Taking chances in life is the only way to stretch ourselves and achieve our dreams. “Everything you want is on the other side of fear.” As traders, we must seize setups that offer a distinct edge while safeguarding our capital. My approach has always been to invest in the world’s best companies at attractive prices and to seek opportunities where good companies are available at great prices.

On April 6th, I shared an article on my experience "facing the Bear," which you can read here .

Below is the concluding paragraph from that article:

As a result of facing my fear in the appropriate way, I was able to participate in the 2nd fastest recovery of a bear market.

Currently, however, I believe we are reaching a juncture where investors may start taking profits and reallocating capital away from these tech giants. I don’t expect a dramatic pullback in technology per se, but I do see tech underperforming relative to other sectors. This is partly because, despite occasional earnings surprises—like NFLX’s impressive performance last quarter—the heavy CAPEX on AI hardware and aggressive talent recruitment are likely weighing on their near-term earnings potential.

In anticipation of these changes, I have already lightened my positions in many winners since the April 7th low and have begun moving capital into areas that have yet to bounce as robustly. Many fellow traders are adopting a similar rotation strategy.

Preparing for Potential Choppiness and the Earnings Season Ahead

While we may be entering the best week of the year historically, I do expect some choppiness among recent big winners, driven by profit-taking.

The S&P 500 is trading at approximately 22.4 times 12-month forward earnings—a level suggesting that market indices like the SPY and QQQ may be overbought and sitting at high valuations. In situations like these, it often doesn’t take much to trigger a small correction, which I expect could be in the 3-5% range. For bulls like me, the question remains: "Do I try to time a pullback, or do I continue to take shots, accepting the small losses that come with them?"

In my experience, unless there’s a clear catalyst (such as the COVID crisis), it’s better to continue trading and accept losses when necessary. I believe the indices could see a 2-3% pullback, but if that happens, it will likely be short-lived as investors buy the dip. The catalysts for this potential pullback are already lining up for next week, but they could also fuel the rally if the data comes in better than expected.

Here’s what we can expect:

Tuesday: Inflation data will be released. If the numbers come in hotter than expected, fears over tariffs could drive a sell-off. Former President Trump recently announced higher-than-expected tariffs on various countries, adding to inflation concerns.

Wednesday: Core PPI, which is Jerome Powell’s preferred inflation measure, will be reported. A "hot" print here could also spark a sell-off.

Thursday: Retail sales numbers may indicate consumer spending is slowing and fuel concerns about the overall economy. Additionally, the weekly jobless claims report could show that the labor market remains too strong for the Federal Reserve to consider rate cuts.

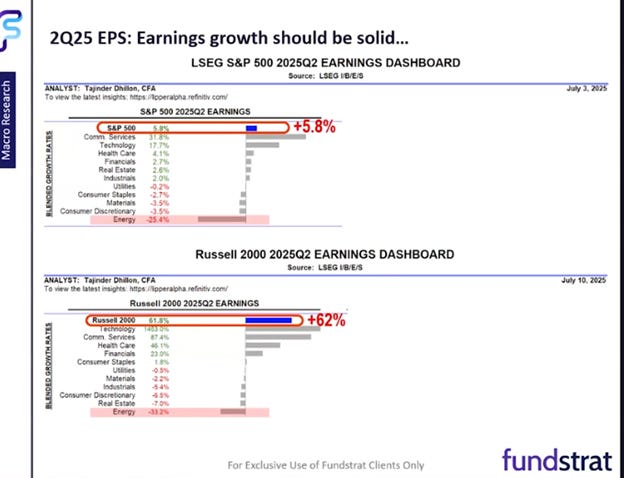

Earnings Season: With earnings season ramping up, this could provide a much-needed catalyst for the market. Beating earnings estimates and raising forecasts could lower the valuation ratios of the S&P 500 without requiring stock prices to fall. Last quarter, analysts lowered the earnings growth forecast from 9% to just 5%. I believe this low bar presents an opportunity, and we’ll likely surpass the 5% target.

The Rotation and Small-Cap Opportunities

As part of my strategy, I’ve been rotating away from large-cap technology stocks and focusing more on small-cap companies, particularly those that are starting to see earnings growth. Small-cap stocks have been underperforming relative to large-cap names, but I believe they offer attractive opportunities, especially as interest rates come down.

Smaller companies will likely benefit more than large-cap firms once the Fed starts lowering rates. This rotation is already underway, and I am participating in it, with names like VFC. I am also considering TTD, LULU, RH, DECK and SAM after digging deeper into their fundamentals.

Here are the 25 worst performing Russell 1,000 stocks for the first half of 2025.

Sector Valuations and Market Outlook

As we look ahead, sector-level valuations will be key to identifying undervalued opportunities. If the S&P 500 maintains a high valuation of around 22x P/E, we’re targeting a range of 6,500-6,600 on the index. For that target to hold, earnings per share (EPS) must meet or exceed 300.24. If this target gets lowered, it could signal further downside. However, if the target remains steady or increases, we could see a push higher into August, followed by the typical seasonal weakness in September and October.

Below is the sector-level bottom-up target price vs closing price.

It’s also important to remember that institutional managers are still not aggressively buying, and many investors remain short. Historically, these managers tend to buy at market tops, suggesting that the market could still have more upside, albeit with increased volatility.

Final Thoughts: Earnings Will Drive the Market

As we head into earnings season, the market stands at a crossroads. Strong earnings beats and optimistic forecasts could propel the S&P 500 toward 6,500, while hotter-than-expected inflation data or profit-taking may trigger a modest 2-3% pullback.

By rotating capital into undervalued small-cap opportunities and staying disciplined with risk management, we can navigate this volatility with confidence.

As always, remain vigilant, assess opportunities with care, and position yourself for success as the data rolls in.

are packed with valuable information. Thank you very much for taking the time to put this information together. I’m pretty heavy into VFC ~ $11 average and would love to add more on a pull to $10 or so. I am also looking at starting a position in TTD. I sold out last year when the price got ridiculously high in Nov for election. Also heavy in IBIT, ETHA, and AMD. Is it time for BABA to finally break out of this multi year base? I’m going to position for it. Thanks again!

Man, these Substacks