I’m excited to share the latest updates on our long-term portfolio and highlight some of our recent technical analysis-driven trades. The market continues to show resilience, and our strategic positioning has yielded strong results. Let’s dive into the details.

Market Overview: A Healthy Rally

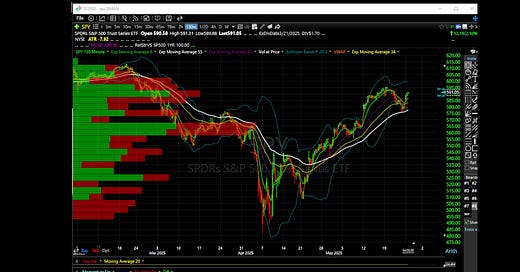

Today, the S&P 500 (SPY) rose 2.1%, and the Nasdaq 100 (QQQ) gained 2.5%, driven by robust market breadth. We saw a 6:1 ratio in both advance/decline data and volume flowing into advancing issues, with 453 of the S&P 500 components posting gains. This broad participation signals a healthy market push, indicating that investor interest extends beyond AI and related themes—a promising sign for sustained momentum.

Portfolio Highlights: Big Wins and Strategic Exits

Our trading room capitalized on several high-conviction opportunities today, with standout performances in both short-term plays and long-term holdings.

Tesla (TSLA): Low-Hanging Fruit

Tesla was the star of the day, delivering exceptional returns. News of Elon Musk’s hands-on leadership—reportedly “sleeping on the factory floor”—catalyzed a strong move. Our well-timed entry paid off handsomely, generating approximately $12,000 in profits.

V.F. Corporation (VFC): Insider Buying and Contrarian Opportunity

VFC has been a focus for me and today we had reports of insider buying. I’ve been vocal about this opportunity, and it’s starting to gain traction. As tempting as it will be to take profits, remember the goal is $25-$30.

Nuclear Plays: LEU and SMR Hit Profit-Taking Zones

Our nuclear investments, Centrus Energy (LEU) and NuScale Power (SMR), have reached significant milestones. LEU hit its highest level since 2014, while SMR broke out to all-time highs. These catalyst-driven trades highlight the value of conviction in A+ ideas.

For SMR, I began accumulating shares in late March at prices as low as $12.

I also purchased August 2025 call options at $1.30–$1.50, selling eight contracts today for $16.00—a gain of over 1,000%. These eight contracts, initially costing $1,040–$1,200, netted approximately $11,500 in profit. Additionally, my January 2026 call options, acquired for $2.50–$3.00, are now trading around $15, and the equity itself has appreciated by roughly 200%. These results underscore the importance of sizing up on high-conviction ideas. Even a modest position of eight contracts delivered outsized returns so you can do the math on my normal 100–200 options contracts.

I’ve taken large portions off on both LEU and SMR to lock in gains while maintaining exposure to future upside.

Etsy (ETSY): Disciplined Profit-Taking

ETSY has reclaimed the $50 level, which was my trigger to pause accumulation. If we see a push toward $55, I plan to take partial profits—either by selling shares or selling covered calls—for approximately 25% gains. This isn’t the ultimate target, but it allows us to lock in profits and re-enter on dips.

ASML: Long-term play with a TTM Squeeze on the Weekly Timeframe

ASML is forming a TTM squeeze on the weekly chart. A breakout could drive us well above 800, at which point I’ll consider taking partial profits as per my normal trading strategy of buying dips and selling rips.

TLT: New Position

As mentioned in my previous Substack, I initiated a position in the iShares 20+ Year Treasury Bond ETF (TLT) today, targeting a 10–15% return by year-end.

Advance Auto Parts (AAP): Turnaround Success

AAP reported strong earnings and highlighted its turnaround story, sparking a 55% rally from my lowest entry point. I’ve held this position for over a year, with a cost basis ranging up to the $60s. While I may have been early, patience is paying off. If AAP reaches the $55–$60 range, I plan to sell most of my lower-cost shares, setting up a low-risk trade for the coming years.

iShares Russell 2000 ETF (IWM): Staying the Course

IWM has been challenging, with my overall position still in the red since October 2023. However, I remain confident in its potential for a 20% gain over the next 12–14 months. I’ll continue buying dips and selling rips to optimize my entry.

Diageo (DEO): A Buffett-Inspired Watchlist Addition

While I don’t currently hold Diageo (DEO), Berkshire Hathaway’s recent investment caught my attention. DEO’s strong balance sheet and temporary impairment make it a classic value play. Despite declining alcohol consumption in the U.S., demand for premium spirits aligns with DEO’s portfolio. I’m closely researching this one for a potential entry.

Technical Plays: High-Probability Setups

In addition to our long-term portfolio, I am looking to execute several technical trades based on high-probability setups. Here’s a rundown:

Meta Platforms (META): The 78-minute TPS chart looks exceptional, making this a top pick.

Carvana (CVNA): Showing stacked squeezes, CVNA is on my radar for a pullback to the 8 EMA on the 130- or 195-minute charts, which would trigger an entry.

Dollar Tree (DLTR): I entered a position today as the stock hit its 8 EMA on the 78-minute chart.

Netflix (NFLX): The 130-minute chart shows a promising setup. If we see a “little U” pattern near the 8 EMA, I expect a push to new all-time highs.

Talen Energy (TLN): The 195-minute chart looks compelling, and I’m positioned for a breakout.

Microsoft (MSFT): A strong 130-minute TTM setup makes this another attractive trade.

Watchlist for Potential Entries

I’m also monitoring the following setups, which show promise but need confirmation:

Amazon (AMZN), AppLovin (APP), DoorDash (DASH), and Interactive Brokers (IBKR): All exhibit TTM squeezes on the 130- or 195-minute charts.

Quanta Services (PWR) and Constellation Energy (CEG): I’m waiting for squeezes to form before entering.

Key Takeaway: Conviction Pays

The standout performance of trades like NuScale Power (SMR) and Tesla (TSLA) underscores a fundamental principle: conviction in your highest-quality ideas, combined with disciplined execution, delivers exceptional returns. Whether through a modest options position or a larger equity stake, the market rewards those who act decisively on well-researched setups.

While I remain optimistic about the market’s near-term trajectory—potentially pushing the S&P 500 (SPY) toward the 600 level absent any unexpected catalysts—it’s critical to stay disciplined. Adhere to our proven edge, avoid overextending into too many setups, and focus on your top ideas with appropriate sizing. By maintaining this balance of conviction and caution, we position ourselves to capitalize on opportunities while managing risk effectively.

Thank you for your continued support, and I’m excited to navigate these markets together. Stay tuned for more updates, and feel free to share your thoughts!

Share this post