At the start of each year, I draft a strategic outlook for what I anticipate will unfold in the financial markets. While predicting the future with absolute certainty is impossible—especially considering unforeseen factors like the rapid evolution of AI—having a well-thought-out plan and reflecting on past predictions is crucial.

In 2024, my investment strategy revolved around three key themes:

The Bull Run Continues: Expecting the upward trend in the market to persist.

No, You Haven't Missed Out: There's still time to invest and capitalize on opportunities.

Love the Pain: View market downturns as buying opportunities.

Just before Christmas, the market offered another dip, triggered by unsettling moves from the Federal Reserve. I seized the chance to "buy the dip," staying true to my strategy.

Shifting Focus for 2025: Stock Picking Over Indices

Looking ahead to 2025, my approach is evolving. While I'm not turning bearish, I believe 2025 will favor skilled stock pickers. In recent years, broad market ETFs like SPY and QQQ delivered substantial returns. While that trend might persist, and I will talk about this possibility later, my analysis suggests subdued growth in major indices next year. Instead, lagging stocks may start catching up, presenting selective opportunities for savvy investors.

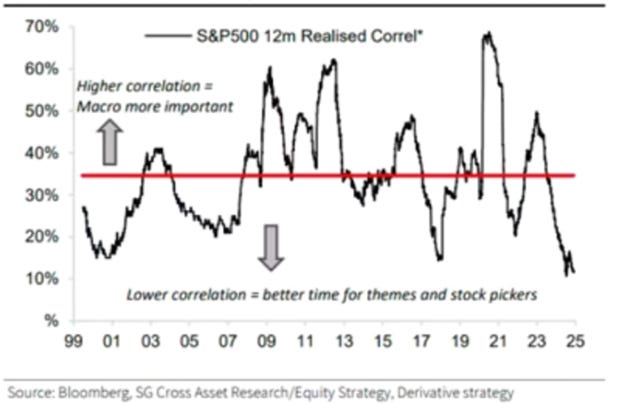

The chart below illustrates the 12-month realized correlation of the S&P 500 from 1999 to the present, revealing that we're at a 25-year low.

This suggests individual stock performance could diverge more significantly from the broader market.

Our task for 2025 is clear: identify the dominant themes and the stocks within them. Broad-based strategies relying on ETFs or mega-cap stocks are unlikely to outperform as they have in recent years. Currently, mega-cap growth and tech stocks are positioned one standard deviation above their median.

Mega-Cap Concentration: A Warning Sign

The "Magnificent Seven" now comprise a record 33% of the index's market cap, pushing the price-to-book ratio to unprecedented highs.

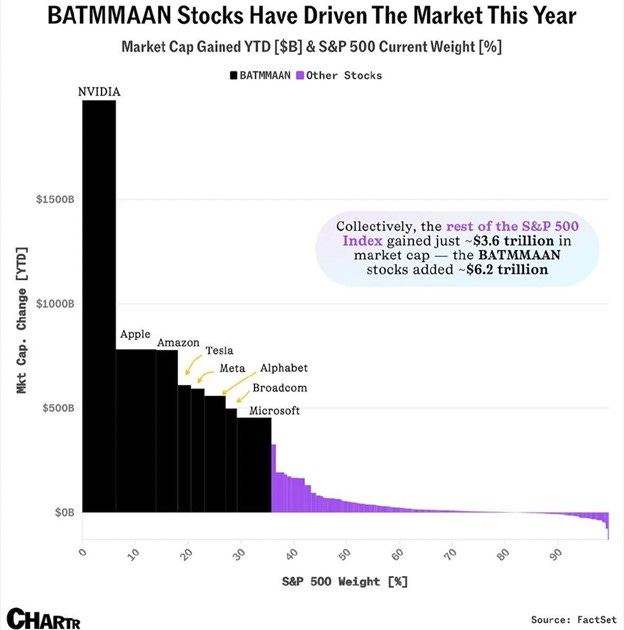

In 2024, the BATMMAAN companies added $6.2 trillion in market cap, while the remaining 492 S&P 500 companies added just $3.6 trillion.

While many of these companies have earnings to support their valuations, earnings growth is decelerating; meanwhile, earnings for the rest of the market are catching up. As this trend continues, the "Magnificent Seven" may appear increasingly overvalued, prompting investors to look elsewhere for better returns.

This doesn’t mean the Mag 7 are in for a bad year, but I believe you will find better returns in these good companies that are now starting to push their EPS and revenue up in 2025.

Sector Spotlight: Health Care, Materials, Industrials, and Beyond

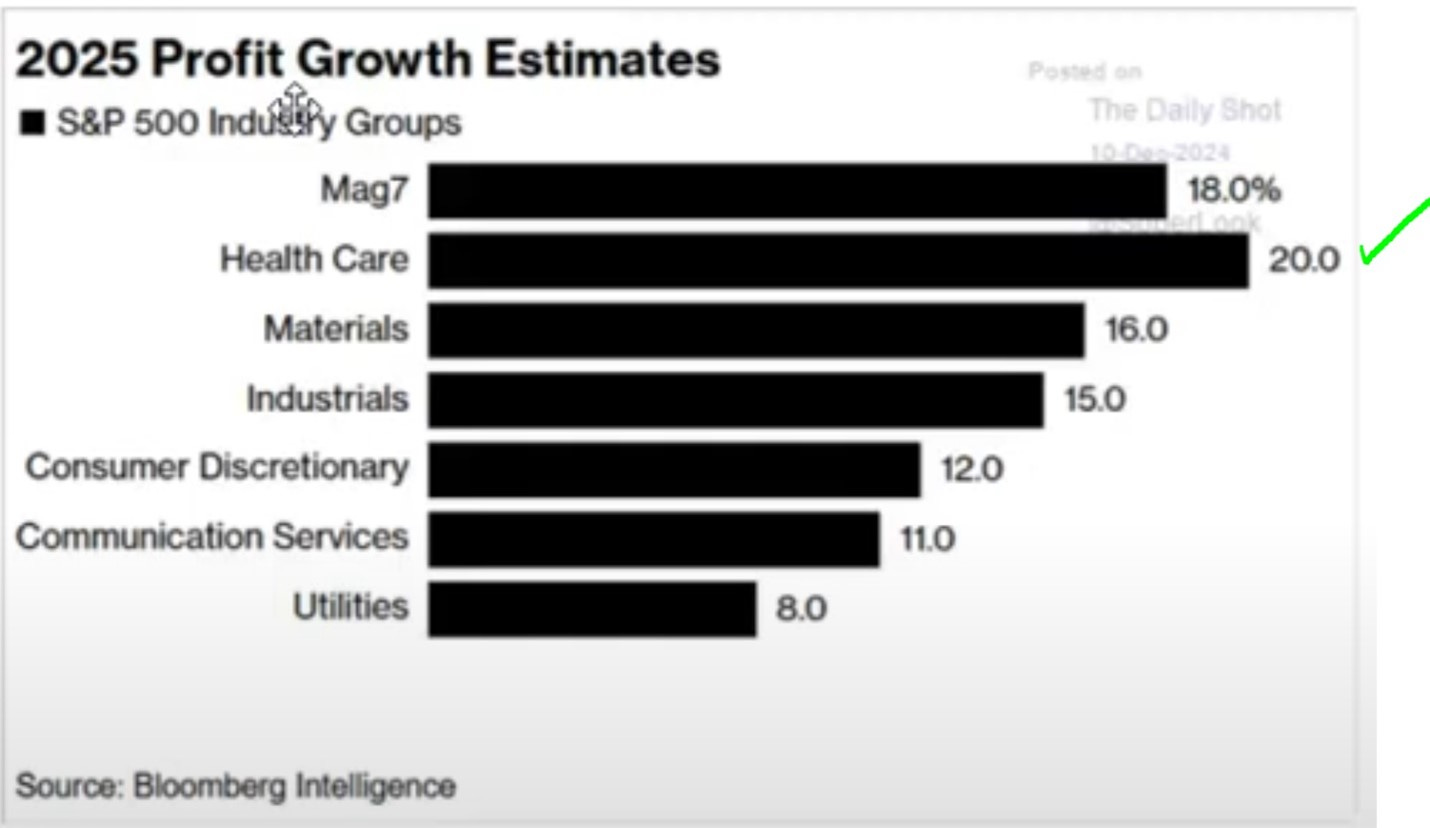

Below you can see the 2025 profit growth estimates by industry.

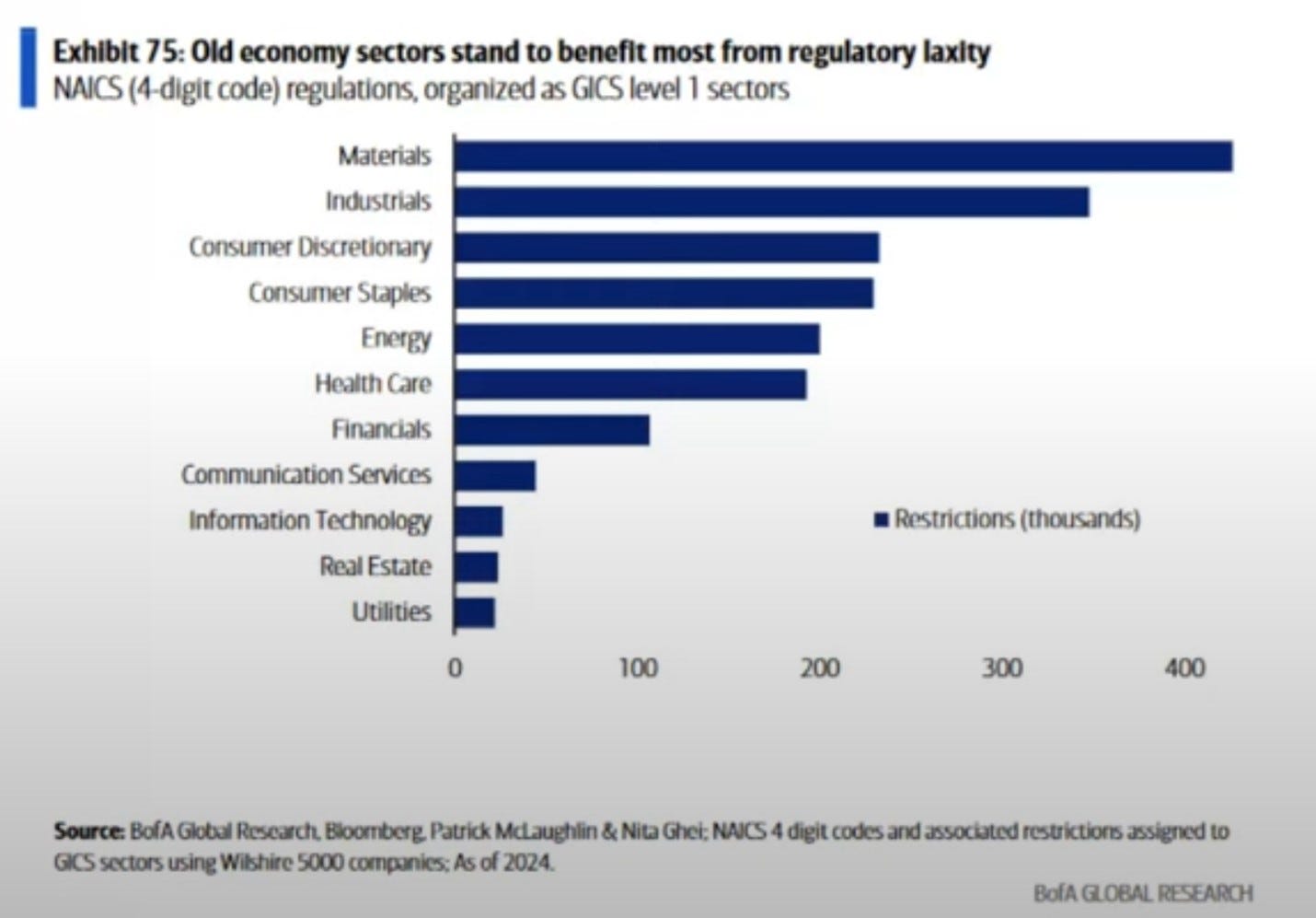

For 2025, sectors like healthcare, materials, and industrials are poised for growth. Materials, in particular, stand out, with YOY growth shifting from -7.3% to an estimated 16+% in 2025. This sector could offer compelling value plays, bolstered by regulatory changes and industrial demand.

Many other sectors, including energy and small caps, also present attractive opportunities. Historical valuations in these areas remain low, setting the stage for potential outperformance.

There are opportunities everywhere that came from the once in a lifetime event – Covid. Below are some charts the show the historical average versus where we are now.

Materials

Communication Services

Small Caps

Equal Weight

Another theme I believe will emerge in the next year or two is robotics. We have already seen developments with Large Language Models (LLM), generative AI, and Artificial Neural Networks (ANN), but we have yet to see the push in robotics. This is the next step in the AI craze that I see coming our way.

Possible Dangers Ahead.

Inflation and tariffs seem to be the highest cause for concern among active traders.

Tariffs: With Donald Trump taking office in January, you can count on tariffs being a tool he will use a lot. He used it in his last presidency, often creating tensions and trade wars, which might disrupt global trade dynamics and affect market stability. His favorite target was China, which has scared many people away from investing in China, compounded by their struggling economy. Let’s look back at how China reacted to Trump's first term:

While Trump talks tough, his #1 goal is always to make deals. He simply wants America to be put first within these deals. I believe something similar will happen this time as well. While history may not repeat, it often rhymes.

Inflation: There's a noted risk of inflation reacceleration, potentially leading to higher interest rates. Analysts like those from Apollo Global Management have suggested a 40% chance of the 10-year treasury yield moving above 5% by mid-2025, which could increase borrowing costs across various sectors.

While I do acknowledge the risk involved in keeping inflation high, as I noted in my article "Inflation Nation," I believe this was the goal from the beginning. It is the only way for us to pay off our debt. We must inflate it away as we did after WWII in the 1940s.

During this 18-year period, we ran inflation at an average of 4.1%, high above the stated 2% goal.

While there are other concerns ahead like geopolitical tensions, consumer weakening, refinancing trillions in national debt, and possible government spending cuts due to D.O.G.E., I do believe the bull run will continue.

Bull Run Cycle – Recovery to Boom

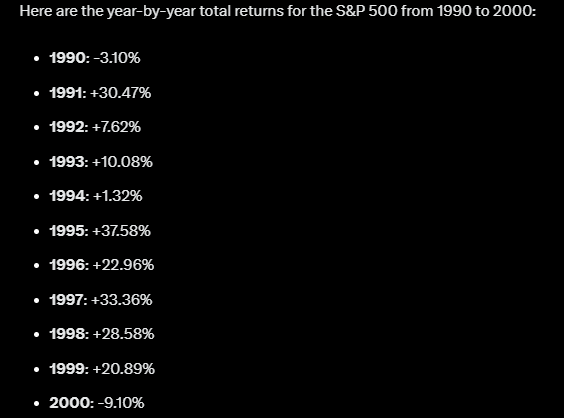

Although I’m cautious about expecting a third consecutive year of 20%+ index gains, I’m not ruling out the possibility. The parallels between today’s market and the 1990s are striking. Back then, the internet spurred massive productivity gains, just as AI is doing now. Additionally, mid-cycle rate cuts in 1995 led to an economic expansion. This led to 4 years of 20%+ gains. Interestingly, when we did the mid cycle cut in the 90s, rates went up just as they are now. Eventually they came down and the boom ensued.

The other thing we have in our favor, for now, is Silicon Valley's decision to invade Washington. Government work is corruptible, bloated, wasteful, and inefficient. The reason for this is because they have nobody to be accountable to, unlike the person who begins a startup and needs to keep costs down. As you can see from the chart below, anything the government touches rises in cost dramatically.

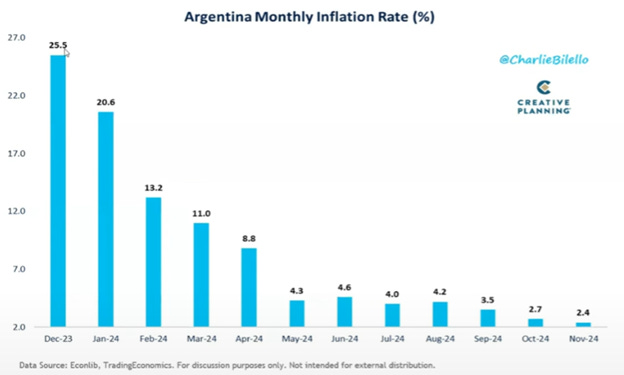

IF, and it’s a big IF, we can run the government like a business and balance the budget, this will bring inflation down as well as set off an economic expansion to the likes the world has never seen. It's hard to imagine the government doing this, but at some point, it has to be done. It was recently done in Argentina, and you can see the inflation rate drop from 25% to 2.4%.

One thing I want to make clear is that even though I think the indices won’t get a third year of 20%+ gains, I am leaving the door open for this possibility. As the chart below shows, capital market liquidity is just starting to recover.

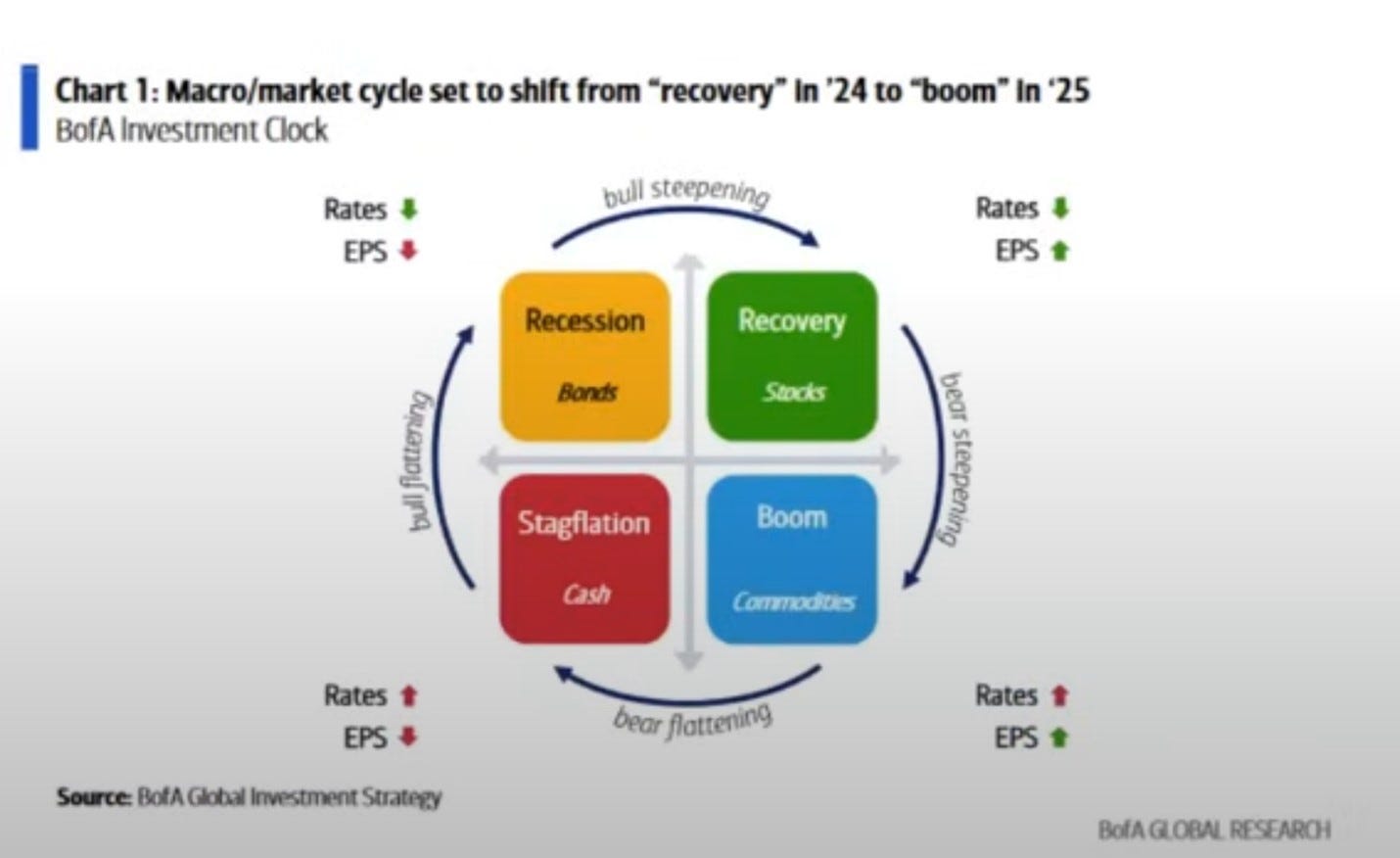

We are coming out of the recovery stage and entering the boom phase as the chart below shows.

One thing to note about the boom phase is rates typically go up. I don’t think this will happen next year, but even if it does, it doesn’t mean we should sell everything and run for the hills. It simply means we have unlocked the economic engine of the USA, which results in more profits for our companies.

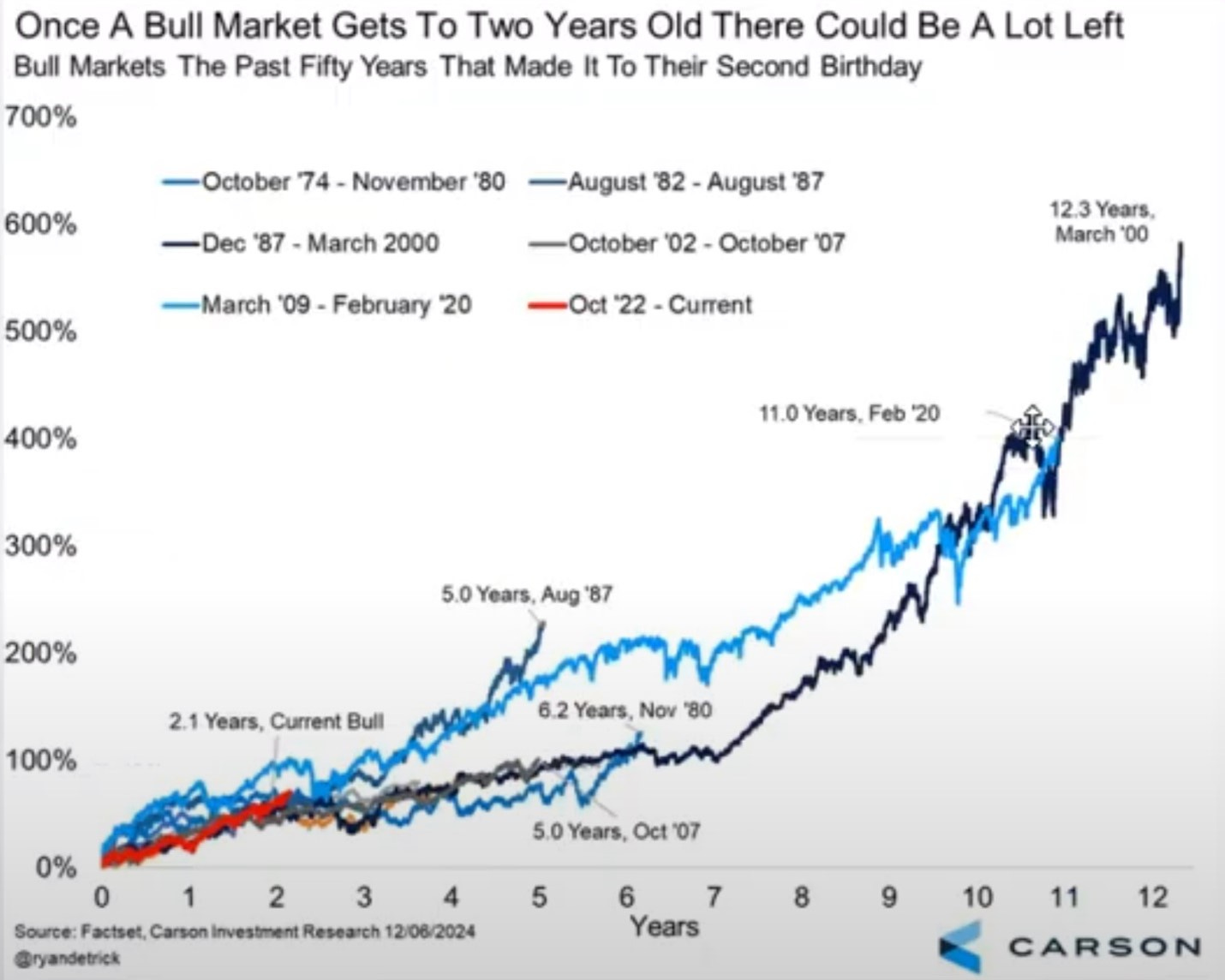

Two years for a bull market is young, and from the chart below, you can see there could be a lot left on this bull run.

So let me list a few reasons that I think we will continue this bull run:

1. Corporate Cash Reserves: With $8 trillion in corporate cash, companies can fuel growth through dividends, buybacks, or M&A activity.

2. Equity Scarcity: US supply of equity is at lows and falling while we have huge demand for our equities market.

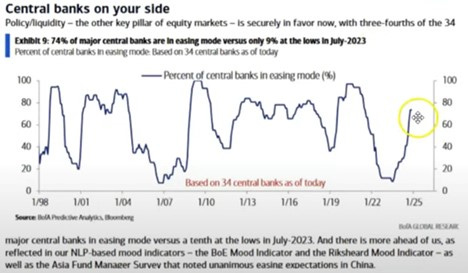

3. Central Bank Cooperation: The FED has run off about 20% of its balance sheet in the last two years, and Powell wants his legacy to be this “no/soft landing”. If we run into trouble, they have ample ammo to fire at whatever problem arises. Many other central banks are also easing and will continue to do so.

4. Trump: Trump wants to win and winning means everyone makes money, not just the USA. Trump is a deal-maker, and he will do whatever it takes to make sure our economy is humming along

5. Historical Momentum: Buying stocks at highs outperforms buying stocks “any time”.

6. 6 Trillion Cash: Money markets have 6 trillion in cash that can be put to work in the market.

7. Profits and Breadth: As already shown above, profits are increasing at double digit rates and not just for a few companies.

8. Tax cuts: Trump dropping tax cuts from 21% to 15% would have a net overall effect for SP500 by 4%

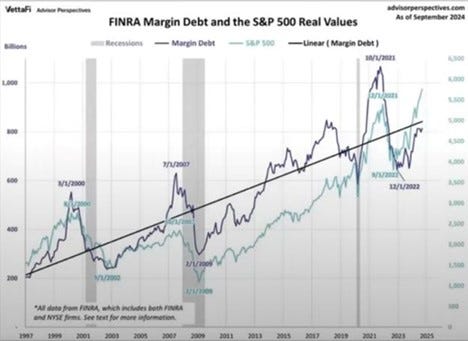

9. FINRA Margin Debt: As amazing as the past 2 years have been, we still have a lot of doubters about the market and this bull run. You can see from the chart below that there is still significant buying power on the sidelines.

10. Households in Good Financial Shape: Many people have struggled over the past couple of years, but the average household is in good shape.

11. Demographic Dividends: We're at a generational junction, with youth poised to nest, fueling housing and consumption.

12. America First: With Trump being elected for putting America first, I expect reshoring, increased spending in infrastructure and innovation.

Conclusion

This bull market, now only two years into its journey, shows signs of youthful vigor. With a confluence of factors like substantial corporate cash reserves, cooperative central bank policies, and favorable demographic shifts, the stage is set for continued growth; however, the landscape of 2025 demands a nuanced approach. The era of broad market gains through passive investment might be waning. Instead, the path to outperformance is likely to be paved with strategic stock selection, focusing on sectors and companies positioned to capitalize on emerging trends like robotics and resurgent sectors such as materials and industrials.

For investors, the message is clear: while the bull run might have legs, success in 2025 will be achieved not just by riding the wave but by navigating it with skill and foresight. The opportunity is vast for those prepared to delve deeper, adapt strategies, and select wisely. As we step into this New Year, let's embrace the challenge and potential of a market that rewards the diligent and the insightful.

Great stuff as always. I wonder, per your chart on communication services, is the reason WB bought Siri