Dancing with Failure and Soaring Beyond Fear

Failure is woven into the fabric of the human experience—unavoidable, essential, and one of life’s greatest teachers. It reveals truths that success often conceals. Yet for years, I let the fear of failure stop me before I even started.

In high school, I deliberately underperformed in a chess tournament, convincing myself, “If I’d really tried, I would’ve won.” In basketball, I passed up open shots to avoid missing. Sound familiar? We all have moments when fear of failure kept us from discovering our potential.

In my mid-20s, I made a pivotal decision: I would never again let fear of failure stop me from trying. Why? Because I had never reached my full potential in basketball. College coaches showed interest, and I even visited schools and played with their teams. But I always backed out, using my single mother as an excuse, claiming she needed me. The truth? Fear held me back.

To this day, I wonder: What if I had pushed myself? How far could I have gone? That lingering question haunted me. I vowed never to live with another “what if.” As J.K. Rowling wisely said:

"It is impossible to live without failing at something, unless you live so cautiously that you might as well not have lived at all—in which case, you fail by default."

The Fire Within

That mindset—refusing to be paralyzed by fear—propelled me to take risks: chasing literal bears, launching businesses, starting franchises, and even facing my biggest fear, marriage. Some of my deepest joys came from pushing past fear to discover the butterfly within the cocoon of Donnie. But this approach also led to significant losses.

I tried to help struggling family members, hired former felons, gave second chances to the homeless. Sometimes it worked. More often, it didn’t. Sometimes it worked; often, it didn’t. My largest financial setback came from investing two million dollars in a lesser-known franchise just to be closer to my brother.

Learning from Pain in Trading and in Life

I’ve failed in trading, too—repeatedly. I’ve lost hundreds of thousands of dollars making rookie mistakes. After my father passed away when I was nine, my mother often said, “It’s better your dad died, because he left us money.” I internalized a damaging belief: a man’s worth is measured in dollars, and losing money meant losing value—or even life itself.

To heal, I had to separate success from money. Losing money isn’t failure, just as making money isn’t success. As Winston Churchill said:

“Success is not final, failure is not fatal: it is the courage to continue that counts.”

I pressed on, stubbornly but never quitting. To avoid going broke, I learned risk control, which allowed me to trade until I mastered it. Eventually, I began making real money as a day trader.

Another failure I have had more recently was the Rabbit and Turtle accounts. I shared two trading accounts publicly: the “rabbit” and the “turtle.” The turtle account had a strong win rate—nine wins, one loss. Yet that single loss weighed heavily on me, not because of the money, but because I feared letting down those who followed me. My deepest fear has always been being a net negative to those I care about. Both accounts were profitable, but I wasn’t successful because I wasn’t doing what I knew I should with them. I couldn’t shake the memory of losing big by blindly following mentors. I will correct this and try again!

When fear arises, I thank my body for trying to protect me. I don’t suppress it with “man up” talk. Instead, I say out loud, “Thanks for keeping me safe. I’ve got this. It’s time to fly.” Once fear trusts me, I soar.

Flying When Others Flee

Recently, fear gripped the markets—tariffs, Trump, “Liberation Day.” Panic spread. People I respect were running for cover. Experts, professors, media heads screamed that the sky was falling. (https://deepvaluedisciple.substack.com/p/the-quant-savant)

Roman, for example, posted a tweet listing why tariffs would destroy America, echoing common arguments about economic collapse

Here’s Roman’s job, which he claims gives him expertise in these tough times:

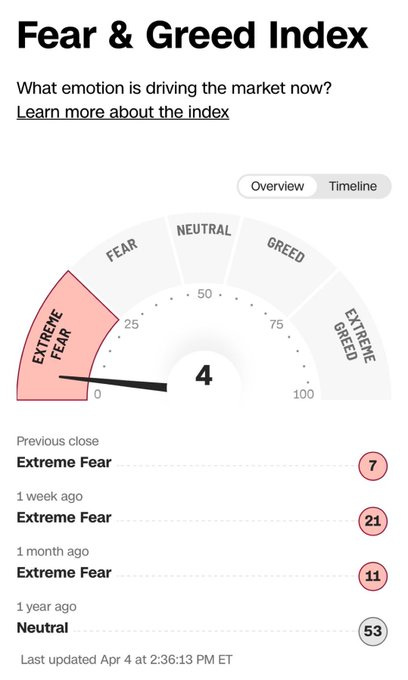

All these people live in their own echo chambers, lacking the self-reflection to consider alternative ideas. This led to sheepish behavior, with people quoting “expert” after “expert,” when in reality, they aren’t experts. This drove the fear and greed index to 4.

Even talking heads on TV, like our dear friend Jim Cramer, repeated the same talking points, scaring people.

Cramer’s take is on April 6, one day before the market bottomed on April 7.

But while everyone panicked, I soared. On April 4th, I tweeted my bullish stance.

On April 6th, I published a Substack outlining my plan.

EVERYONE was selling, too afraid to buy.

On April 7th, I put $3.5 million into short-dated call options.

As you know, April 7 was the bottom,

leading to my largest realized P/L day ever.

Why was I able to do this? Because I didn’t let fear make my decisions. I used hard data, logic, and math. My rule? Buy great companies at good prices and good companies at great prices. I didn’t “man up.” I acknowledged the fear, built a plan my brain could trust, and executed.

From March 26th to April 4th, I tweeted and wrote publicly about what I was doing. I laid out the roadmap. Did you follow? If not, why? Was fear in the driver’s seat?

March 26th I tweeted,

On March 31st I tweeted,

On March 31st I sent you an article about some of the companies I was targeting.

Here is the result of just a few.

Why was I soaring? Was it because I made money? No! It was because I forced myself to do what I knew I should do.

Where do you stand in the stock market? Do you have the knowledge and the discipline to act on it? That’s when you become valuable, even if it doesn’t always lead to profits!

I followed this up on April 2nd by tweeting,

Then April 3rd,

And April 4th

Pay attention to the last 2 tweets, its always been a signal for me that when everyone is running for the doors, I start running in!

It’s always been a signal for me: when everyone is running for the doors, I start running in. I knew panic was coming, but it didn’t deter me from buying. Monday did panic, but to buy the panic, I needed a safe plan my lizard brain could trust. Otherwise, I wouldn’t have had the conviction to take or hold the trade. My plan is simple: buy great companies at good prices and good companies at great prices. Don’t size in all at once, and when the margin of safety becomes large, swing for the fences.

When the next pull came on the 20th, when futures opened, I saw it as a gift!

I bought more of these great companies, specially those where I had taken partial profits on the way up.

The SPY gained 7.5% that week! Add to winners!

The reason I am showing you this is because if you follow me on twitter, watch me trade in the DPL room or have access to me through SubStack, I laid out a very clear path to make A LOT of money in a short period of time. Did you follow my roadmap? If not, why? Was fear in the driver’s seat?

If you missed the big bounce, I still provided a path to more profits. On April 25, I tweeted,

And I followed up with specific ideas on my Substack on April 27.

Soar Above Fear: Profit from a Bullish Market with Clarity

Last Thursday, I walked away from my trading desk and made no trades. I was caught in a self-sabotaging mindset, one that could have led to reckless decisions harming my portfolio—and my family. Growing up, my father battled manic depression, and I’ve inherited traces of that emotional turbulence. When I push myself to grow, my nervous system, wired for…

Another opportunity was when AMZN sold off hard in after hours after their earnings report.

Was I afraid? Absolutely, but doing what you know you should do in the face of fear is called courage. I showed courage, with safety, and I bought the dip on AMZN.

I followed up on May 4 with another Substack post outlining many of the great companies I repurchased.

Courage Over Conformity

This article isn’t about boasting or proving I’m a great trader. It’s about showing the conviction to say, “I’m right, everyone else is wrong.” Without the courage to go against so-called experts, from TV talking heads, professors theorizing in ivory towers, you’ll never profit in the market.

My time as a day trader is winding down as I shift to investing only, but I want to help transform your life. I challenge you to develop the conviction to stand alone or entrust your money to someone who does. This doesn’t mean buying recklessly when scared. It means creating a system where you have an edge. Mine is simple: buy support, sell resistance and follow the chart patterns, then act when the advantage appears.

Failure, though often feared and misunderstood, is an inevitable and integral part of the human experience. It serves as a profound teacher, offering lessons that triumph cannot impart. Too often, we let failure to overshadow our worth, defining us by a single moment rather than the resilience and courage we demonstrate in its aftermath. The truth is, failure is not the end of the story but a chapter within it, a stepping stone toward growth, innovation, and eventual success. It is through embracing our setbacks, learning from them, and pushing forward that we truly discover our potential. Let us remember that failure is not a measure of defeat but a testament to having tried, and more importantly, to the strength it takes to rise again.

Decide today: Will you be the Donnie who never discovered his true potential as a basketball player, or the Donnie who pushed so hard in trading that he made life-changing money in just 2.5 months? Life doesn’t teach us to avoid the rain; it teaches us to dance in it. Are you ready to risk rejection and invite a company to dance with you in the storm? Or will you remain a wallflower, never stretching for the sunlight, finishing life as J.K. Rowling warned: “live so cautiously that you might as well not have lived at all, in which case, you fail by default”?

Share this post