At the start of the year, I published an article titled “Navigating the Bull Run: Strategic Shifts for 2025” on my Substack . My thesis was simple: the sky-high valuations of the Magnificent 7 (Mag 7) would push investors to seek opportunities elsewhere. Historically, value stocks have outperformed growth by 4.4% annually since 1928, yet over the last decade, growth has dominated. Recency bias blinds many traders to this shift, causing them to overlook exceptional companies trading at bargain valuations. I argued this was a golden opportunity—and 2025 is proving me right. You can see from the chart below that we are just getting started.

Last week, in my video update, I highlighted the historical weakness of the second half of February and flagged underwhelming earnings from most of the Mag 7 (META being the exception). This set the stage for a likely pullback. Sure enough, the market turned red—but it was one of my best weeks ever as a trader, both in realized and unrealized gains. Why? I’m not chasing overhyped, high-multiple stocks like Palantir (PLTR). Instead, I’ve stuck to the value strategy I outlined in January, and it’s paying off.

About a year ago, in my training “The Weighing Machine vs. The Voting Machine”, I emphasized the critical role of valuations in long-term investing. The market’s short-term “voting machine” may cheer momentum, but over time, the “weighing machine” of fundamentals prevails. I urged viewers to revisit this lesson as rich Mag 7 valuations spark the current pullback. As earnings roll in, the Mag 7’s multiples are ballooning, while undervalued stocks grow more attractive.

Take Japan’s rising rates, for instance. They’re unwinding the yen carry trade, where borrowed funds fueled Mag 7 investments. As that money flows out, it’s landing in the other 493 S&P companies, emerging markets, and value plays like Alibaba (BABA), a stock I spotlighted in that same training. Consider this slide from the session:

BABA grew revenues by 900%, cash flow by over 500%, and earnings by over 500%, yet its share price stagnated at 0% growth. That disconnect handed us a once-in-a-generation value play. I’ve said it before: I’ve rarely seen a company as undervalued as BABA was.

Last week’s surge in BABA was the backbone of my stellar performance. Even after its run-up, with multiples no longer in the low teens, I still see it as undervalued. Fair value likely sits between $250-$300; factoring in China risk, maybe $200-$250. I’m not alone—Ryan Cohen recently boosted his stake, signaling confidence.

BABA’s latest earnings (February 20, 2025) underscore this, with a non-GAAP EPS of ~$2.95 beating expectations and driving the stock past $137.

This shift isn’t just about BABA. Post-earnings, the Mag 7’s overvaluation is glaring, redirecting capital to overlooked corners of the market.

My earlier piece, “China… Finally”, dives into why China still offers upside. The MSCI China Index, for example, boasts a P/E below 15—room to climb into the high teens.

BABA, best-in-class, is leading this charge.

Year-to-date, BABA’s up roughly 70%, but after such a sprint, it’s due for a breather. I don’t expect a retreat to prior lows—just a consolidation before pushing toward $200. Last week, I sold 40,000 OF MY 140,000 shares to lock in some gains, planning to buy back during this pause. I’m keeping BABA on my radar for tactical plays—think TTM Squeeze or The Strat setups.

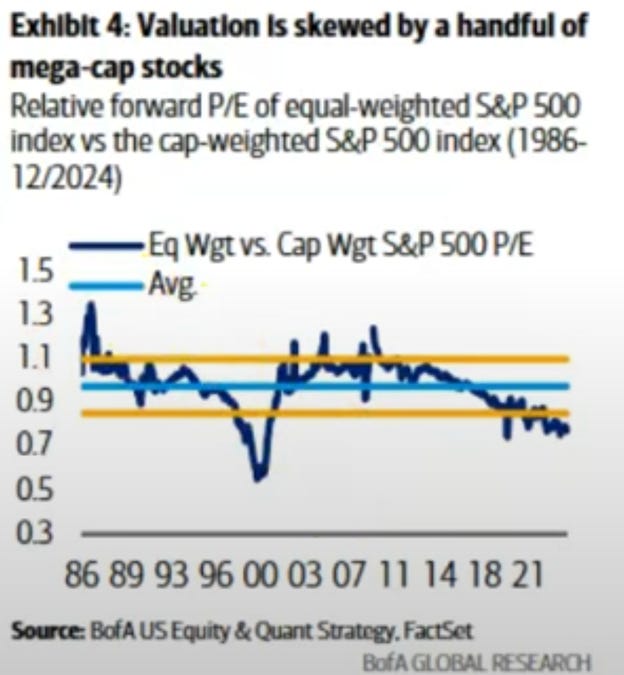

Beyond China, the U.S. market offers plenty once you see past the mega-cap distortion.

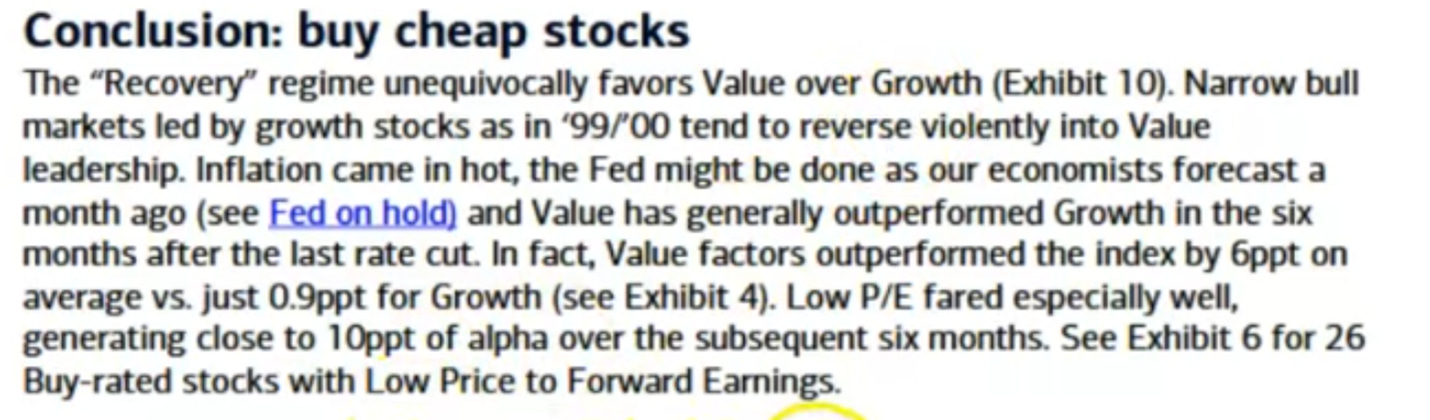

Bank of America recently echoed my January advice: look beyond the highflyers.

Weeks like last week punish those chasing shiny objects with bloated multiples. The antidote? Buy below intrinsic value and wait. This bull market is young, but its next leg won’t just reward passive wave-riders—it demands skill and foresight to bridge the valuation gap between growth darlings and value gems.

Success in 2025 hinges on navigating these shifts. Opportunities abound, and I’ll be sharing more over the year ahead. Stay tuned.

Thanks for sharing your valuable insights..

Thanks for sharing your valuable insights..