

Regardless, I’m betting on an economic boom driven by deregulation and AI-fueled productivity gains in private enterprises. Will we face “short-term pain,” as Elon Musk put it? Sure. Will it spiral into a recession? I’m not convinced, and I don’t think anyone can say for certain. If it happens, I expect it to be brief, with a swift recovery following.

Technical Perspective: Watching Key Levels

From a technical standpoint, we’re at a critical juncture. Mark summarizes below:

Mark nailed it: both SPY and QQQ have pulled back. If we break below these lows, we could see SPY drop to 540, maybe even 517.

Back in 2022, we had a similar breakdown and technically, it should’ve tanked further.

I called it a buying opportunity then, loaded up, and enjoyed two of my best trading years ever.

Here’s the lesson from our technical analysis training: the crowd often gets played by these signals. That 2022 “false breakdown” triggered back-to-back 20% years for the market. I’m looking for a repeat—maybe a break below lows followed by a reclaim, or a dip around 15%. Since I don’t see a recession coming, I’m starting to buy pullbacks in companies I value.

NVDA: I don’t see NVIDIA as the next Cisco. As I’ve mentioned before, if you can grab NVDA shares between $100 and $115, I’m confident you’ll be pleased with the returns in a couple of years.

AMZN: Among the "Magnificent 7" stocks, Amazon stands out as one of the more undervalued names. Its massive moat gives me little reason to worry about its long-term strength.

GOOGL: Google’s stock looks like a bargain, but investing here requires faith that Google Search will hold its ground. Alternatively, you’d need to trust they can offset any revenue lost to AI-driven search alternatives.

AVGO, CRM, PANW, ASML, NFLX: These are tech giants I’m genuinely excited about. I’m comfortable building long-term positions in Broadcom, Salesforce, Palo Alto Networks, ASML, and Netflix—they’re all winners in my book.

NRG: This energy play is one I feel good about holding for the long haul. It’s a solid, steady contender.

DIS: I remain a staunch believer in Disney. It might take a bit longer to shine, but I still see the potential for the stock to double.

AAP: Advance Auto Parts is a long-term pick I’m optimistic about—doubling in value within 2-3 years feels very achievable.

PYPL: PayPal has retreated so far from its highs that I’m ready to dive back in with a full position. The pullback has created a compelling opportunity.

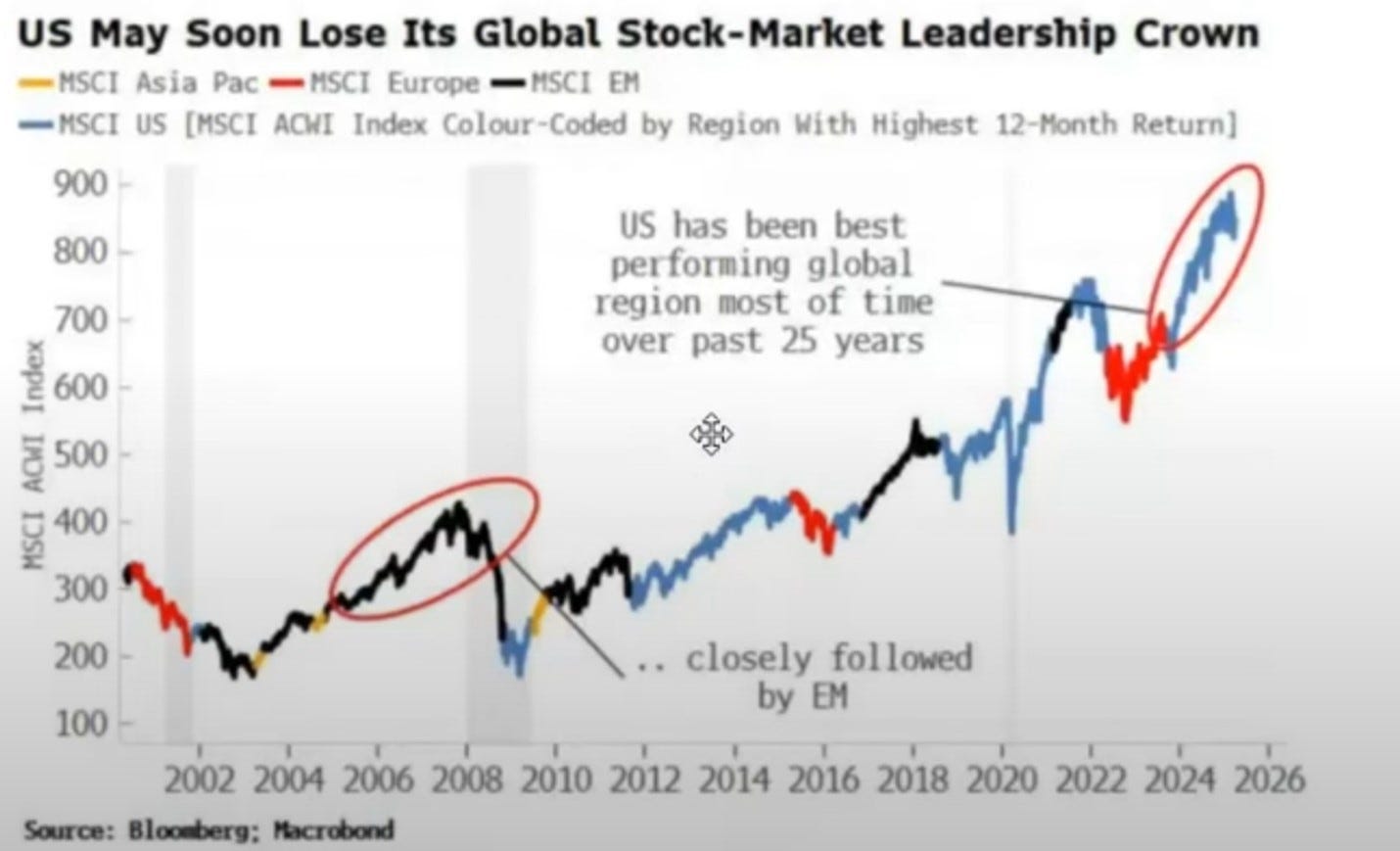

Even as I buy these U.S. powerhouses, I don’t expect the U.S. to keep outperforming like it has.

I called it at the start of the year: emerging markets will take the lead. My biggest holdings are in China, which has already outpaced expectations this year—and I’m staying heavily invested there for the long haul.

As the dollar declines EX-US stocks will continue to shine.

Reversion to the Mean

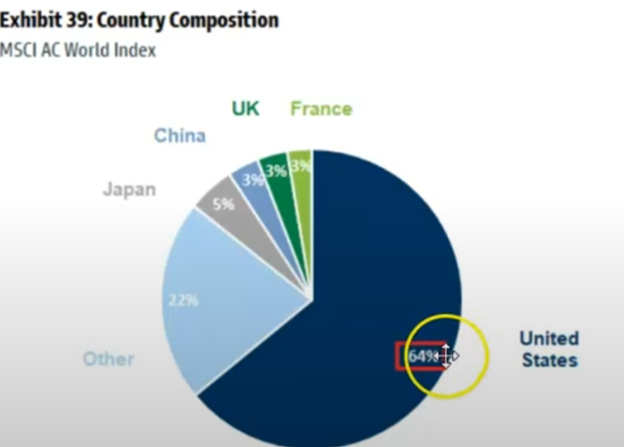

I’m a big believer in reversion to the mean. The U.S. has dominated for years, making up 64% of the global index without earning 64% of the world’s profits. That gap won’t last forever.

Below you can see a few different scenarios of returning to the mean. Even without a recession there could be a pullback to the 4550-5000 area looking at 5YR to 10YR. This shows you how low we can go and how low people are thinking we can go with a recession.

So why buy U.S. dips? Because I still believe in American exceptionalism. Our top companies can deliver solid returns over the next few years—not the 20% SPY/QQQ rockets of the past two years, but respectable gains when valuations make sense. This is a stock picker’s market, and I see that holding for the next two years.

A Look Back: Buying at the Worst Time

Here’s a nugget I shared in early 2024: if you’d started buying 10 shares of SPY every month from its 2022 peak—the absolute worst timing—you’d be up about 23% by now. You’d have endured a brutal 27% drawdown over a year, but faith in the market’s long-term value would’ve paid off. That’s the mindset I’m bringing now.

My Playbook

I’ll keep day trading and swinging where it makes sense, but I’m going heavier on U.S. stocks for the long term. The companies I believe in? I’ll keep buying if they dip further. To get what others don’t, you’ve got to do what others won’t: scoop up good companies at great prices and great companies at good prices. That’s how I’m navigating this market—and I’m confident it’ll work out.

Excited to see you back with another article this morning; always a great read and definitely use pieces to influence decisions through the week. Thank you for your time invested into these DMAN!

Excellent article. What other countries outside of China are you considering?