In Chapter 12 of The General Theory of Employment, Interest and Money, titled “The State of Long-Term Expectations,” John Maynard Keynes unveils a powerful truth: investment decisions hinge on future profitability, yet they swim in a sea of uncertainty. Confidence becomes the heartbeat of the market, pulsing through every choice. Optimism can ignite a fire, pessimism can douse it, and psychological currents often drown out cold, rational calculations. Keynes nails it with his stock market metaphor—a beauty contest where investors scramble to guess what others will crown as "attractive," sidelining intrinsic value for fleeting perception.

But I’m here to tell you: intrinsic value and earnings do drive the market, and I stand firm in that conviction. Sure, earnings for "the others" have soared, while the Mag 7 stumbled—a disappointment I saw coming and warned you about. What I didn’t fully anticipate was the short-term psychological storm unleashed by Trump and his tariff uncertainties. That chaos has seized the markets with an iron grip. Right now, we’re witnessing Keynes’ beauty pageant in full swing: investors chasing shadows, guessing what others will value, and flocking to safety like it’s the only prize worth winning.

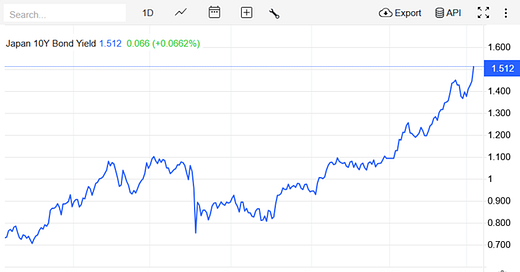

Another miscalculation? The scale of the Yen carry trade unwind. I broke this down a year ago: Japan’s near-zero interest rates fueled a flood of cheap money into U.S. markets.

Here’s a quick recap: as Japan’s interest rates climb, that free lunch is over. Borrowers are repaying loans, pulling capital out of American equities. The higher Japan’s rates go, the stronger the repatriation pressure—a slow bleed I didn’t fully size up.

I misjudged the bounce’s timing, expecting it last week, but my short-term trades hit the mark perfectly. Swing trades, however, have taken a beating in this brutal chop. Volatility roars like a beast, and I’ve sized down to keep my edge razor-sharp.

Here’s the fire in my gut: I still believe a massive rally is coming, a chance to stack serious gains fast. History shouts the evidence, proving the fiercest rallies often ignite in bear markets or steep downtrends. Don’t ease up yet, though, because smooth waters won’t follow. I’m eyeing 10% for the year, so hold tight, this chop isn’t fading soon. Yet, when we anchor ourselves to fundamentals and intrinsic value, these turbulent swings turn into prime moments, letting us scoop up great companies at unbeatable prices.

Technicals and Sentiment

From a technical lens, momentum’s whispering clues that a bounce may be in the short-term future. Daily momentum is bottoming out, kissing the 200-day moving average.

Monthly momentum, though, is curving—maybe peaking. We’re inches from a short-term bounce, but will it hold? I don’t know yet. My play: take partial profits, let the runners ride. If history’s our guide, we could charge into mid-year before rolling over.

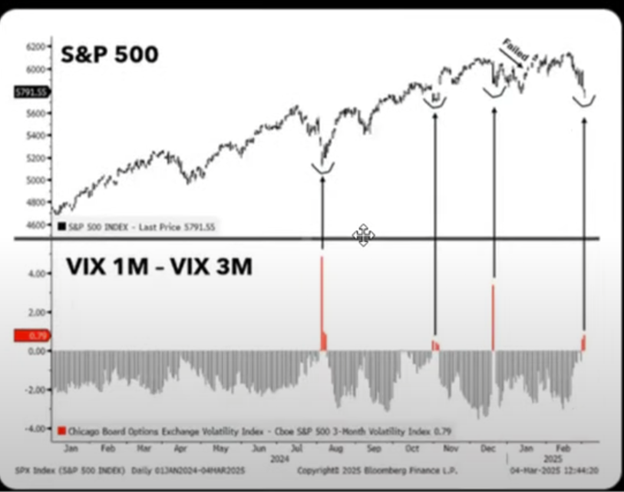

More fuel stokes the case for a bounce, and it’s lit by the VIX 1-month versus 3-month ratio. When the one-month price surges past the three-month, history signals a bottom taking root. This isn’t guesswork, it’s a pattern we can seize with confidence.

Historical data shows we get this chop for a couple months before a rally.

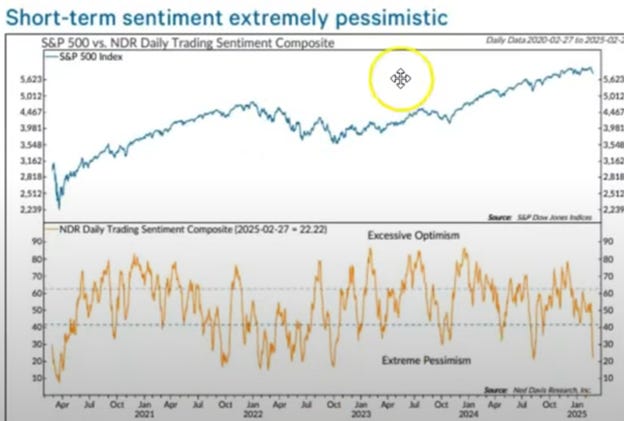

Extreme pessimism blazes across the markets, with put volume soaring to the second highest ever and the Fear and Greed Index bellowing "extreme fear." I’m convinced the sellers have run dry, their fight burned out. That’s my signal, and it’s time to act with boldness.

Beyond the U.S.: China’s Quiet Rise

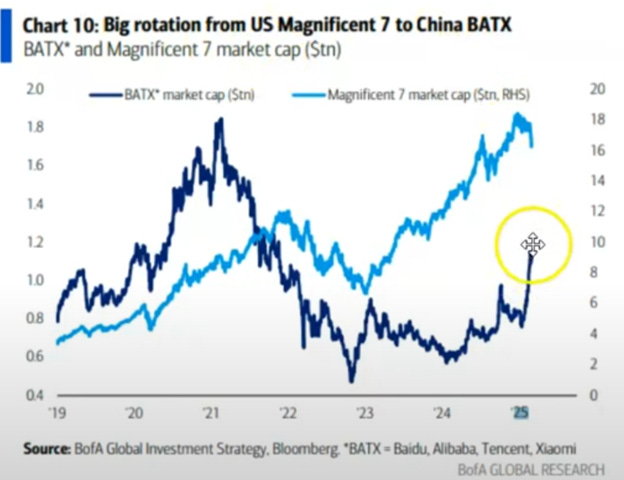

While fear chokes U.S. markets, others are thriving. On February 18th, I dropped a video (9 minute mark) spotlighting value in China. I charted the gaping spread between U.S. and China tech stocks. The image I shared then is below:

Here’s the update: that gap’s shrinking.

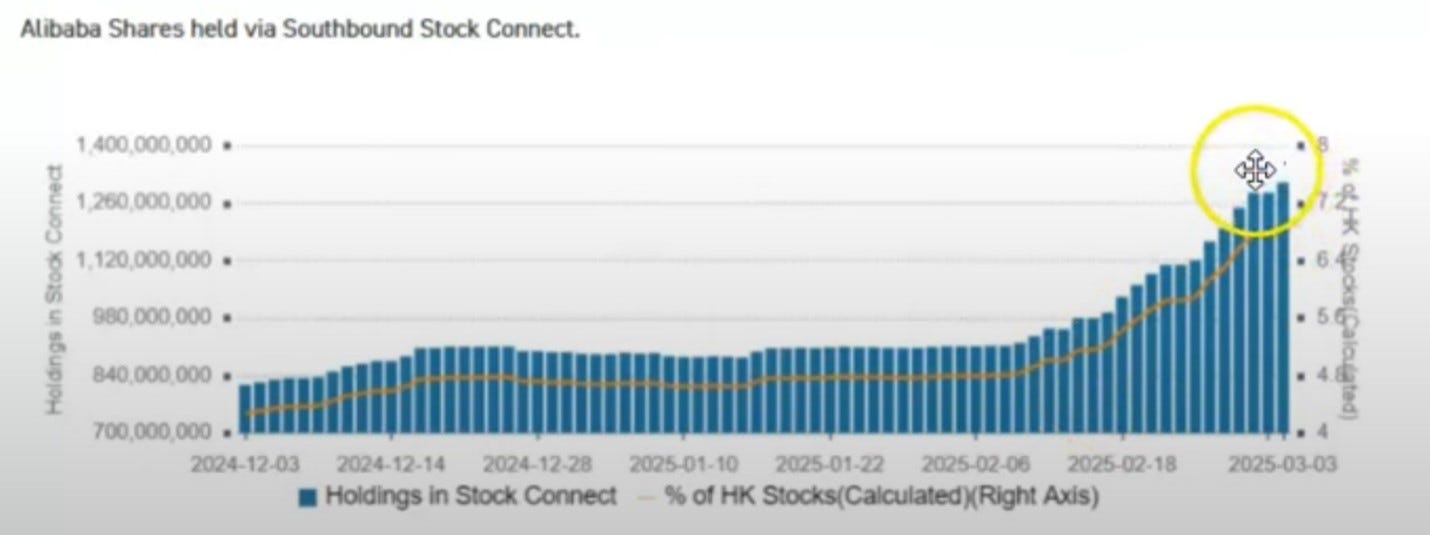

That gap’s shrinking, and I’m betting it closes within two years. China might even leapfrog the U.S., like it did from 2018 to 2021. One catalyst i mentioned for the BABA trade was the Southbound Stock Connect buying. It hit its highest since 2021 in February.

I see it climbing to 10-15% ownership; we’re at 7% now. Compare that to Tencent (10%) and Bilibili (15%). Alibaba’s got room to run—I’ll update you soon.

The Bigger Picture

Here’s the truth I need you to grasp. I saw this coming. I warned you. Everything unfolding fits the plan.

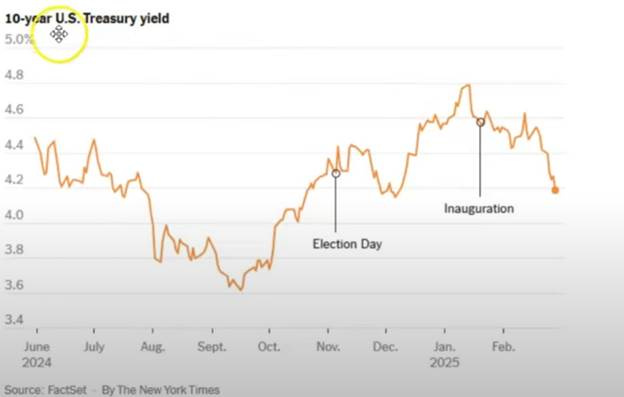

Trump’s pushing to refinance debt at rock-bottom rates, nudging the Fed to slash rates. Why juice the economy just to let Powell tighten the screws? Instead, he’s slashing government jobs, sparking psychological pain—Keynes’ playbook—and dimming the future outlook. Powell’s forced to ease, not squeeze. That’s why the 10-year Treasury yield’s plunging fast.

What’s unfolding in the markets isn’t chaos, but the rhythm of the game, a cycle as old as investing itself. These dips and wild swings aren’t signals to flee for safety, clutching emotions like a life raft. No, they form our battleground, our chance to strike. We possess the tools, logic, discipline, and a laser focus on intrinsic value, to turn these tremors into triumphs. While others panic and run, we stand tall, buying greatness at a discount. This is our moment to make money, not mourn it. Let’s wield our edge and win.

Enjoying your insight. Nicely done.

Great overview Dman!