2025 Market Update: Strong Earnings, Pullback Opportunities, and Why Alibaba Remains a Top Pick

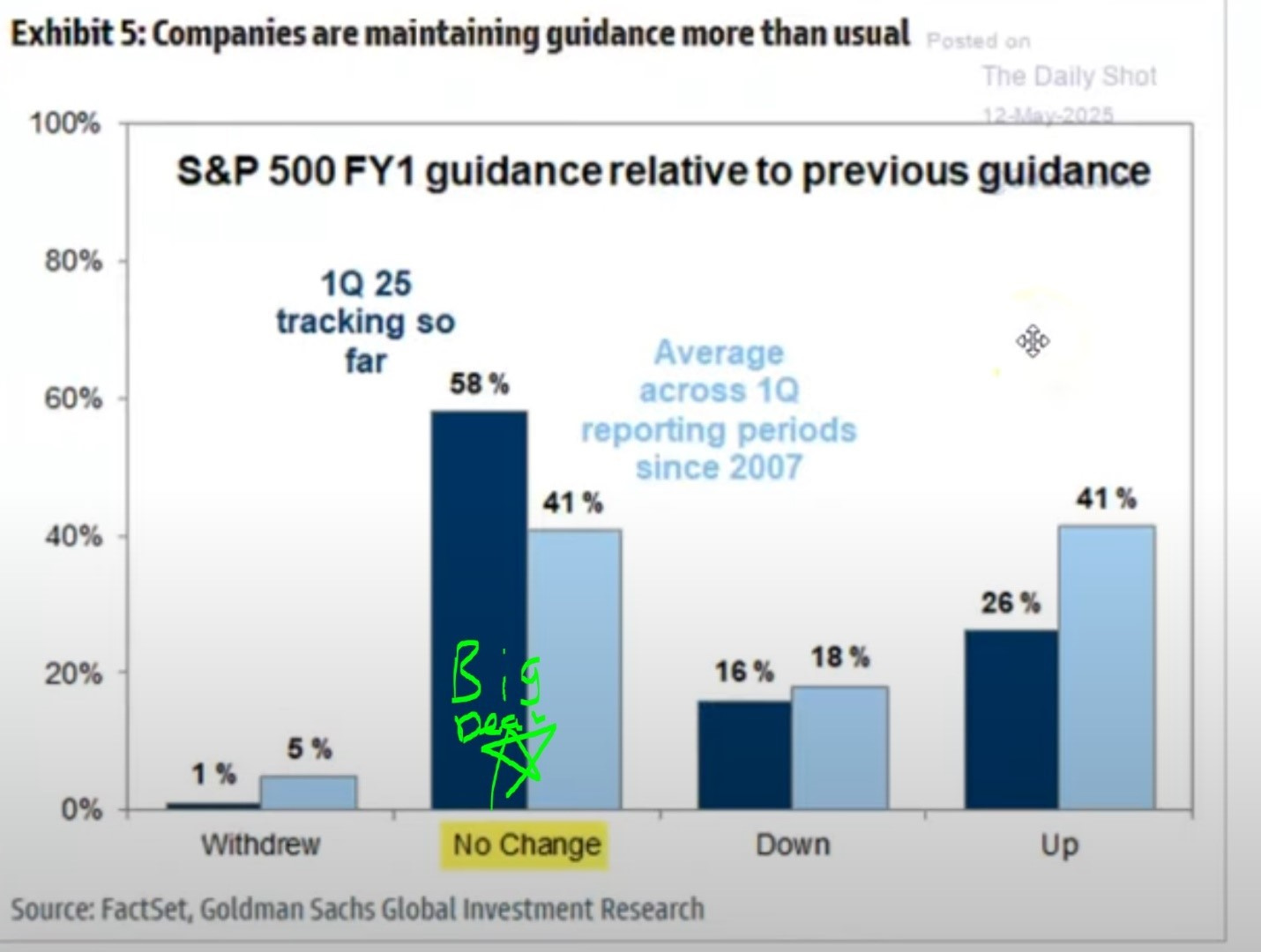

Earnings season has been a pleasant surprise this quarter, with fewer companies pulling guidance than expected despite tariff concerns. Many S&P 500 firms reaffirmed or raised their outlooks, signaling confidence in the economic backdrop.

S&P 500 EPS growth is on track for a robust 13.5% year-over-year increase, surpassing the anticipated 6%.

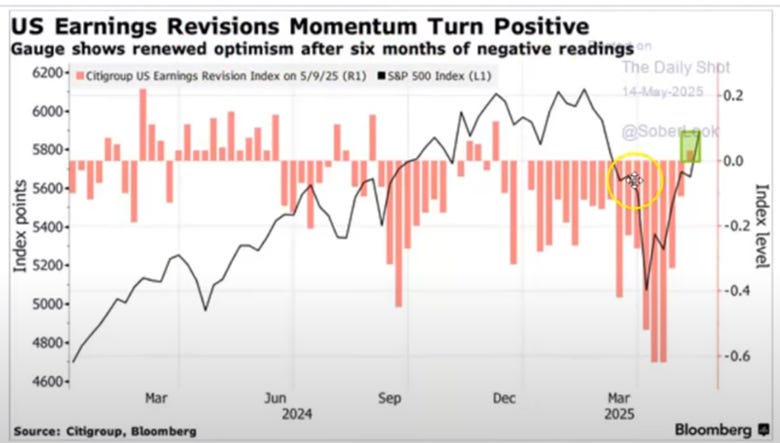

Earnings revisions momentum has also flipped positive after months of negative readings, a bullish sign for markets.

The most anticipated earnings report this quarter is Nvidia (NVDA). I expect NVDA to deliver another blowout, driven by unrelenting demand for AI infrastructure.

While we’re seeing a welcome market pullback, I believe institutions are poised to buy the dip. Asset managers remain underweight U.S. stocks, making this rally a “hated” one, reminiscent of the V-shaped recovery post-COVID. History suggests these setups can fuel significant upside.

Treasury Yields and Inflation: A Temporary Hiccup?

A recent “weak” U.S. Treasury sale pushed yields higher, sparking concerns about demand for U.S. debt. This could pose risks if sustained, as rising yields pressure valuations; however, I view this as a one-off event tied to uncertainty around long-term inflation expectations, similar to a blip we saw last year. Inflation has since stabilized, and I expect bank regulations to adjust, boosting Treasury demand. For investors, this makes the iShares 20+ Year Treasury Bond ETF (TLT) an attractive play—I’m projecting at least a 10% return within 12 months.

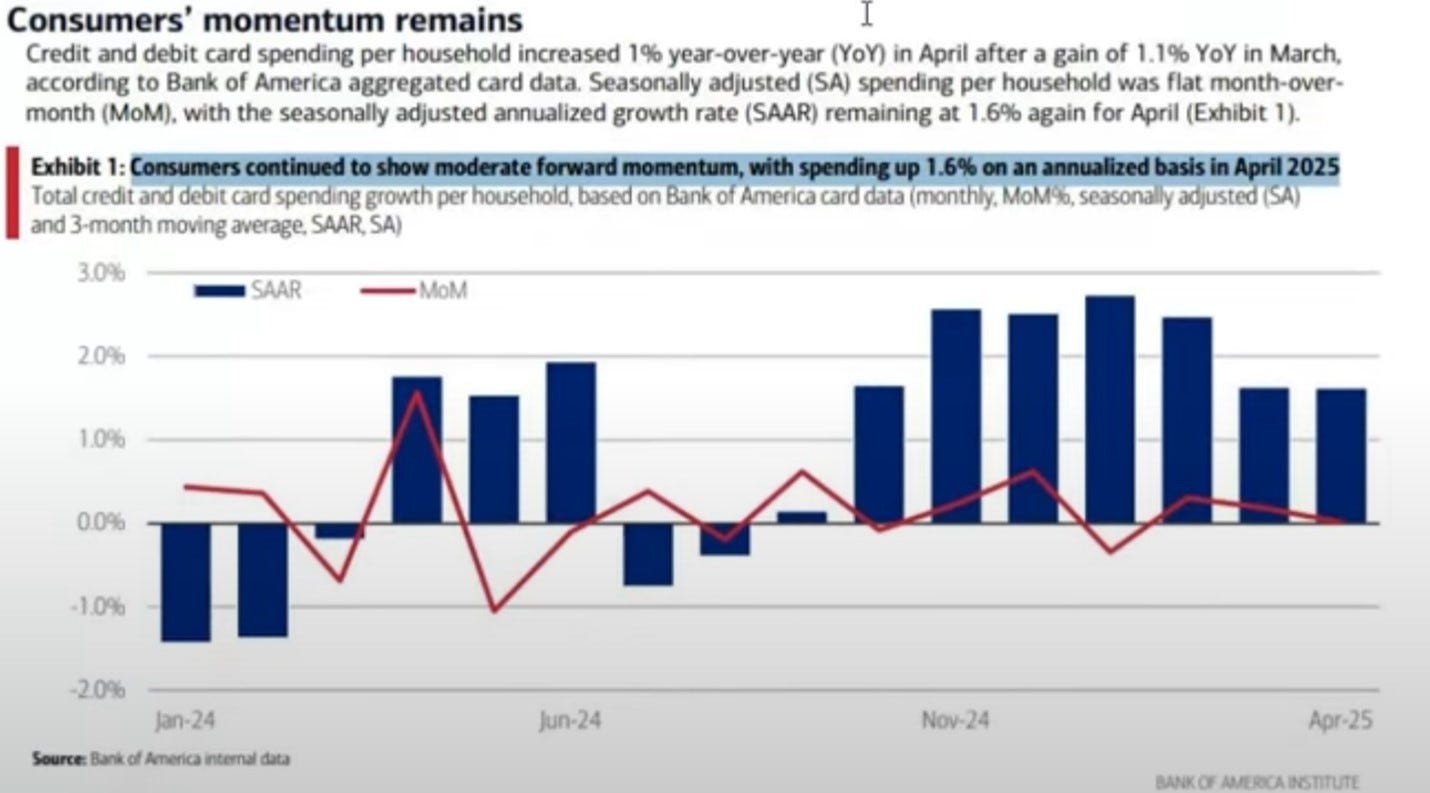

Despite inflation chatter and economic pessimism, consumer and business spending remain resilient, near pre-2020 levels.

While credit card debt has risen, the share of households carrying balances is lower than in 2019 across all income groups, signaling healthy consumer finances.

Market Outlook: Rally into Year-End?

I believe the market has bottomed and is set for a rally into year-end, consistent with historical post-election patterns that often see a trough in early April followed by gains.

RBC’s technical analysis supports this, noting weekly momentum turning upward from oversold levels, suggesting upside into early-to-mid Q3.

My strategy is to avoid being too early on pullback buys. I’m targeting support levels in the SPDR S&P 500 ETF (SPY) to enter positions if we break $578:

550-555: I’ll deploy large positions with wider stops to capture a potential rebound.

565-567: I’ll use medium-sized positions, taking profits on a bounce with a stop just above entry.

To maximize returns, I align stock picks with market bounces. For example, last Friday’s gap-down offered a chance to buy AppLovin (APP) at support using the TPS edge, anticipating an index rebound.

Stocks on my radar for a pullback include Microsoft (MSFT), NRG Energy (NRG), Constellation Energy (CEG), Amazon (AMZN), Disney (DIS), and L3Harris Technologies (LHX).

Valuations and Market Breadth

U.S. market valuations remain elevated, driven by a handful of mega-cap names. However, market breadth is improving, and I expect the Invesco S&P 500 Equal Weight ETF (RSP) to outperform the SPY as smaller companies catch up. Even more compelling, emerging markets (EM) are poised to outshine the U.S., as I highlighted in my 2025 outlook. China, in particular, stands out as undervalued, and my top pick there is Alibaba (BABA).

Why Alibaba Is a Buy on This Pullback

Despite a 45% year-to-date gain, Alibaba remains a compelling long-term investment, especially on this pullback. China’s shift toward a consumption-driven economy—targeting 70% of GDP by 2030 (up from ~38% today)—positions Alibaba to capitalize on a projected e-commerce market expansion from $1.57 trillion in 2025 to $2.54 trillion by 2030 (10.07% CAGR). Alibaba’s platforms (Taobao, Tmall, AliExpress) and Alipay, which powered 90% of Singles Day 2017 purchases via mobile, align perfectly with this trend.

Last quarter, Alibaba’s revenue and EPS slightly missed expectations due to heavy AI and cloud infrastructure investments; however, I don’t see this as a red flag—here’s why:

Cloud and AI Growth: Alibaba’s cloud segment grew 18% YoY, with EBITDA surging 69% to $333 million. AI-related revenue posted triple-digit YoY growth for the seventh consecutive quarter. The Qwen3 series, Alibaba’s leading open-source large language model (LLM), strengthens its dual leadership in AI and cloud, a unique synergy no other company globally matches.

E-commerce Strength: Taobao and Tmall revenues rose 9%, with EBITA up 8%. The premium 88VIP membership grew double-digits, surpassing 50 million users. Customer Management Revenues (CMR) increased 12%, with strong growth projected through 2026.

Cainiao and AIDC: While Cainiao (logistics) and AIDC (international e-commerce) underperformed, these are growth bets, not structural issues. Cainiao’s integration enhances delivery efficiency, and AIDC’s platforms (AliExpress, Lazada) are expanding globally, particularly in Southeast Asia.

Capital Returns: Alibaba returned $16.5 billion to shareholders in FY2025 ($11.9 billion in buybacks, reducing share count by 5.1%, and $4.6 billion in dividends). Non-core asset sales, like Sun Art, could yield $2.6 billion more.

Alibaba’s AI investments, while pressuring short-term free cash flow, position it as the cheapest way to play the AI boom in a market transitioning to consumption. Its stake in Ant Group, poised for a future IPO, and strategic investments in smaller firms via free AI/cloud services add further upside.

Conclusion

This quarter’s robust earnings, with S&P 500 EPS growth tracking at 13.5% YoY, well above the expected 6%, signal a resilient market despite tariff concerns. Consumer and business spending remain strong, and with credit card balance trends healthier than pre-2019 levels, the economy is on solid footing. The market offers tactical opportunities to buy pullbacks, but the easiest money lies in owning great companies at discounted prices. Alibaba stands out as the best way to play China’s consumer-driven transformation and the global AI race. For long-term investors, I recommend reviewing Alibaba’s latest earnings call transcript to appreciate its full potential. Other China plays like Estée Lauder (EL) and JD.com (JD) are also on my radar. I’ll do a deeper dive into these in a future article.

Thanks Dman. Appreciate the info. I have a position in BABA today, but agree that buying the dip has merit and will increase my position.