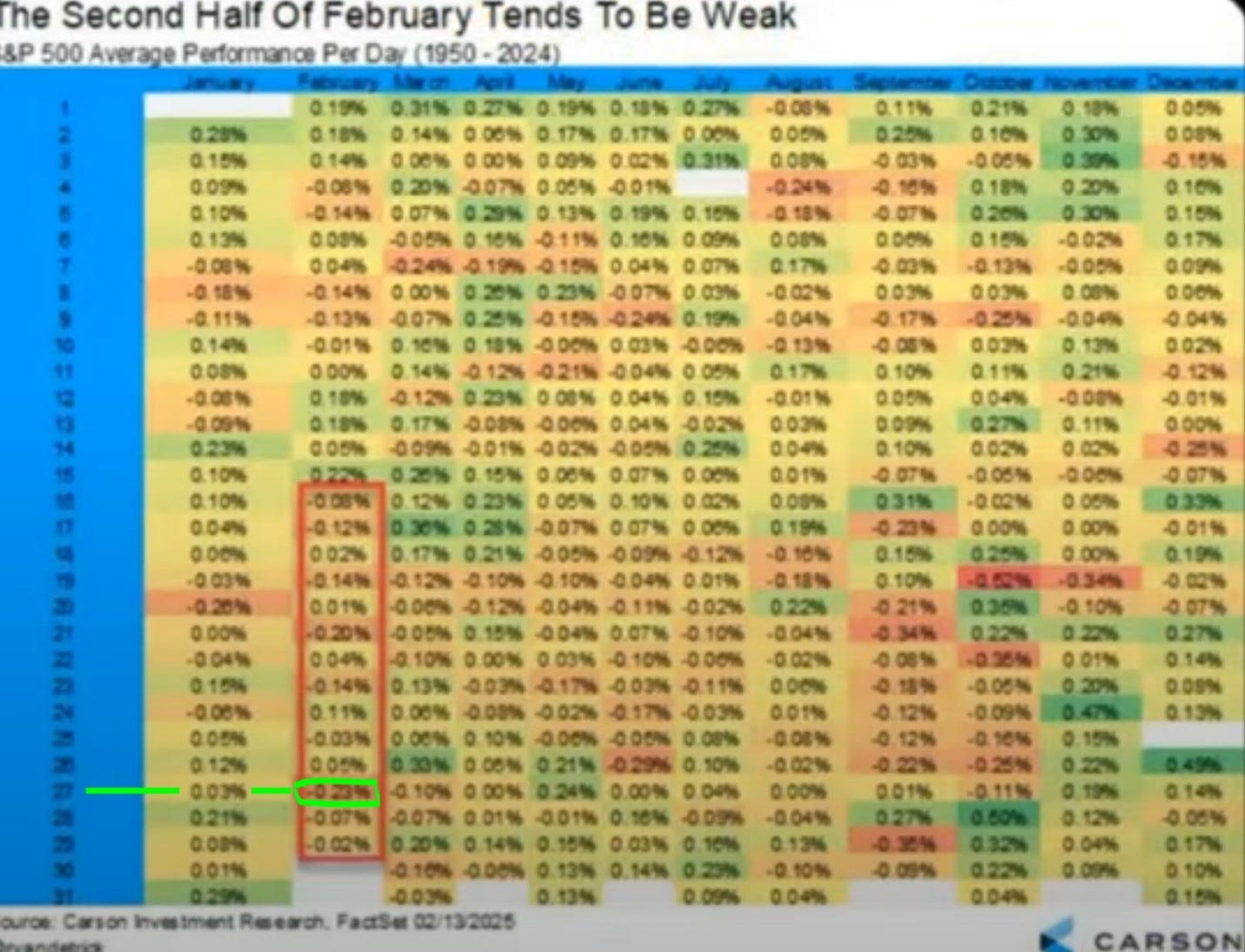

The end of February brought some turbulence, with the SPY dropping roughly 5% in just six days. I hope everyone stayed safe and found my guidance on the weakness in the second half of February helpful. Below, you’ll find a breakdown of the market’s performance for every day of the year.

Notably, February 27th stands out as the worst day in one of the year’s toughest months. This year, it lived up to its reputation, delivering a 2% pullback. In my previous articles, I’ve urged readers to stay calm during times like these, relying on data rather than letting emotions take the wheel.

I see no evidence suggesting the bull market is over. The rerating of mega-caps and the "Mag 7" stocks, which I’ve highlighted before, is unfolding exactly as anticipated. Momentum chasers got hit hard, but I view this correction as normal and expected—unlike the bears, who are calling it the end of the bull run. For me, it was an opportunity to buy the dip and ride the bounce. On Friday, that strategy paid off with a 2% surge from the lows on the SPY.

This wasn’t my first time buying the dip while others panicked. Below, you can see how often sticking to data over emotion has rewarded me.

Each dip I’ve bought has paid off handsomely. Of course, I always prepare for the possibility of a loss when I take these trades: if it doesn’t work, I’ll cut it quickly, stay safe, and try again.

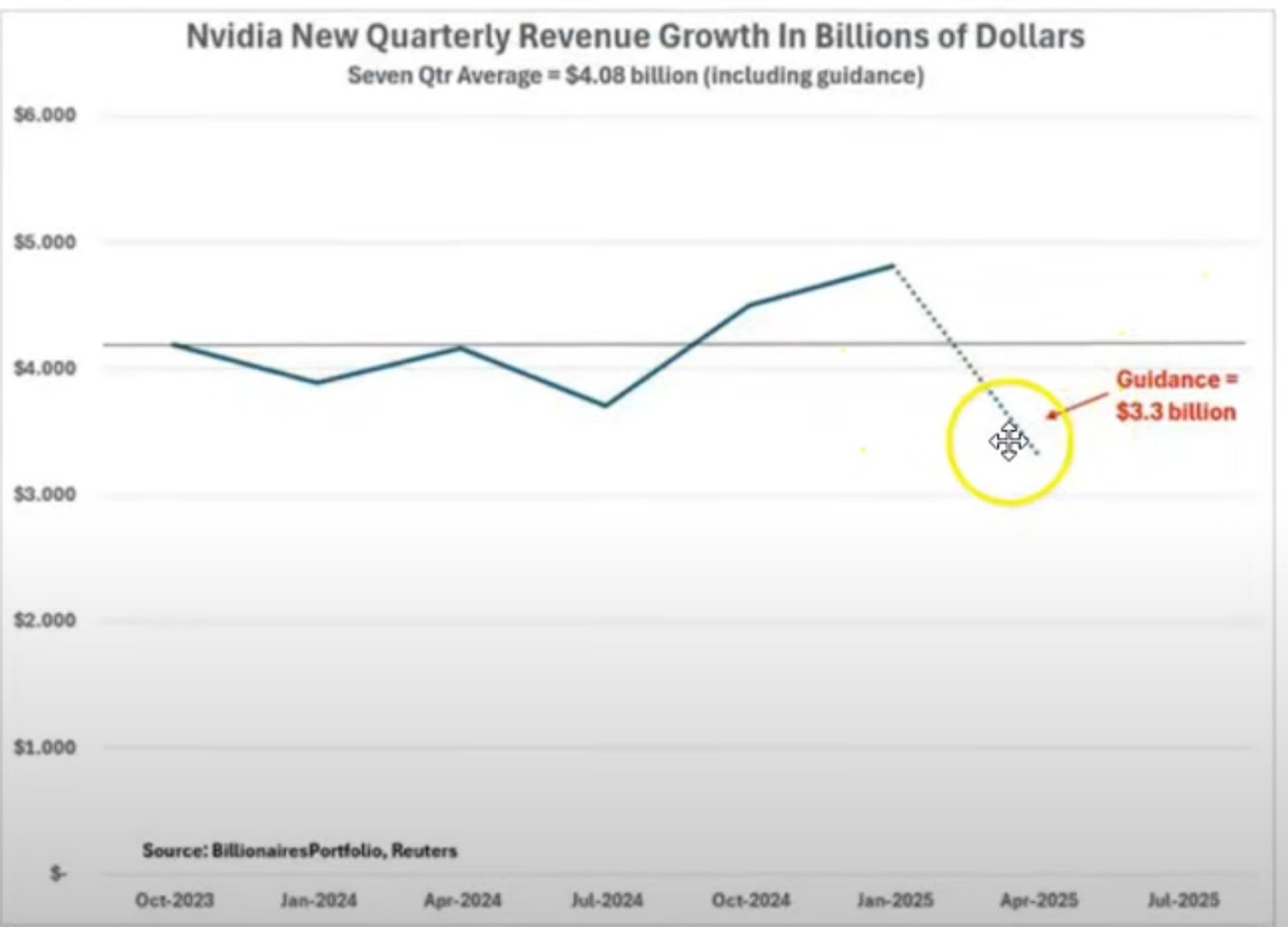

What sparked this latest wave of unease? Uncertainty around Trump’s tariff policies and a perceived slowdown in Mag 7 earnings. Take NVDA, for example: its growth has been impressive, adding about $4 billion per quarter.

But jumping from $10 billion to $14 billion looks far more striking than climbing from $26 billion to $30 billion. As growth slows, investors grow cautious about paying premium prices. NVDA’s data center growth has dipped below 50% and is trending downward.

Their latest guidance also fell well short of recent quarters.

While I suspect NVDA management is sandbagging, it’s still concerning for a stock trading at 50X sales to see key metrics softening. I flagged this risk at the start of the year, suggesting a shift away from high-fliers like the Mag 7 (Read here). I hope some of you adjusted accordingly.

Looking ahead to March and April, historical data shows a bounce to kick off March, followed by another dip before a push into summer. I expect we’ll rally through March 6th or 7th, then see a dip to test the bulls’ resolve before climbing higher.

The data also suggests a mid-year peak is typical, though this will hinge on earnings. I’m keeping an open mind for another strong year, but for now, I’m projecting a modest 10% return for the major indices.

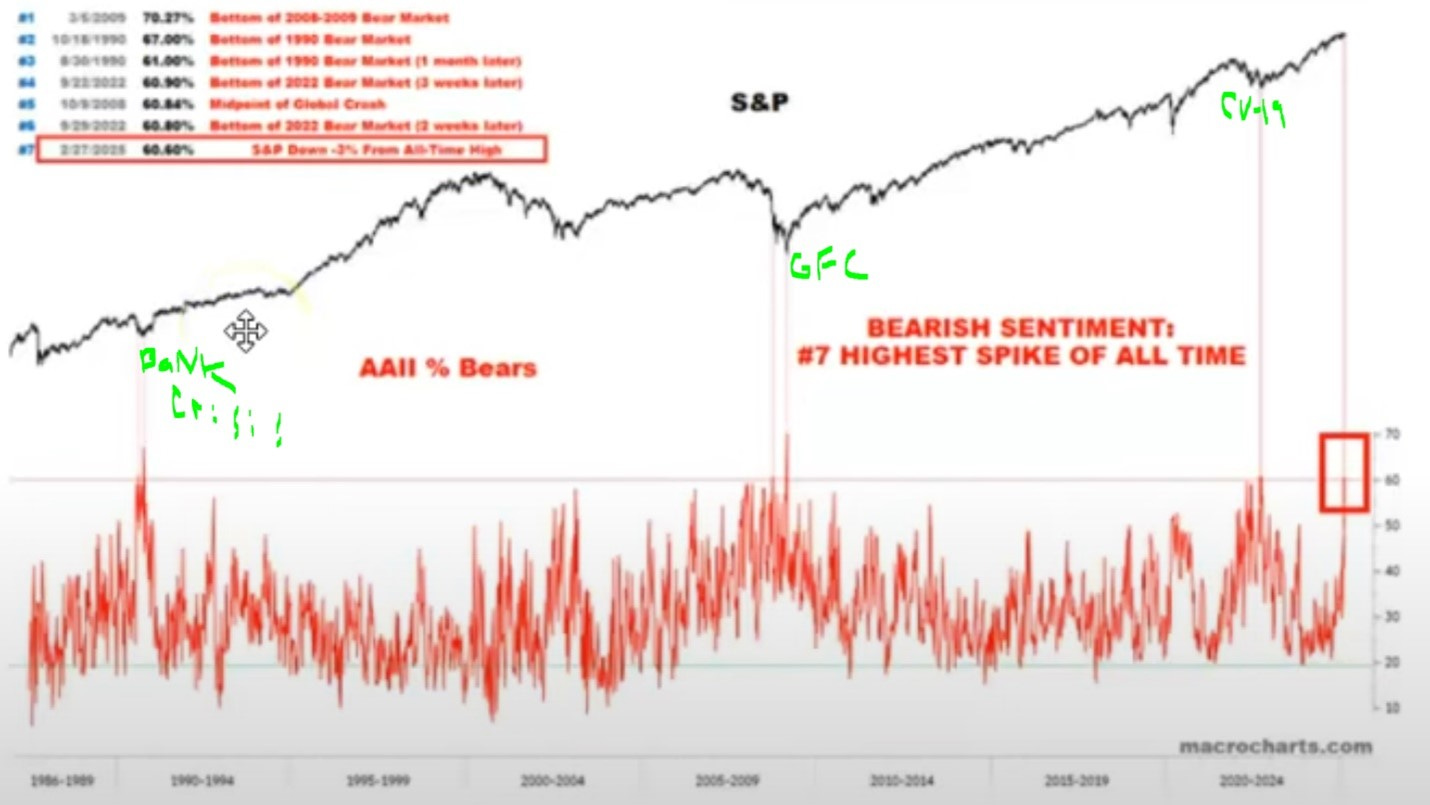

Another factor spooking investors is the AAII bull-bear spread.

We have only had this high of reading a few times in recent history. Each time there was a major event. 2020 we had covid-19, then before that it was the great financial crisis, then before that it was the banking crisis. Do you believe we are having one of these momentous events taking place right now? If not, I would buy the dip.

Below shows the average returns after the AAII bull-bear falls below 40%.

Historical returns after the AAII bull-bear ratio drops below 40% support buying the dip: a month later, we’re typically up about 2%, and a year out, gains average around 20%.

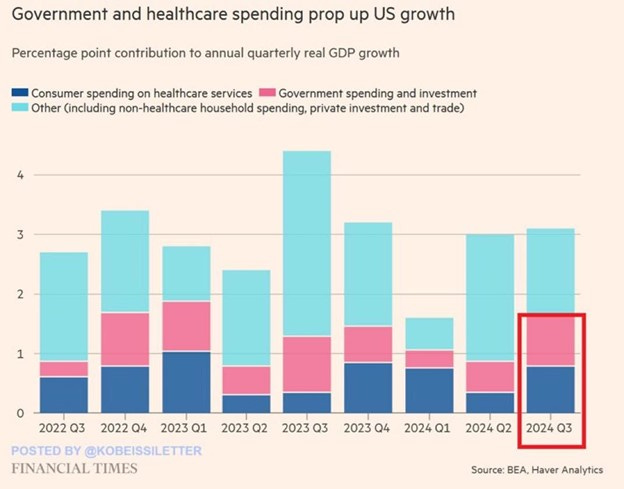

Trump’s DOGE initiatives and potential spending cuts could significantly impact the economy, alongside tariffs that might drive prices higher. The previous administration’s job growth leaned heavily on government and healthcare roles.

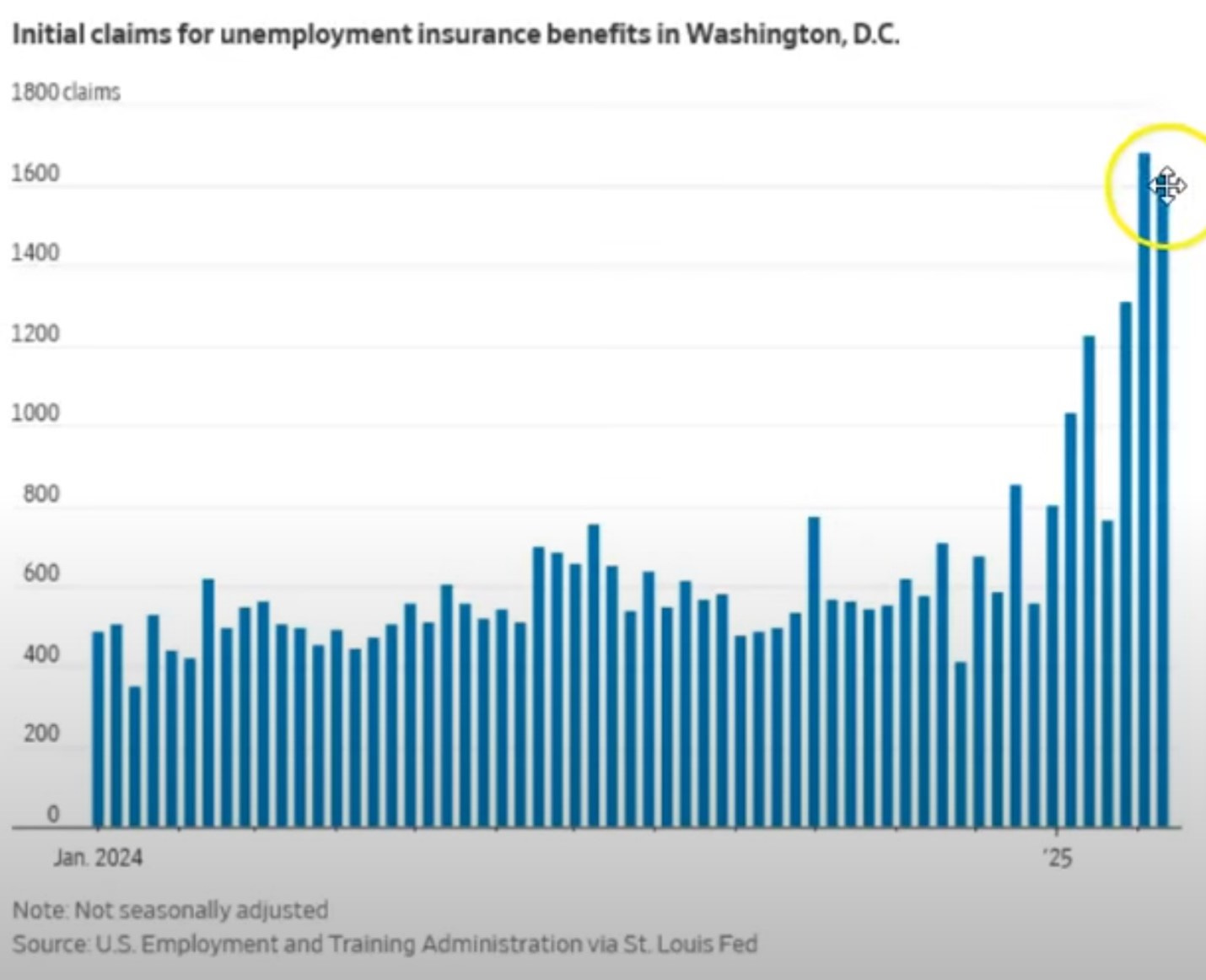

As Trump streamlines government and reduces bureaucracy, those workers will need to transition to the private sector. Keep an eye on initial unemployment claims in Washington, D.C.—they could signal broader shifts.

A weakening of the economy and higher unemployment might prompt the Fed to step in with more rate cuts. Either way, quarterly earnings and corporate cash allocation will be the metrics to watch.

For now, the data supports buying these dips. I’m picking up some Mag 7 names like NVDA, TSLA, AMZN, and possibly GOOGL, but I’m also diversifying elsewhere with JPM, HIMS, PYPL, UBER, ISRG, EL, CPS, and ETSY. Some of these—like TSLA, AMZN, and NVDA—are short-term bounce plays, while others, such as EL, CPS, PYPL, and ETSY, are longer-term holds.

March kicks off a new month, bringing fresh inside candles on the monthly timeframe. February left us with a few monthly breakdowns that could turn into reversal strategies. The strongest candidate right now is MLI.

I’m also watching AVGO—it broke down on the monthly but could reverse if we see a bounce.

I’m tracking 19 companies for inside months and 8 for inside weeks. If you’re unfamiliar with how to trade these setups, check out my training here.

Inside months:

Inside weeks:

One of my top picks for the week is HIMS. I’m long via options with longer expirations, but I’m also open to shorter-dated options to push this back toward $50.

For a low-maintenance swing play, consider SPGI’s 130 TPS/TTM setup. It’s back testing the breakout, and I see this possibly hitting 127.2 fib level.

(if you don’t know how to play the TPS pattern, please watch this video.

BROS, flagged by someone in the room, also looks promising. We’re facing resistance at $81–82, but I think we can rally to that level, take partial profits, and set up a risk-free trade.

PANW is another dip-buy favorite of mine. With stacked squeezes, I might take a shot next week.

That said, even as I buy this dip, I can’t rule out further downside after this short-term rally. I expect larger pullbacks this year than last, so my strategy is to buy dips cautiously. As we rally, I’ll take partial profits and set hard stops near my entry levels to protect gains.

In volatile times like these, the ability to remain calm and anchor decisions in data, rather than succumbing to panic, can set you apart. As we’ve seen, markets will test your resolve with sharp dips and sudden rallies, but history shows that sticking to a disciplined, data-driven approach pays off. Whether it’s buying the dip on names like NVDA or spotting setups like HIMS and SPGI, the rewards can be substantial when you get it right. My strategy remains simple: analyze the data, manage risk with properly placed stops, and take profits as opportunities arise. Volatility isn’t the enemy, it’s the terrain where profits are forged, if you navigate it with a steady hand.

Great article! Thanks Dman