Profit from the Pivot: January's Market Trends for 2025 Investors

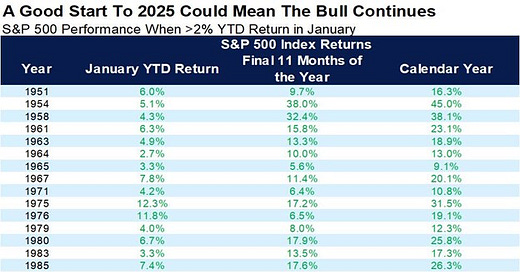

January turned out to be a stellar month for me personally and a solid one for the market. As you can see from the image below, when January gains are up by 2% or more, the following 11 months tend to be profitable 84% of the time, with an average gain of 12.3%.

I expect the bull run to persist, but January also revealed underlying strategic shifts. DeepSeek, whether a genuine threat or not, has clearly signaled to investors in the Magnificent Seven that they might be overpaying for these stocks. On November 24, 2024, I published an article titled “From Cash Hoards to Market Roars: Anticipating a Republican-Led Economic Boom” where I noted:

“Mega-cap stocks might currently offer “poor value,” suggesting that investors should explore opportunities elsewhere. Equal-weighted stocks are historically undervalued, presenting a golden window for investors.”

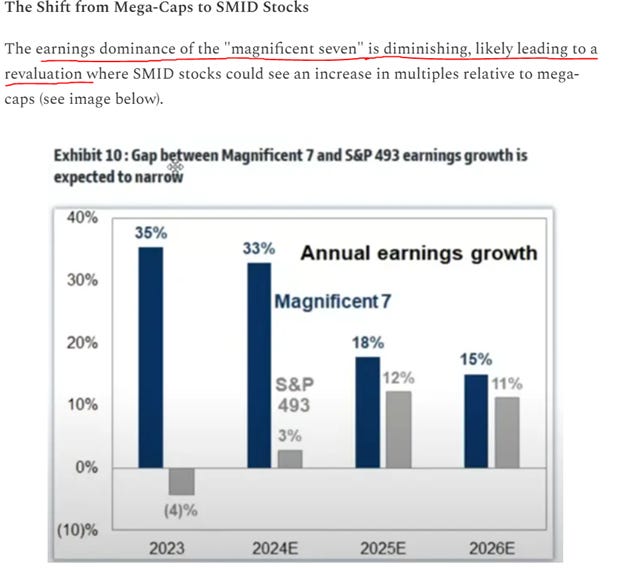

In that same article, I also predicted a revaluation for Magnificent Seven (see image below).

Investors who relied on the Mag 7 experienced a turbulent January. An article from MarketWatch highlighted, “Furthermore, when taking a market-cap weighted composite of those seven companies, versus the S&P 500’s remaining 493 companies, the 'Magnificent Seven' shed 0.7% in 2025 through Friday’s close, while the rest gained 4.4%, according to a review by Dow Jones Market Data.”

At the start of the year, in my article “Navigating the Bull Run: Strategic Shifts for 2025,” I stressed the importance of not depending solely on the Mag 7 for market growth. I shared the following:

“Our task for 2025 is clear: identify the dominant themes and the stocks within them. Broad-based strategies relying on ETFs or mega-cap stocks are unlikely to outperform as they have in recent years. Currently, mega-cap growth and tech stocks are positioned one standard deviation above their median.”

I discussed the deceleration in earnings for these companies, making them appear more expensive and possibly overvalued:

“While many of these companies have earnings to support their valuations, earnings growth is decelerating; meanwhile, earnings for the rest of the market are catching up. As this trend continues, the ‘Magnificent Seven’ may appear increasingly overvalued, prompting investors to look elsewhere for better returns.”

The market's reaction to recent earnings reports has shown that investors are reluctant to pay high multiples unless companies like NFLX deliver exceptional growth and nearly perfect earnings. Meanwhile, both MSFT and AAPL had rather unremarkable earnings reports. TSLA, where fundamentals often take a backseat, also had a lackluster performance. META, on the other hand, reported impressive growth and margin expansion, yet despite META's 18% rise in January, the Mag 7 ETF (MAGS) only increased by 2.3%.

I hope none of this surprises you, as I've been cautioning that chasing after the "shiny objects" could lead to a reckoning. From my latest article, “Be the Legend of Your Family”:

“Additionally, the weakening dollar—a trend I’ve been betting on for months—should boost emerging markets. Those chasing ‘shiny objects’ will face a reckoning, while value investors stand to gain significantly.”

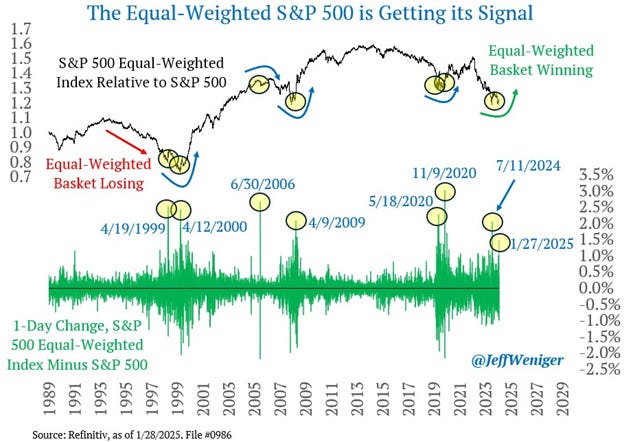

We've just seen a signal - on Monday, the equal-weighted S&P 500 outperformed the standard S&P 500 by 1.48%. Looking back, such occurrences in '99, '00, '06, '09, and '20 were all transition years.

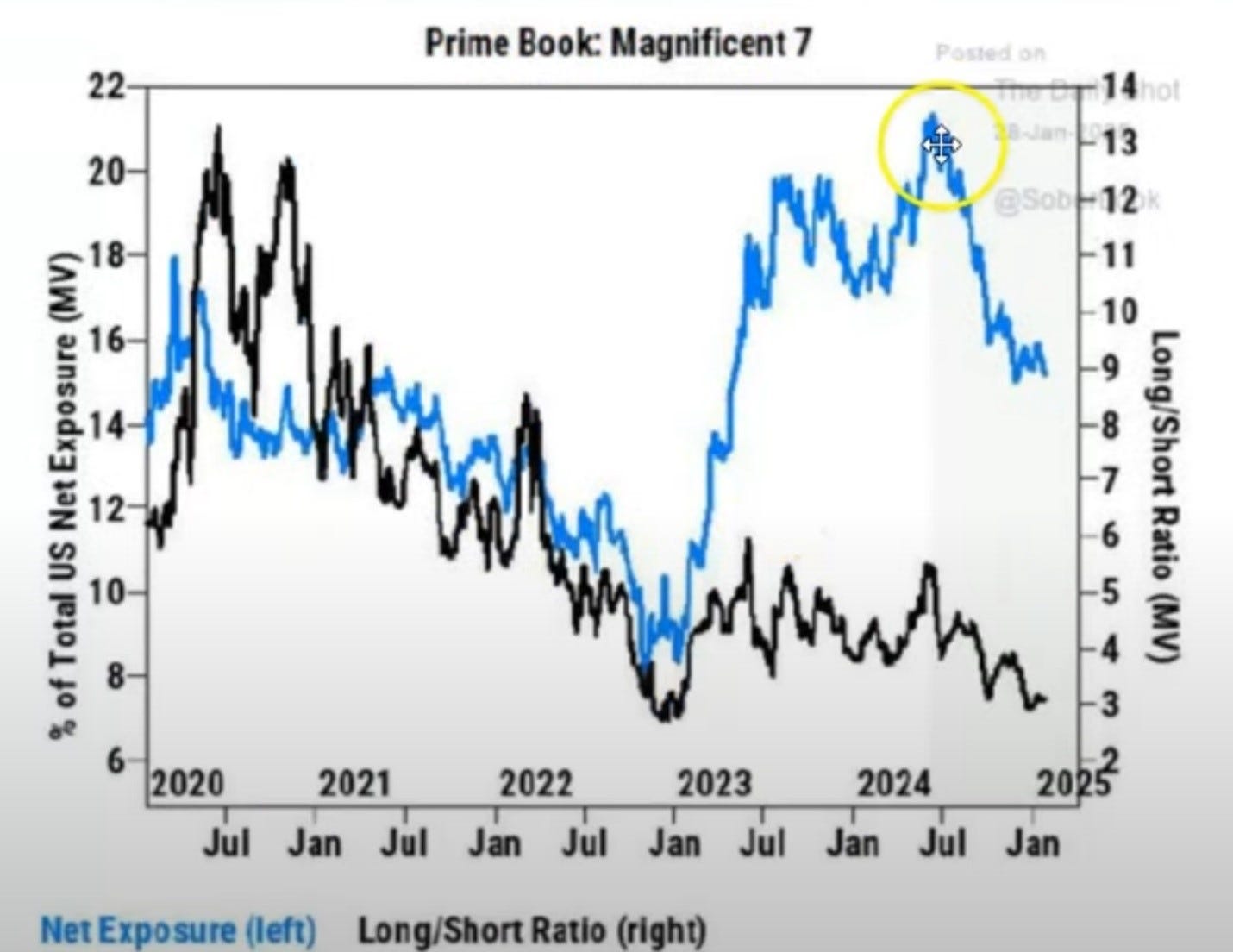

Hedge fund managers are now recognizing these signs and are unwinding their Mag 7 investments, a move further amplified by the need to adjust carry trades due to the Bank of Japan's interest rate hikes.

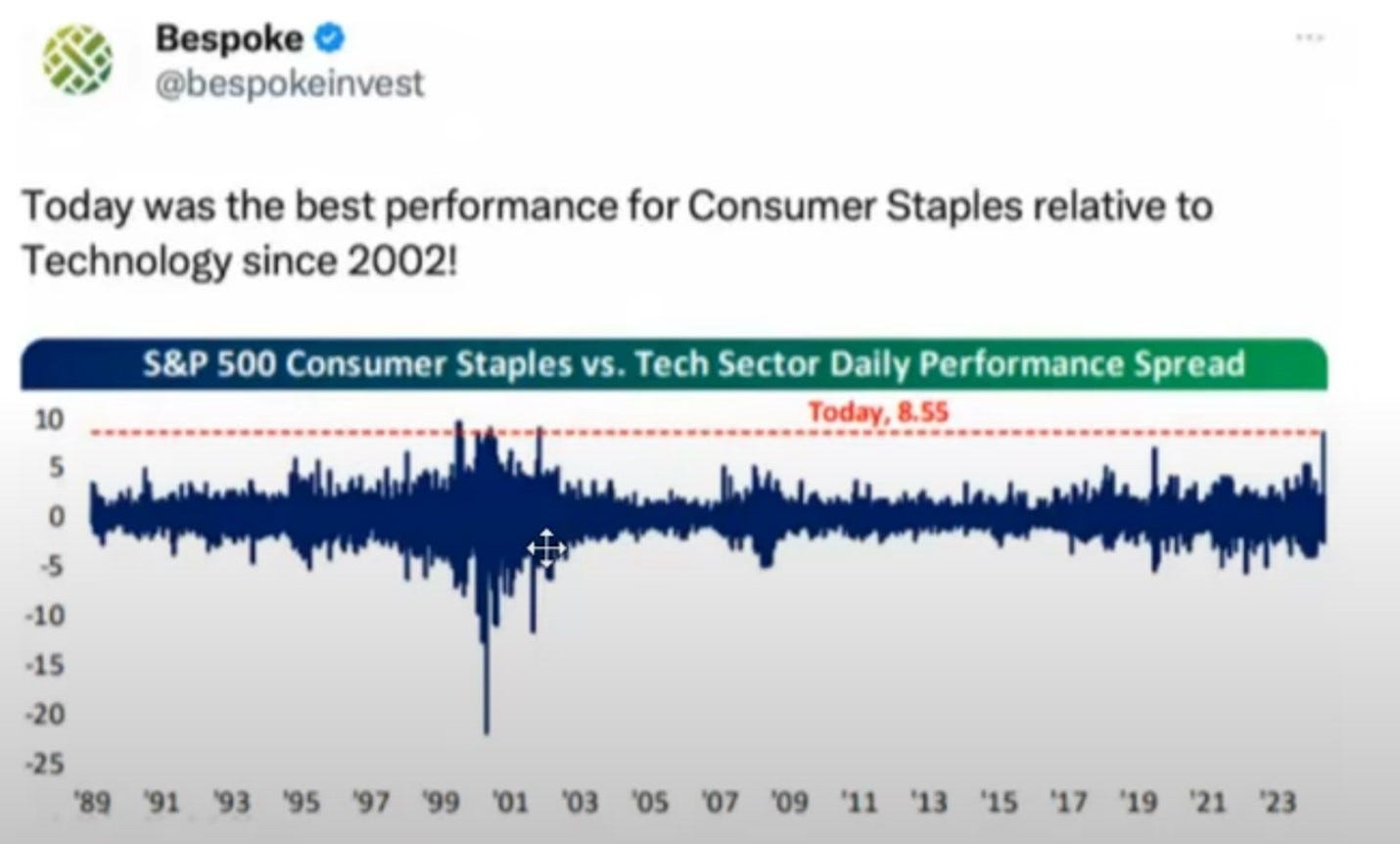

Capital is now flowing into sectors like Consumer Staples and Healthcare, with the latter breaking its trendline as seen in the SPDR Health Care Select Sector ETF.

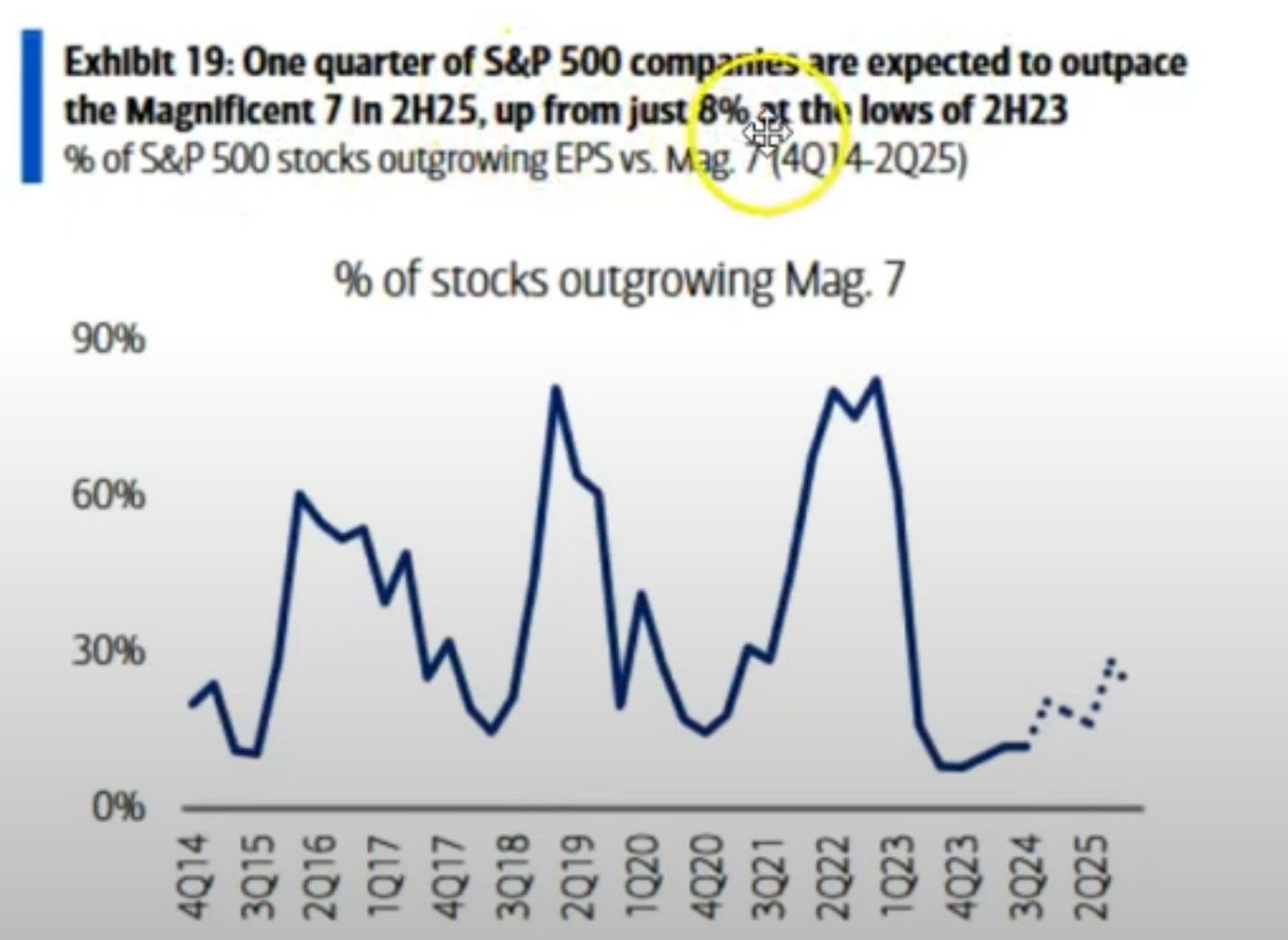

What I've been warning about for months is now unfolding, and I anticipate this trend to continue. It's projected that 25% of the S&P 500 will outperform the Mag 7 in the second half of 2025, up from just 8% at the 2023 lows.

Moreover, many companies outside the U.S. present more attractive valuation ratios with similar growth prospects. I've invested in Chinese companies like BABA and JD. I also invested in GXO, which earns significant revenue from the UK and Europe. For more details on GXO, you can read my article here.

The recent rise in BABA suggests investors are now willing to risk tariffs rather than pay the high multiples seen in many U.S. tech companies. We've also just witnessed the largest monthly rotation into EU stocks in 25 years.

Interestingly, only one Mag 7 stock made it into January's top 20 performers, whereas I was able to capitalize on seven of these stocks by shifting focus away from the Mag 7.

In summary, January's performance has set the stage for a broader shift in investment strategy for 2025. The days of relying solely on the Mag 7 for market gains are giving way to a more discerning approach where value and sector diversity are key. The trends we're observing, from the outperformance of equal-weighted indices to the increasing appeal of international stocks, underscore a market that rewards the vigilant and strategic investor. By adapting to these changes, diversifying into undervalued sectors, and looking beyond U.S. borders, we can position our portfolios not just to weather the coming months but to thrive. The signs are clear: 2025 is shaping up to be a year where astute stock picking and value investing will lead the charge. I hope your investments in January have already begun to reflect these strategic insights, and I look forward to navigating this dynamic market landscape together.